- Canada

- /

- Metals and Mining

- /

- TSX:III

It Looks Like The CEO Of Imperial Metals Corporation (TSE:III) May Be Underpaid Compared To Peers

Shareholders will be pleased by the impressive results for Imperial Metals Corporation (TSE:III) recently and CEO J. Kynoch has played a key role. This would be kept in mind at the upcoming AGM on 26 May 2021 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

View our latest analysis for Imperial Metals

Comparing Imperial Metals Corporation's CEO Compensation With the industry

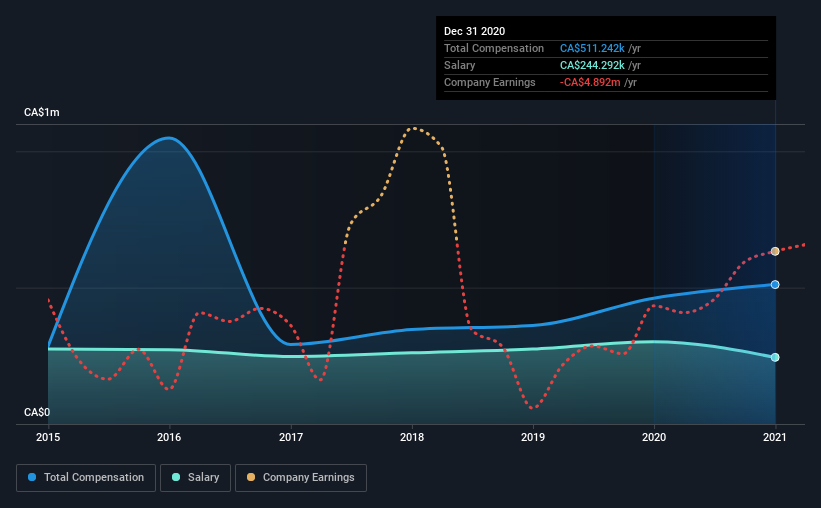

Our data indicates that Imperial Metals Corporation has a market capitalization of CA$659m, and total annual CEO compensation was reported as CA$511k for the year to December 2020. That's a notable increase of 11% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$244k.

On examining similar-sized companies in the industry with market capitalizations between CA$241m and CA$964m, we discovered that the median CEO total compensation of that group was CA$750k. That is to say, J. Kynoch is paid under the industry median. What's more, J. Kynoch holds CA$6.8m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$244k | CA$302k | 48% |

| Other | CA$267k | CA$160k | 52% |

| Total Compensation | CA$511k | CA$461k | 100% |

On an industry level, around 94% of total compensation represents salary and 6% is other remuneration. In Imperial Metals' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Imperial Metals Corporation's Growth

Imperial Metals Corporation has seen its earnings per share (EPS) increase by 17% a year over the past three years. It achieved revenue growth of 78% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Imperial Metals Corporation Been A Good Investment?

We think that the total shareholder return of 174%, over three years, would leave most Imperial Metals Corporation shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given the improved performance, shareholders may be more forgiving of CEO compensation in the upcoming AGM. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Imperial Metals that investors should look into moving forward.

Switching gears from Imperial Metals, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:III

Imperial Metals

Engages in the exploration, development, and production of base and precious metals in the United States, Switzerland, China, the Philippines, Singapore, and Canada.

Solid track record and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026