- Canada

- /

- Metals and Mining

- /

- TSX:KNT

K92 Mining (TSX:KNT) Reports Promising Drilling Results Highlighting Strong Mining Potential

Reviewed by Simply Wall St

K92 Mining (TSX:KNT) recently announced significant drilling results from its Arakompa site and expansion plans, potentially enhancing its near-surface resource potential. Despite a 12% share price rise last month, the broader market also climbed with indexes such as the S&P 500 reaching record highs amid anticipation of Federal Reserve rate cuts. However, K92’s legal challenges in Papua New Guinea could counterbalance the positive momentum from its drilling advancements. Collectively, these events indicate a blend of favorable exploratory outcomes and legal uncertainties, which may align with or have little effect on the observed share price trend.

K92 Mining has 1 warning sign we think you should know about.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

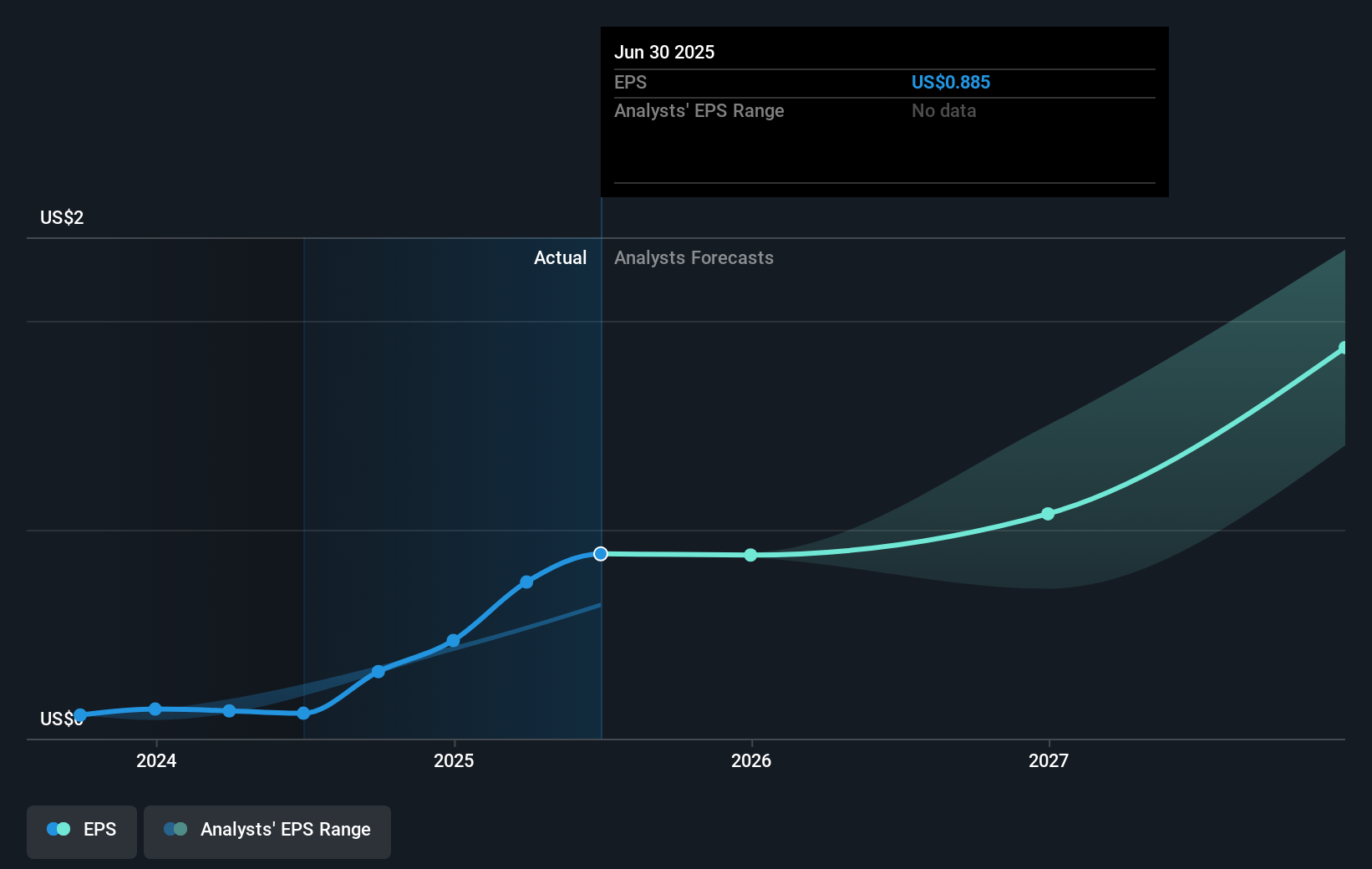

The recent news of K92 Mining's drilling results and expansion plans could potentially bolster the company's resource base, supporting future revenue growth and enhanced profitability through increased operational capacities. However, legal challenges in Papua New Guinea might dampen this otherwise positive trajectory, casting uncertainties over the revenue and earnings forecasts. Over a broader timeframe, K92 Mining's total shareholder return has been impressive, with a gain of 125.34% over three years, highlighting significant longer-term strength despite recent short-term share price fluctuations.

In terms of recent performance, while K92 Mining's share price has surged 12% over the past month, the broader market also experienced upward momentum. Notably, K92's one-year return outpaced both the Canadian market and the Metals and Mining industry, showcasing the company's robust performance relative to its peers. Looking ahead, though the current share price of CA$16.72 trails the consensus analyst price target of CA$19.34, it suggests potential for further appreciation. The ongoing expansion initiatives and high-grade exploration successes play a crucial role in maintaining confidence in achieving these earnings and revenue targets.

Examine K92 Mining's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K92 Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KNT

K92 Mining

Engages in the exploration and development of mineral deposits in Papua New Guinea.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives