- Canada

- /

- Metals and Mining

- /

- TSX:K

Kinross Gold (TSX:K) Valuation: Has Recent Momentum Stretched the Stock Too Far?

Reviewed by Kshitija Bhandaru

Kinross Gold (TSX:K) shares have seen steady momentum, with the stock recently posting a 6% gain in the past week and climbing nearly 18% over the past month. Investors are weighing these moves as they consider gold prices and overall sector sentiment.

See our latest analysis for Kinross Gold.

Momentum has only picked up speed for Kinross Gold, with its recent share price surge capping off a strong run that now sees a year-to-date share price return over 165%. Remarkably, the company’s 1-year total shareholder return is even higher at 176%, suggesting both short-term excitement and growing long-term confidence around gold’s renewed appeal.

If Kinross’s rally has your attention, now is a great time to widen your perspective and check out fast growing stocks with high insider ownership

With such strong gains and a share price now well above most analyst targets, investors must consider whether Kinross Gold remains undervalued or if the market has already priced in all of its future growth potential.

Most Popular Narrative: 19.9% Overvalued

With Kinross Gold’s last close at CA$37.78, the most widely followed narrative puts its fair value at CA$31.50. This suggests the current price stands well above what analysts believe is justified. This sets up a key debate around whether the stock has run too far ahead of its fundamentals as gold sentiment heats up.

The company is poised to benefit from persistent global inflation and ongoing geopolitical uncertainty, trends that are expected to support robust gold prices and investor demand. This underpins Kinross's strong realized sales prices and record operating margins, with a positive outlook for sustained revenue and net earnings growth.

What projections could possibly explain this rich price tag? The narrative is built on ambitious assumptions about operational efficiency, resilient cash flows, and a gold market that keeps defying gravity. Curious which one factor tips the scales? Spoiler: it isn’t just gold prices. Find out how these upside drivers and bold financial forecasts are connected in the full breakdown.

Result: Fair Value of $31.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising costs across key operations and delays in permitting new projects could quickly put pressure on Kinross’s margins and long-term growth prospects.

Find out about the key risks to this Kinross Gold narrative.

Another View: Are Multiples Sending a Mixed Signal?

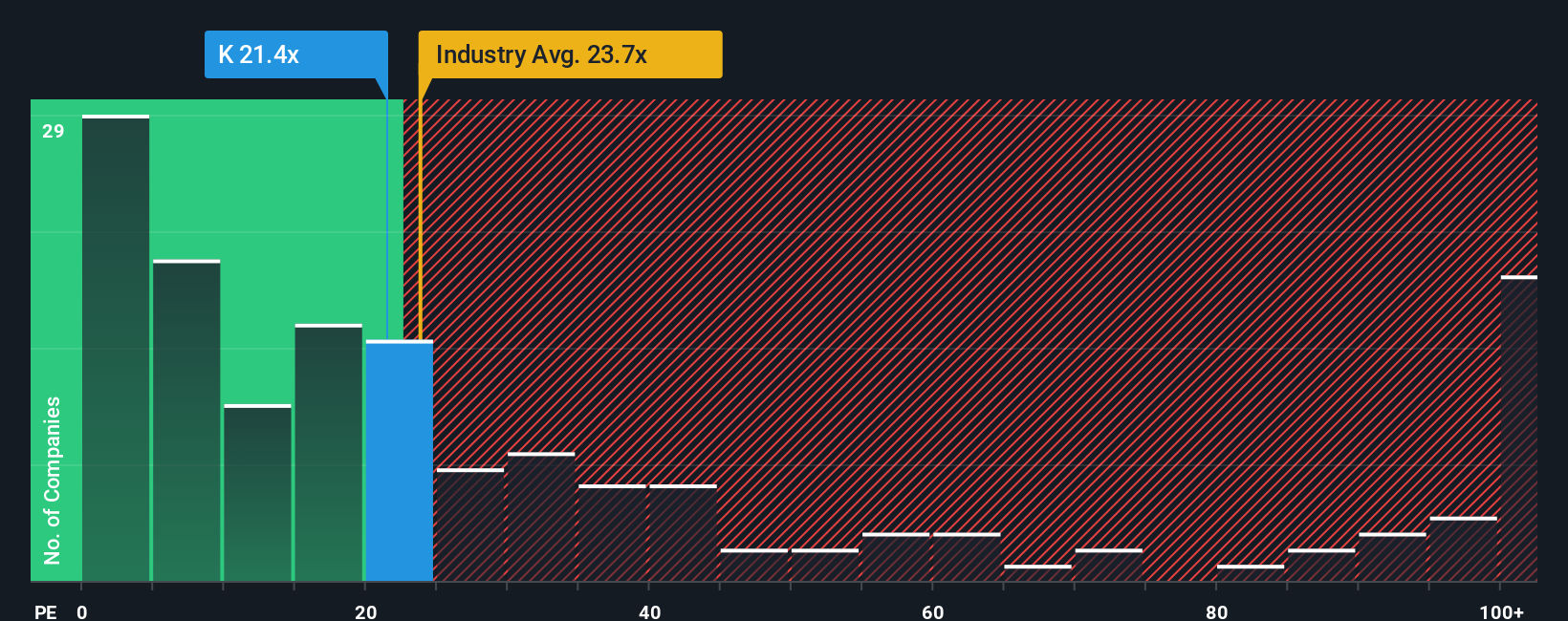

While the analyst consensus highlights Kinross Gold as overvalued based on fair value estimates, a look at the price-to-earnings ratio tells a slightly different story. The company’s ratio of 21.4x sits comfortably below both the Canadian industry average (23.8x) and its peers (42.2x). However, the fair ratio for Kinross is estimated at just 19.8x, so today’s market price still leans toward the expensive side. Could this disconnect flag valuation risk, or is the gap a reflection of the company’s unique strengths?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinross Gold Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly put together your own story based on the latest data. Do it your way

A great starting point for your Kinross Gold research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. If you want to spot tomorrow’s winners before the crowd, these categories could spark your next move:

- Reimagine your portfolio with steady yields and tap into growth by evaluating these 18 dividend stocks with yields > 3%, featuring proven companies with payouts exceeding 3%.

- Accelerate your returns by targeting undervalued plays using these 870 undervalued stocks based on cash flows, where cash flow strength meets market mispricing.

- Be part of the digital transformation by checking out these 79 cryptocurrency and blockchain stocks, keeping you at the forefront of blockchain innovation and financial disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives