- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Hudbay Minerals Inc. (TSE:HBM) Screens Well But There Might Be A Catch

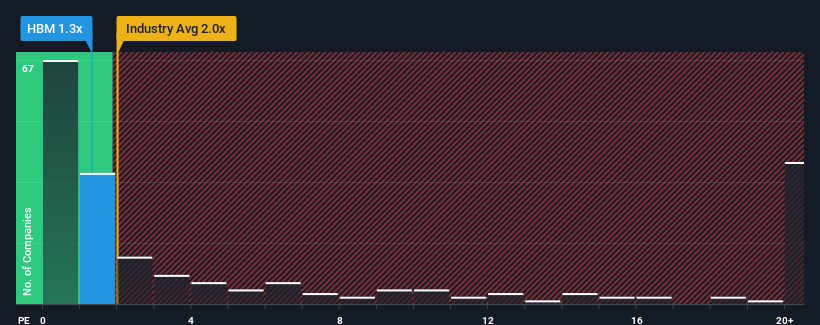

Hudbay Minerals Inc.'s (TSE:HBM) price-to-sales (or "P/S") ratio of 1.3x might make it look like a buy right now compared to the Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 2x and even P/S above 14x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hudbay Minerals

What Does Hudbay Minerals' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Hudbay Minerals' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Hudbay Minerals will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Hudbay Minerals' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10.0% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 29% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 13% per year over the next three years. With the industry only predicted to deliver 9.5% each year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Hudbay Minerals' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Hudbay Minerals' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Hudbay Minerals' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Hudbay Minerals (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives