- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Hudbay’s Strong Q2 Profit and Dividend Might Change the Case for Investing in TSX:HBM

Reviewed by Simply Wall St

- Hudbay Minerals Inc. recently reported its second quarter 2025 results, posting sales of US$536.4 million and net income of US$117.7 million, reversing a net loss from the previous year, while reaffirming production guidance and announcing a semi-annual dividend.

- This marks a considerable turnaround in profitability and highlights the company's improved operational performance over the first half of 2025.

- We'll assess how Hudbay's stronger earnings and improved profitability could impact the company's investment outlook and growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Hudbay Minerals Investment Narrative Recap

To be a Hudbay Minerals shareholder, you generally need to believe in the company’s ability to execute large, capital-intensive projects and grow its copper production footprint, especially as demand shifts toward critical minerals. The recent earnings beat and reaffirmed guidance highlight near-term strength and suggest improved cost control, but they do not eliminate the major short-term risk: project execution and potential operational disruptions, especially given the company’s concentrated asset base in Manitoba and Peru.

Among recent announcements, the reaffirmation of 2025 production guidance is most relevant, signaling management’s confidence in operational continuity and project delivery after a period of volatility. For investors tracking catalysts, this stability supports Hudbay’s growth ambitions tied to both existing operations and upcoming development projects, even as permitting, cost inflation, and geopolitical factors continue to demand close attention.

By contrast, investors should also keep in mind the potential impact of project delays and cost overruns at Hudbay’s largest developments, since ...

Read the full narrative on Hudbay Minerals (it's free!)

Hudbay Minerals' outlook anticipates $2.4 billion in revenue and $361.1 million in earnings by 2028. This scenario requires a 4.7% annual revenue growth and a $206.3 million increase in earnings from the current $154.8 million.

Uncover how Hudbay Minerals' forecasts yield a CA$17.87 fair value, a 17% upside to its current price.

Exploring Other Perspectives

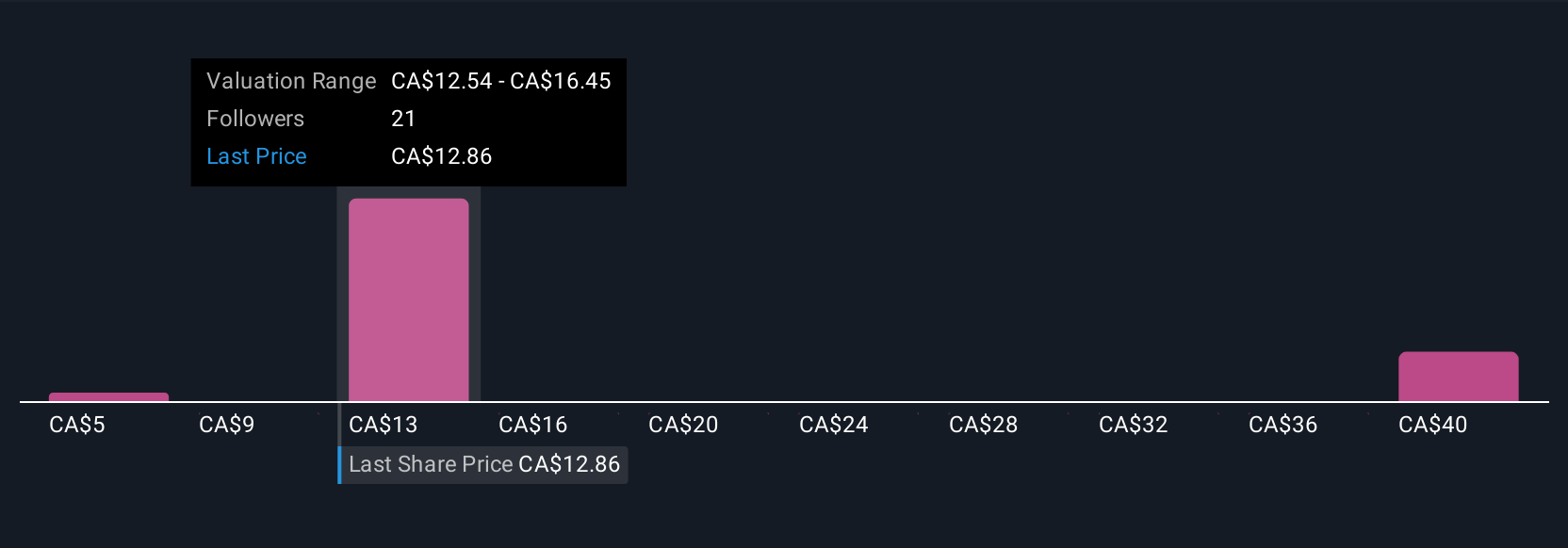

Simply Wall St Community members valued Hudbay from CA$4.71 to CA$69.56 across 5 fair value estimates. While you see wide differences in opinion, the company’s focus on project delivery and cost control is something everyone should follow for its broader market performance implications.

Explore 5 other fair value estimates on Hudbay Minerals - why the stock might be worth over 4x more than the current price!

Build Your Own Hudbay Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hudbay Minerals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Hudbay Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hudbay Minerals' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives