3 TSX Stocks That May Be Trading Up To 49.2% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

The Canadian market has shown resilience, with the TSX only down 4% from its record high, buoyed by a strong performance in the materials sector. As markets navigate between past lows and highs amid global trade developments, investors may find opportunities in stocks that appear undervalued relative to their intrinsic value estimates. Identifying such stocks requires careful consideration of their fundamentals and potential for growth within the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Propel Holdings (TSX:PRL) | CA$27.05 | CA$45.33 | 40.3% |

| K92 Mining (TSX:KNT) | CA$12.59 | CA$24.79 | 49.2% |

| Computer Modelling Group (TSX:CMG) | CA$7.88 | CA$10.87 | 27.5% |

| Savaria (TSX:SIS) | CA$17.28 | CA$30.98 | 44.2% |

| Docebo (TSX:DCBO) | CA$43.76 | CA$78.15 | 44% |

| illumin Holdings (TSX:ILLM) | CA$1.93 | CA$3.65 | 47.1% |

| Lithium Royalty (TSX:LIRC) | CA$5.10 | CA$9.05 | 43.7% |

| AtkinsRéalis Group (TSX:ATRL) | CA$68.05 | CA$112.71 | 39.6% |

| Teck Resources (TSX:TECK.B) | CA$48.77 | CA$62.96 | 22.5% |

| CAE (TSX:CAE) | CA$33.79 | CA$64.58 | 47.7% |

Here's a peek at a few of the choices from the screener.

Computer Modelling Group (TSX:CMG)

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that develops and licenses reservoir simulation and seismic interpretation software, with a market cap of CA$651.24 million.

Operations: The company's revenue segments include Seismic Solutions, generating CA$37.62 million, and Reservoir & Production Solutions, contributing CA$90.44 million.

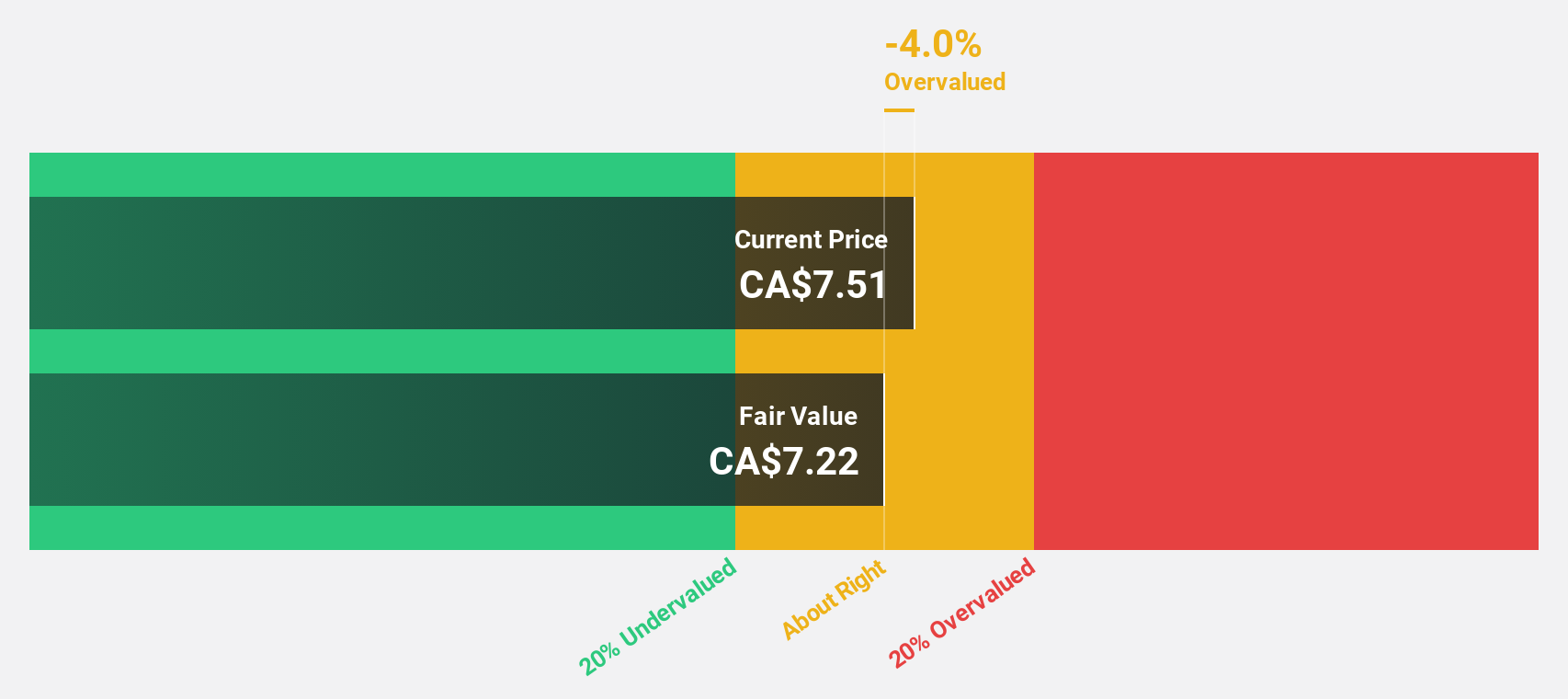

Estimated Discount To Fair Value: 27.5%

Computer Modelling Group's recent earnings report shows a promising increase in net income, with CAD 9.61 million for the third quarter compared to CAD 5.61 million a year ago. The stock is trading at CA$7.88, significantly below its estimated fair value of CA$10.87, indicating it may be undervalued based on cash flows. Analysts expect earnings to grow at 28.6% annually, outpacing the Canadian market's growth rate of 16.7%.

- Our expertly prepared growth report on Computer Modelling Group implies its future financial outlook may be stronger than recent results.

- Take a closer look at Computer Modelling Group's balance sheet health here in our report.

K92 Mining (TSX:KNT)

Overview: K92 Mining Inc. is involved in the exploration and development of mineral deposits in Papua New Guinea, with a market cap of CA$3.01 billion.

Operations: The company's revenue is primarily generated from the Kainantu Project, which amounted to $350.62 million.

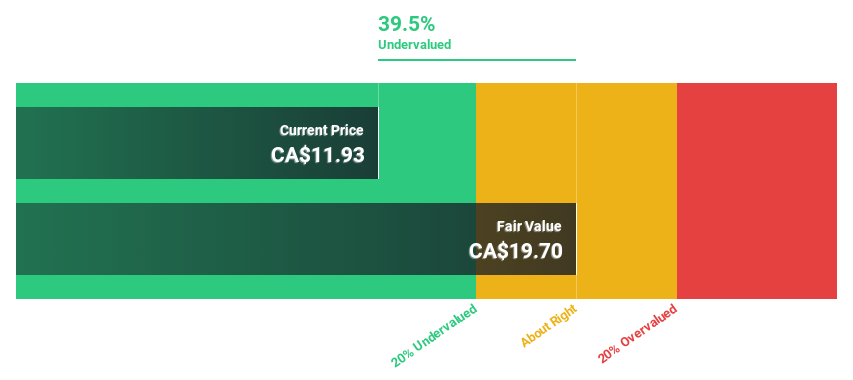

Estimated Discount To Fair Value: 49.2%

K92 Mining's strong cash flow position is highlighted by its trading price of CA$12.59, which is significantly below the estimated fair value of CA$24.79, suggesting it may be undervalued. Recent production results from the Kainantu Gold Mine show substantial growth, with a 74% increase in gold output year-over-year for Q1 2025. Analysts forecast robust annual earnings and revenue growth at rates surpassing Canadian market averages, despite recent insider selling activity.

- The analysis detailed in our K92 Mining growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of K92 Mining.

Topicus.com (TSXV:TOI)

Overview: Topicus.com Inc. operates by providing vertical market software and platforms in the Netherlands and internationally, with a market capitalization of CA$13.04 billion.

Operations: The company generates revenue of €1.29 billion from its software and programming segment.

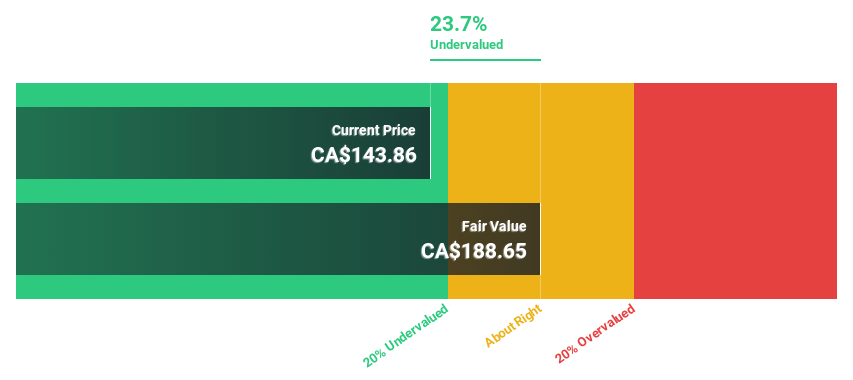

Estimated Discount To Fair Value: 15.2%

Topicus.com Inc. demonstrates potential as an undervalued stock, trading at CA$159.99, approximately 15.2% below its estimated fair value of CA$188.67. Recent earnings reports show revenue growth to EUR 1.29 billion and net income increase to EUR 91.99 million for 2024, reflecting strong financial performance despite significant insider selling in the past quarter. Analysts project annual earnings growth of over 21%, outpacing the Canadian market's forecasted growth rate.

- Upon reviewing our latest growth report, Topicus.com's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Topicus.com's balance sheet by reading our health report here.

Summing It All Up

- Discover the full array of 18 Undervalued TSX Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CMG

Computer Modelling Group

A software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives