- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Hudbay Minerals (TSX:HBM) Quickly Restores Peru Output After Blockades: What Does This Signal for Stability?

Reviewed by Sasha Jovanovic

- Hudbay Minerals recently announced the resumption of full operations at its Constancia mine in Peru after a precautionary shutdown due to local demonstrations and illegal blockades, with production now restored and concentrate inventories normalized.

- This quick operational recovery underscores Hudbay’s approach to working with local communities and maintaining strong stakeholder relationships, helping to address disruptions and support long-term stability.

- We’ll examine how the restoration of full production at Constancia impacts Hudbay’s investment outlook and risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hudbay Minerals Investment Narrative Recap

To be a Hudbay Minerals shareholder, you generally need to believe in the company’s ability to deliver reliable copper production growth, maintain cost discipline amid operational volatility, and manage stakeholder relationships in regions like Peru. The recent resumption of full operations at Constancia following protests points to ongoing jurisdictional risks but does not materially alter the key short-term catalyst: advancing major development projects on time and within budget. The biggest risk, unplanned production shutdowns in Peru or Manitoba, remains present, but restoration of guidance suggests resilience for now.

Of the recent company announcements, Hudbay’s reaffirmation of full-year 2025 production and cost guidance, despite disruptions at Constancia and Snow Lake, is particularly relevant. This provides reassurance that management anticipates delivering on previously stated commitments, with the Peru recovery limiting near-term downside to earnings drivers.

By contrast, recurring local unrest and related stoppages are factors investors should be mindful of when considering potential for...

Read the full narrative on Hudbay Minerals (it's free!)

Hudbay Minerals' outlook anticipates $2.4 billion in revenue and $373.5 million in earnings by 2028. This relies on a 2.6% annual revenue growth rate and a $84.5 million increase in earnings from the current $289.0 million.

Uncover how Hudbay Minerals' forecasts yield a CA$21.79 fair value, a 9% downside to its current price.

Exploring Other Perspectives

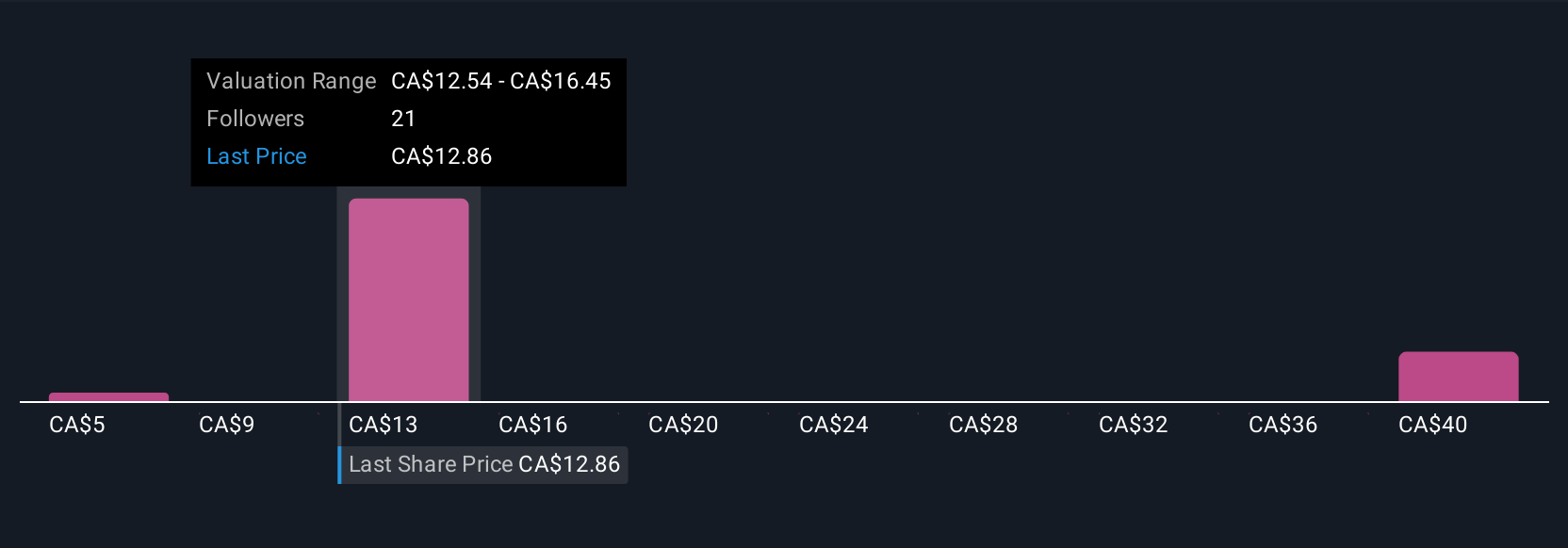

Seven Simply Wall St Community members estimate Hudbay’s fair value in a wide range from CA$4.71 up to CA$57.38 per share. Given recent operational disruptions and reliance on key projects, your outlook may depend on how you weigh jurisdictional risks and recovery potential.

Explore 7 other fair value estimates on Hudbay Minerals - why the stock might be worth over 2x more than the current price!

Build Your Own Hudbay Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hudbay Minerals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Hudbay Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hudbay Minerals' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives