- Canada

- /

- Metals and Mining

- /

- TSX:K

It's Unlikely That Kinross Gold Corporation's (TSE:K) CEO Will See A Huge Pay Rise This Year

Key Insights

- Kinross Gold to hold its Annual General Meeting on 8th of May

- CEO J. Rollinson's total compensation includes salary of US$1.19m

- The total compensation is 34% higher than the average for the industry

- Over the past three years, Kinross Gold's EPS fell by 32% and over the past three years, the total shareholder return was 7.8%

Under the guidance of CEO J. Rollinson, Kinross Gold Corporation (TSE:K) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 8th of May. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Kinross Gold

How Does Total Compensation For J. Rollinson Compare With Other Companies In The Industry?

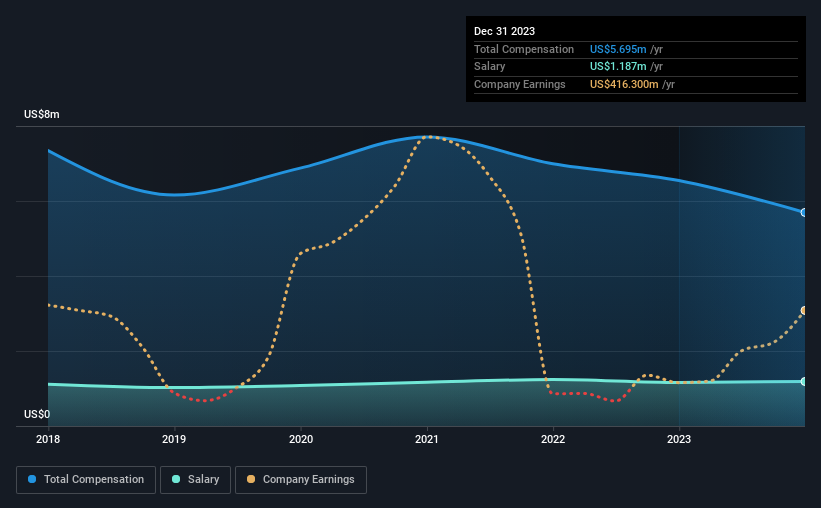

Our data indicates that Kinross Gold Corporation has a market capitalization of CA$11b, and total annual CEO compensation was reported as US$5.7m for the year to December 2023. We note that's a decrease of 13% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$1.2m.

For comparison, other companies in the Canadian Metals and Mining industry with market capitalizations ranging between CA$5.5b and CA$17b had a median total CEO compensation of US$4.3m. Hence, we can conclude that J. Rollinson is remunerated higher than the industry median. What's more, J. Rollinson holds CA$46m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.2m | US$1.2m | 21% |

| Other | US$4.5m | US$5.4m | 79% |

| Total Compensation | US$5.7m | US$6.5m | 100% |

Talking in terms of the industry, salary represented approximately 94% of total compensation out of all the companies we analyzed, while other remuneration made up 6% of the pie. Kinross Gold pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Kinross Gold Corporation's Growth Numbers

Kinross Gold Corporation has reduced its earnings per share by 32% a year over the last three years. It achieved revenue growth of 23% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Kinross Gold Corporation Been A Good Investment?

Kinross Gold Corporation has generated a total shareholder return of 7.8% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 2 warning signs (and 1 which is a bit unpleasant) in Kinross Gold we think you should know about.

Important note: Kinross Gold is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking to trade Kinross Gold, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives