- Canada

- /

- Metals and Mining

- /

- TSX:K

Is It Too Late to Consider Kinross Gold After Its Massive Multi Year Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether Kinross Gold is still a smart buy after its huge run, or if you are late to the party, this article will help unpack what the market is really pricing in.

- The stock has cooled slightly in the last week with a -1.7% move, but that comes after a powerful 15.1% climb over 30 days, 165.8% year to date, 172.8% over 1 year, 588.4% over 3 years, and 345.0% over 5 years.

- Those gains have come alongside a renewed spotlight on gold as investors look for hedges against inflation and geopolitical tension. Kinross has been in the mix as one of the higher beta ways to approach that theme. Recent coverage has focused on its portfolio quality and capital allocation discipline, which helps explain why sentiment has shifted sharply in its favor.

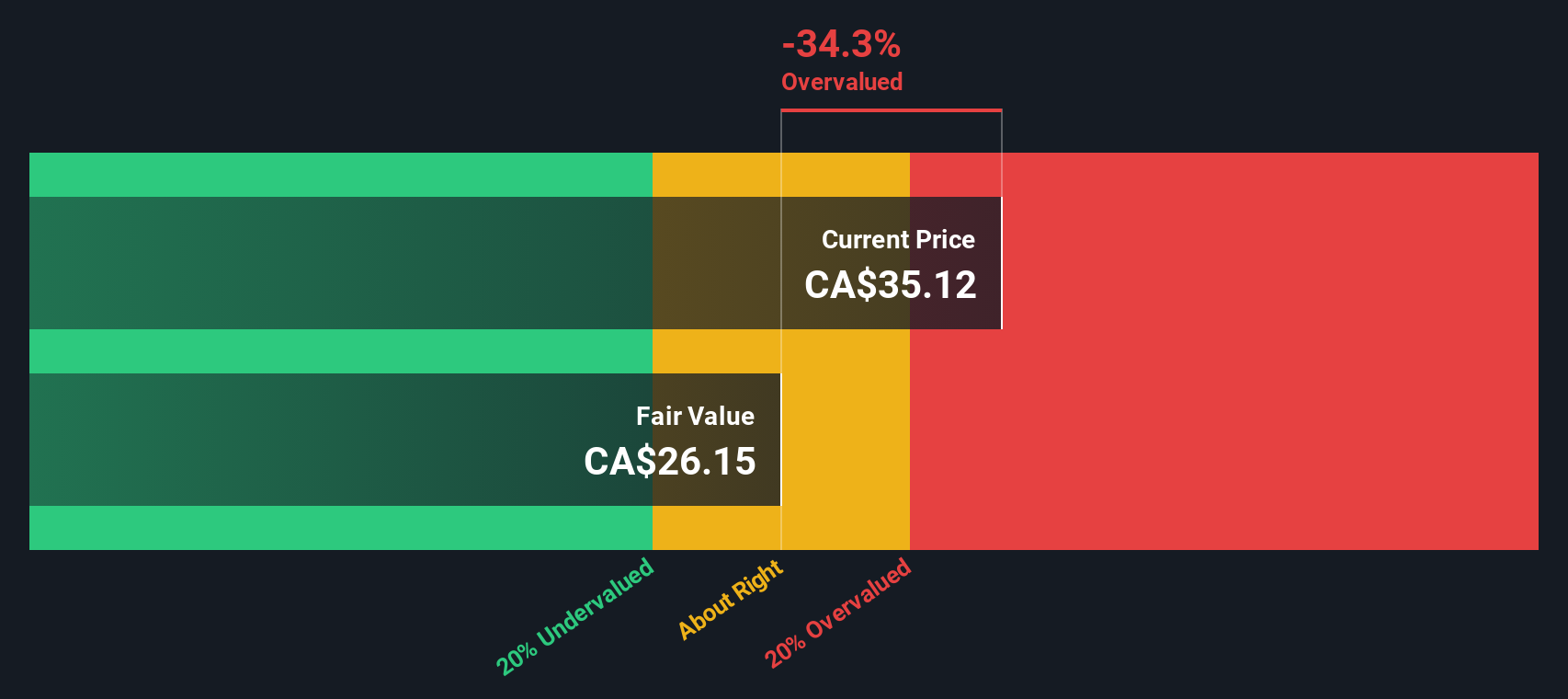

- Despite that surge, Kinross Gold only scores a 3/6 on our valuation checks. Next, we will examine what different valuation methods suggest about the stock and, by the end, explore an alternative way to think about its underlying worth.

Approach 1: Kinross Gold Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Kinross Gold, the model starts from last twelve month Free Cash Flow of about $1.87 billion and then layers on analyst forecasts and longer term extrapolations.

Analysts expect Free Cash Flow to remain robust in the near term, with projections such as $2.86 billion in 2026 and $3.05 billion in 2027, before moderating to around $1.22 billion by 2029 as growth normalizes. Beyond those explicit estimates, Simply Wall St extends the trend to build a two-stage Free Cash Flow to Equity profile over the next decade.

When all these projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $23.19 per share. Compared with the current share price, this output indicates the stock is roughly 63.3% overvalued. This suggests that a significant amount of optimism may already be reflected in the current market price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kinross Gold may be overvalued by 63.3%. Discover 918 undervalued stocks or create your own screener to find better value opportunities.

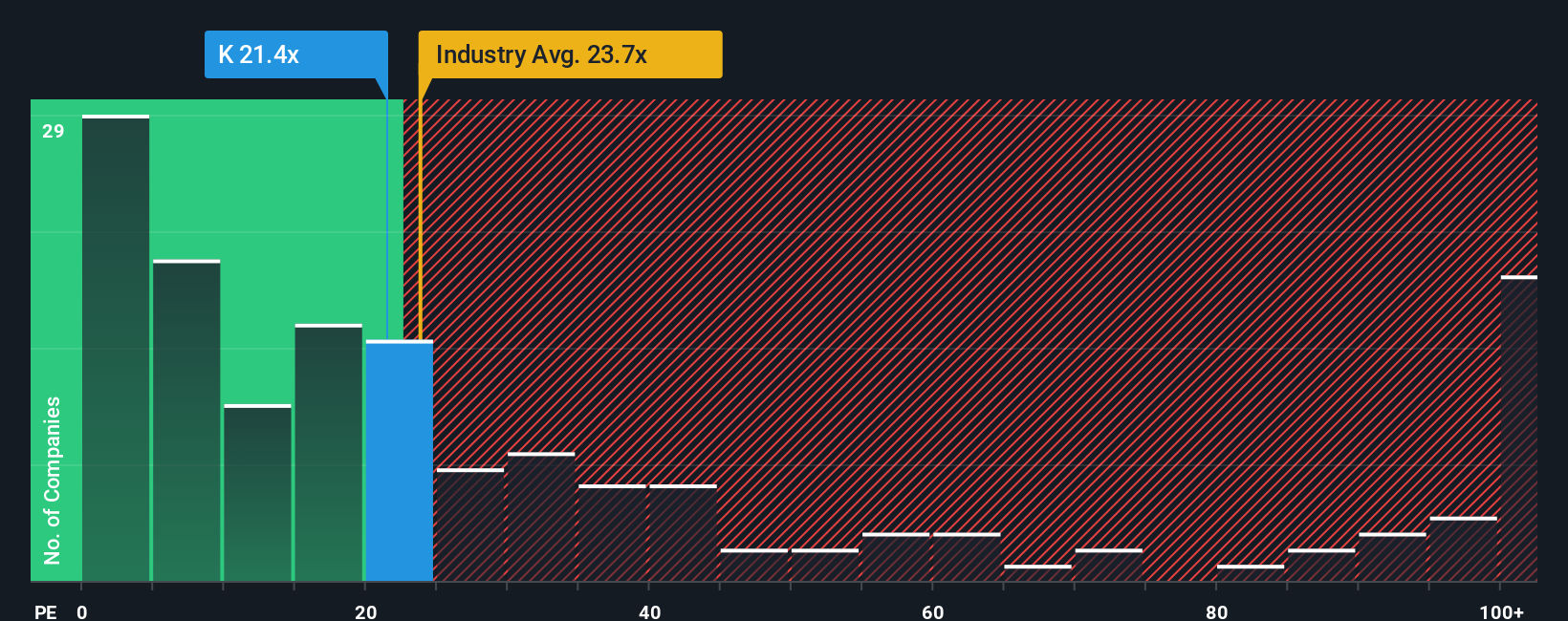

Approach 2: Kinross Gold Price vs Earnings

For profitable companies like Kinross Gold, the Price to Earnings ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. In general, faster growing and lower risk businesses can justify higher PE ratios, while slower growth or higher uncertainty should lead to a lower, more conservative multiple.

Kinross currently trades on a PE of about 18.6x, which sits below both the Metals and Mining industry average of roughly 21.2x and the peer group average of around 37.2x. To move beyond these broad comparisons, Simply Wall St calculates a proprietary Fair Ratio of 19.4x, which represents the PE you might expect given Kinross Gold’s specific combination of earnings growth prospects, profit margins, size and risk profile.

This Fair Ratio framework is more tailored than simple peer or industry comparisons, because it explicitly adjusts for company level factors such as growth outlook, risk and profitability, as well as its industry and market capitalization. With Kinross trading slightly below its Fair Ratio, the multiple based view suggests the market is pricing the stock a bit too conservatively.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

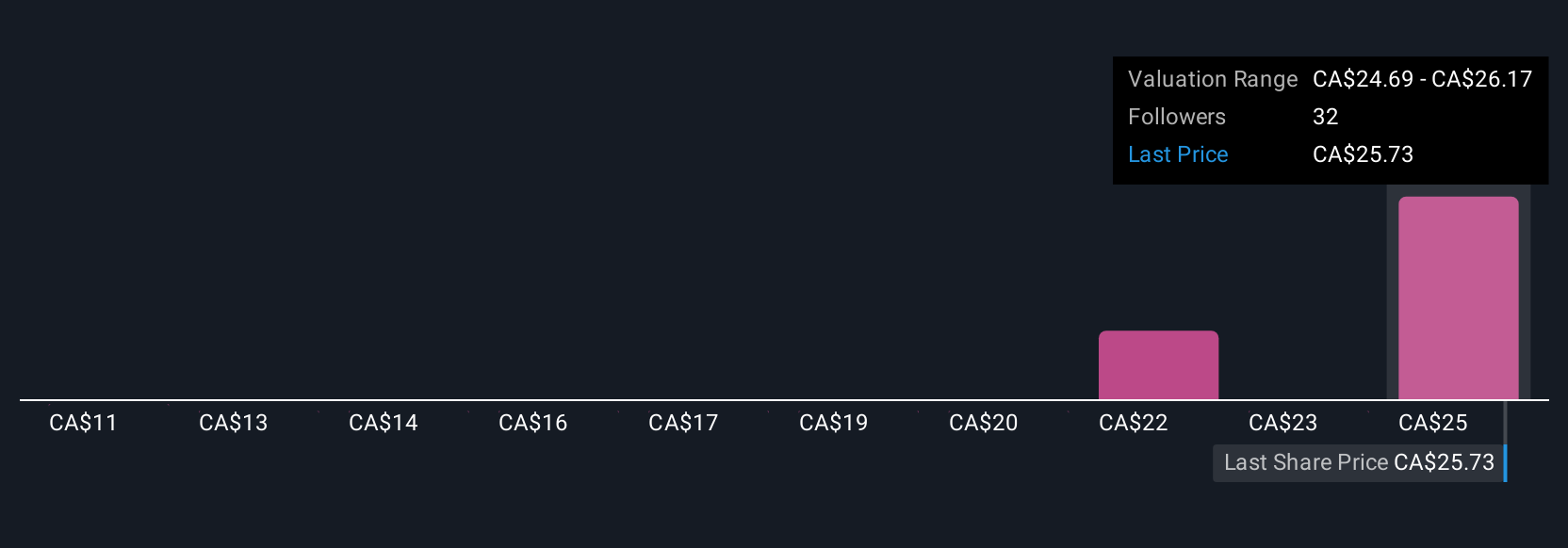

Upgrade Your Decision Making: Choose your Kinross Gold Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company linked directly to your expectations for its future revenue, earnings, margins and, in turn, its fair value. On Simply Wall St’s Community page, Narratives are an easy, accessible tool used by millions of investors to turn their view of a business into a structured financial forecast that flows through to a fair value estimate they can compare with today’s share price to inform their decision to buy, hold or sell. Because Narratives are updated dynamically as new information arrives, such as Kinross Gold’s latest production guidance, margin trends, buybacks or analyst target changes, your fair value automatically stays in sync with the story you believe. For example, one Kinross Narrative might assume that efficiency gains, reserve growth and resilient gold prices justify a fair value near CA$37.79. A more cautious Narrative that focuses on rising costs, political risk and production uncertainty could anchor closer to CA$9.98. Your task is to decide which story, and which number, matches your own conviction.

Do you think there's more to the story for Kinross Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026