- Canada

- /

- Metals and Mining

- /

- TSX:KNT

3 TSX Stocks Estimated To Be 33.8% To 36.3% Below Intrinsic Value

Reviewed by Simply Wall St

In Canada, recent economic indicators suggest a stabilizing labor market and inflation rates within the Bank of Canada's target range, providing a cautiously optimistic outlook for investors. Despite the potential for market volatility as we enter a seasonally choppier period, identifying stocks that are trading significantly below their intrinsic value can offer opportunities for those looking to navigate these uncertain times effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WELL Health Technologies (TSX:WELL) | CA$5.16 | CA$9.83 | 47.5% |

| Vitalhub (TSX:VHI) | CA$11.18 | CA$19.13 | 41.6% |

| Meren Energy (TSX:MER) | CA$1.89 | CA$3.05 | 38% |

| Magellan Aerospace (TSX:MAL) | CA$16.22 | CA$28.43 | 42.9% |

| Haivision Systems (TSX:HAI) | CA$4.82 | CA$9.38 | 48.6% |

| GURU Organic Energy (TSX:GURU) | CA$4.94 | CA$8.97 | 44.9% |

| First Majestic Silver (TSX:AG) | CA$17.27 | CA$26.56 | 35% |

| BRP (TSX:DOO) | CA$84.06 | CA$143.16 | 41.3% |

| Aritzia (TSX:ATZ) | CA$86.80 | CA$140.83 | 38.4% |

| Americas Gold and Silver (TSX:USA) | CA$5.08 | CA$7.97 | 36.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Discovery Silver (TSX:DSV)

Overview: Discovery Silver Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada, with a market cap of CA$4.18 billion.

Operations: Discovery Silver Corp. does not currently report any revenue segments, as it is primarily focused on mineral exploration and development activities in Canada.

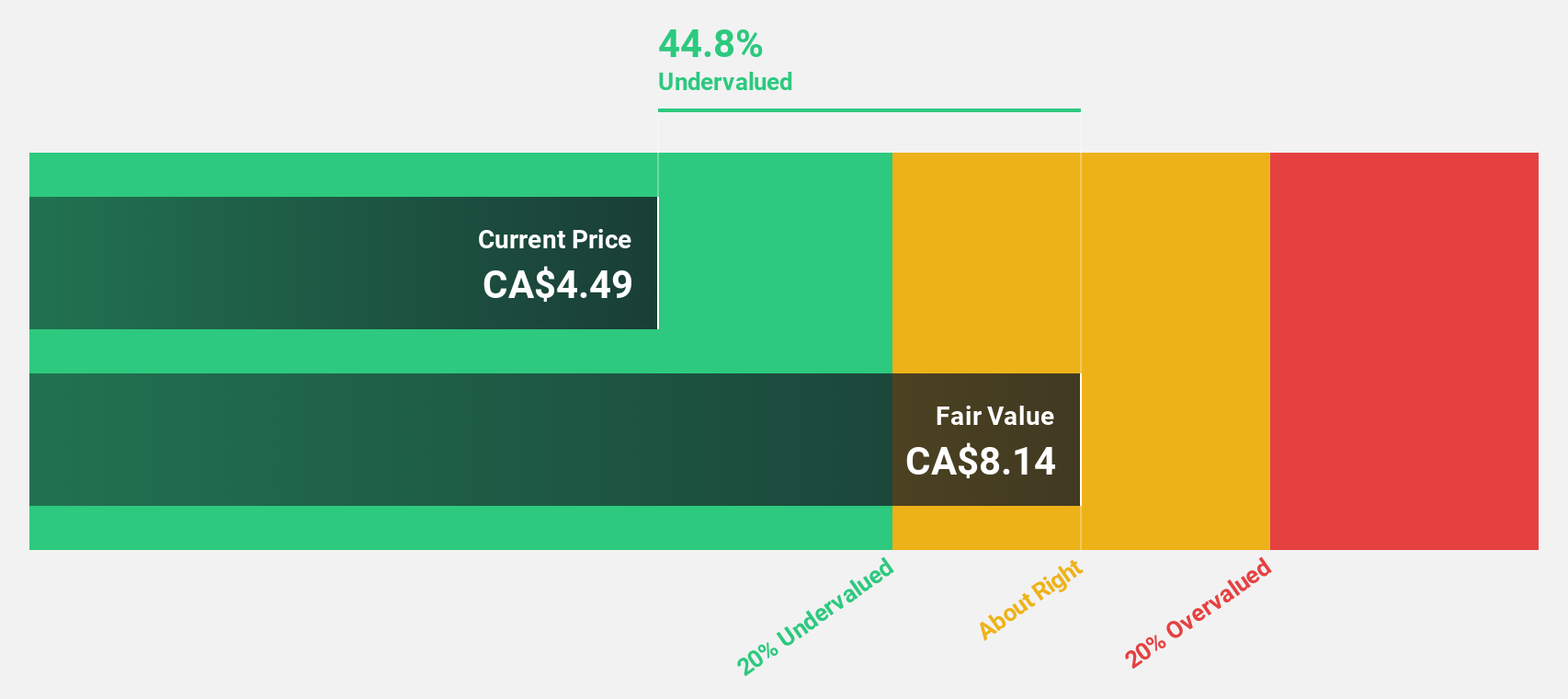

Estimated Discount To Fair Value: 34.7%

Discovery Silver is trading at CA$5.37, significantly below its estimated fair value of CA$8.22, suggesting it's undervalued based on discounted cash flow analysis. The company has secured a US$250 million revolving credit facility and reported a positive shift to profitability with net income of US$5.53 million for Q2 2025, compared to a loss the previous year. However, substantial insider selling and recent shareholder dilution are potential concerns for investors.

- The growth report we've compiled suggests that Discovery Silver's future prospects could be on the up.

- Get an in-depth perspective on Discovery Silver's balance sheet by reading our health report here.

K92 Mining (TSX:KNT)

Overview: K92 Mining Inc. is involved in the exploration and development of mineral deposits in Papua New Guinea, with a market capitalization of CA$4.03 billion.

Operations: The company's revenue is primarily generated from the Kainantu Project, amounting to $483.98 million.

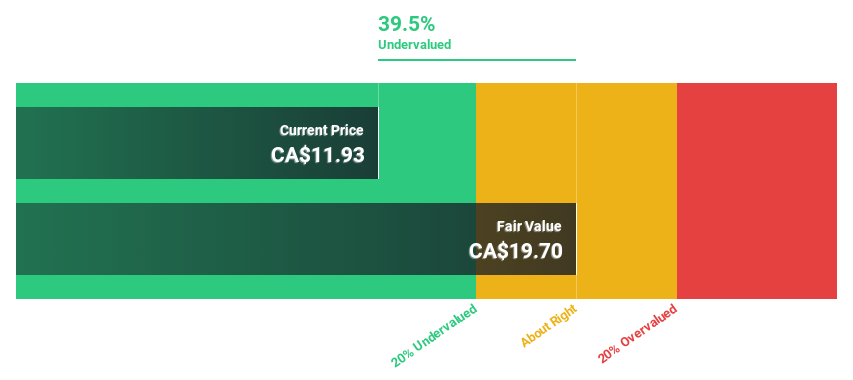

Estimated Discount To Fair Value: 33.8%

K92 Mining, trading at CA$16.93, is undervalued with an estimated fair value of CA$25.58 based on discounted cash flow analysis. The company reported a significant earnings increase with net income of US$39.2 million in Q2 2025 compared to the previous year and forecasts robust revenue growth exceeding the Canadian market average. However, ongoing legal issues regarding exploration rights in Papua New Guinea could pose potential risks to future operations and expansion plans.

- Our expertly prepared growth report on K92 Mining implies its future financial outlook may be stronger than recent results.

- Take a closer look at K92 Mining's balance sheet health here in our report.

Americas Gold and Silver (TSX:USA)

Overview: Americas Gold and Silver Corporation, along with its subsidiaries, focuses on the exploration, development, and production of mineral properties in the Americas and has a market cap of CA$1.32 billion.

Operations: The company's revenue is primarily derived from its Metals & Mining segment, specifically Gold and Other Precious Metals, amounting to $96.60 million.

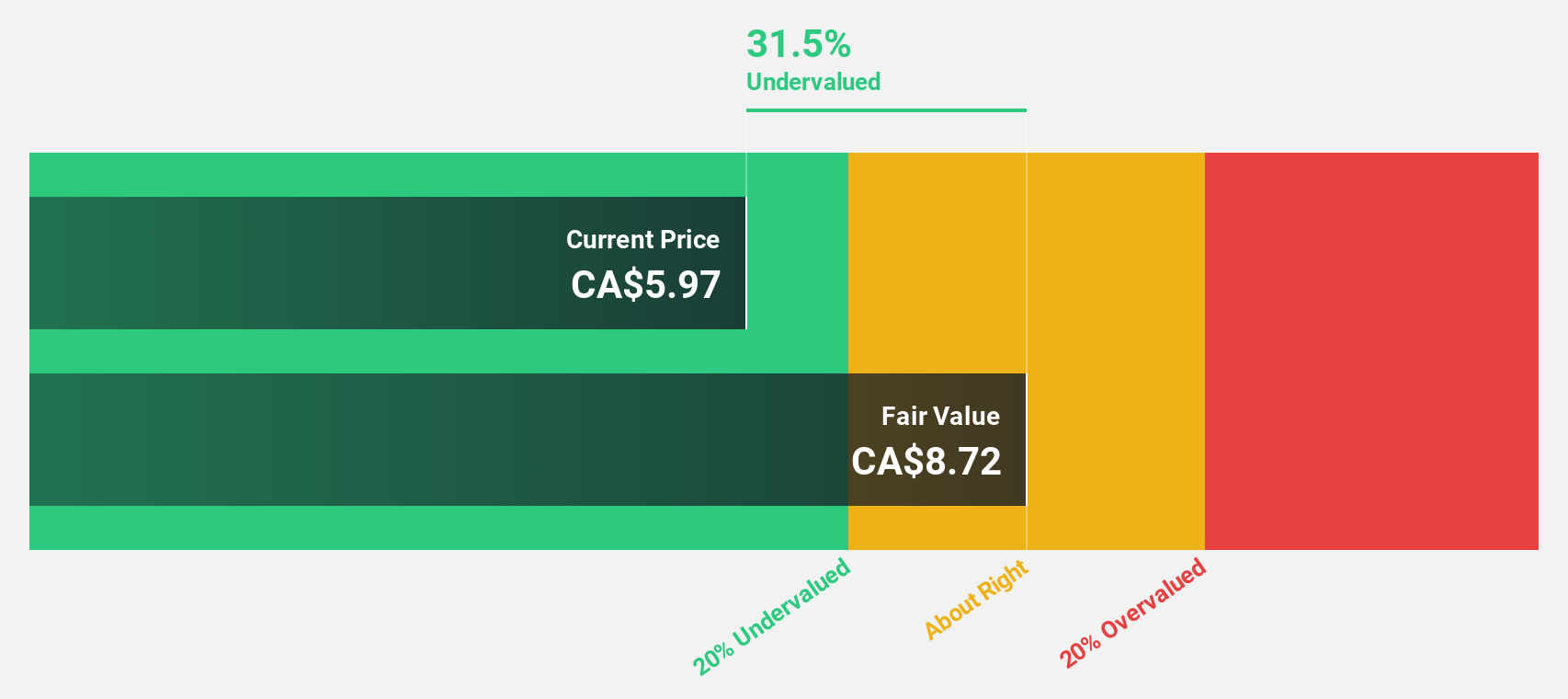

Estimated Discount To Fair Value: 36.3%

Americas Gold and Silver, trading at CA$5.08, is undervalued with a fair value estimate of CA$7.97 based on discounted cash flow analysis. The company has been added to the S&P Global BMI Index and completed Phase 1 upgrades at its Galena Complex, enhancing production capacity. Despite past shareholder dilution, revenue is forecast to grow significantly faster than the Canadian market average, with profitability expected within three years. Recent exploration results also highlight potential for increased resource delineation.

- In light of our recent growth report, it seems possible that Americas Gold and Silver's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Americas Gold and Silver.

Turning Ideas Into Actions

- Dive into all 24 of the Undervalued TSX Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K92 Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KNT

K92 Mining

Engages in the exploration and development of mineral deposits in Papua New Guinea.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives