- Canada

- /

- Metals and Mining

- /

- TSX:GOLD

GoldMining (TSX:GOLD) Is Up 20.3% After Posting Third-Quarter Profit and Reversing Last Year’s Losses

Reviewed by Sasha Jovanovic

- GoldMining Inc. announced quarterly results for the period ended August 31, 2025, reporting a net income of C$372,000 in the third quarter, reversing a net loss of C$8.58 million from the same period last year.

- This turnaround to profitability comes as the company also showed a sharply reduced nine-month net loss, reflecting improved operational performance amidst an active Canadian gold sector.

- We'll explore how GoldMining's shift to third-quarter profit strengthens its investment narrative during an upswing for gold mining companies.

Find companies with promising cash flow potential yet trading below their fair value.

What Is GoldMining's Investment Narrative?

GoldMining’s surprise shift to profitability in the latest quarter marks a significant development for shareholders who believe in the upside embedded in resource exploration companies, especially those leveraged to the gold price cycle. Against a backdrop of surging interest in Canadian gold miners and a near doubling in GoldMining’s share price year-to-date, this earnings inflection could serve as a meaningful short-term catalyst. While historic earnings have been deeply negative, the recent result offers encouragement and may ease selling pressure, at least for now. However, risks around limited cash runway and continued absence of meaningful revenue remain front and center, especially if gold prices or investor sentiment soften. The news may not fully offset long-running structural challenges, but it does suggest a partial re-rating of risk in the company, making upcoming exploration milestones and financing updates even more influential. Still, there’s real risk in relying on a single profitable quarter with little recurring revenue to back it up.

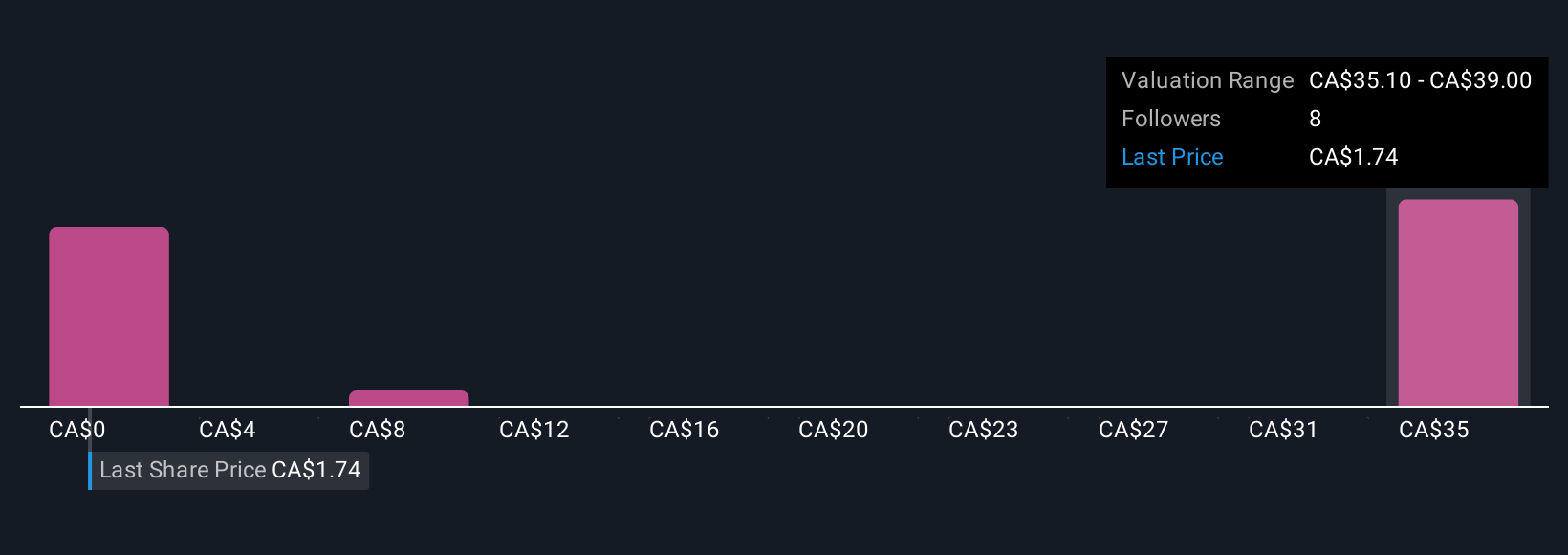

Upon reviewing our latest valuation report, GoldMining's share price might be too optimistic.Exploring Other Perspectives

Explore 9 other fair value estimates on GoldMining - why the stock might be a potential multi-bagger!

Build Your Own GoldMining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoldMining research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free GoldMining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoldMining's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOLD

GoldMining

A mineral exploration company, engages in the acquisition, exploration, and development of gold and copper assets in the Americas.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>