- Canada

- /

- Metals and Mining

- /

- TSX:IVN

How Investors Are Reacting To Ivanhoe Mines (TSX:IVN) Record Zinc Production and Copper Output Milestones

Reviewed by Sasha Jovanovic

- Ivanhoe Mines Ltd. recently reported strong third quarter 2025 operating results, including record zinc production at the Kipushi mine and robust copper output from the Kamoa-Kakula complex, following operational upgrades and a completed debottlenecking program.

- With the upcoming start-up of Africa’s largest copper smelter and initial platinum-group metal production from the Platreef mine later this year, the company continues to advance key projects that could further broaden its resource base and output.

- We'll now explore how Kipushi's record zinc production and the company's project milestones could reshape Ivanhoe Mines' investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ivanhoe Mines Investment Narrative Recap

Owning Ivanhoe Mines often comes down to confidence in its ability to deliver on major project ramp-ups and manage operational resilience, especially at Kamoa-Kakula. The record-setting Q3 zinc output at Kipushi is a positive, but the most important short-term catalyst, successful start-up of Africa’s largest copper smelter, remains on schedule and the biggest risk, persistent geotechnical and dewatering issues at Kamoa-Kakula, appears unchanged for now.

The recent CAD 690 million private placement, which brought in the Qatar Investment Authority as a 4 percent shareholder, stands out in this context. This capital infusion directly supports Ivanhoe’s project build-out, adding balance sheet flexibility as the company approaches critical milestones.

But while investors may focus on strong operational results, the risk tied to ongoing Kamoa-Kakula dewatering and the potential for disruptions remains crucial information investors should be aware of if...

Read the full narrative on Ivanhoe Mines (it's free!)

Ivanhoe Mines' outlook projects $1.1 billion in revenue and $805.9 million in earnings by 2028. This requires 73.9% annual revenue growth and a $414.8 million increase in earnings from $391.1 million today.

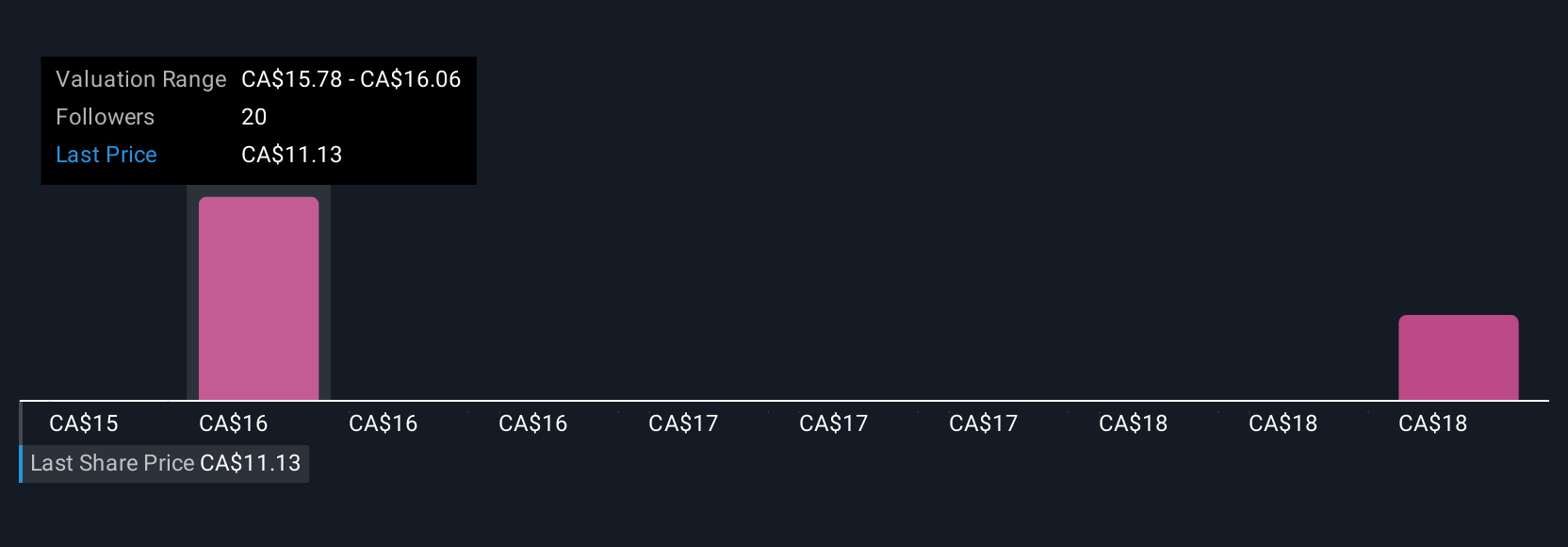

Uncover how Ivanhoe Mines' forecasts yield a CA$16.73 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span a wide range from CA$8.66 to CA$20.66 per share. Amid this range of views, the upcoming copper smelter ramp-up could shape sentiment and impact Ivanhoe’s long-term potential, explore how other investors see the opportunity differently.

Explore 3 other fair value estimates on Ivanhoe Mines - why the stock might be worth as much as 37% more than the current price!

Build Your Own Ivanhoe Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ivanhoe Mines research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ivanhoe Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ivanhoe Mines' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives