- Canada

- /

- Metals and Mining

- /

- TSX:GMIN

G Mining Ventures (TSX:GMIN): Valuation Insights After Profit Turnaround and Reaffirmed Gold Production Guidance

Reviewed by Simply Wall St

G Mining Ventures (TSX:GMIN) just turned some heads with its latest update. The company swung from a loss into strong profitability for both the second quarter and first half of 2025, and at the same time it reaffirmed its full-year gold production guidance. This has given investors a solid sense that operations are on track. Those looking to better understand the future for this gold miner now have a compelling new data point, the kind that changes how the market values a stock.

This shift in results has not gone unnoticed. The stock has gained momentum in recent months, rising over 65% year-to-date and more than doubling over the last year, even as the broader sector has seen ups and downs. Earlier events, such as previous production updates and management’s clear communication, laid a foundation. However, this earnings jump provides a new anchor for any valuation discussion, especially given market attention to consistent growth and execution.

With such a sharp turnaround and positive production outlook, the question remains: Is G Mining Ventures still trading at an attractive price, or has the market already captured these gains in its current valuation?

Price-to-Earnings of 21.6x: Is it justified?

Based on its Price-to-Earnings ratio, G Mining Ventures appears undervalued compared to peers but is expensive relative to the broader Canadian Metals and Mining industry. This ratio is a common yardstick for quickly comparing how much investors are willing to pay for a dollar of earnings.

The P/E ratio is especially relevant in the mining sector, where profitability can be volatile. It also signals market expectations of future earnings growth. With G Mining Ventures recently turning profitable, its P/E ratio reflects both renewed confidence in earnings stability and the premium investors may place on a strong turnaround story.

While its 21.6x multiple puts the stock at good value compared to similar companies, it trades above the industry average. This suggests the market may be pricing in strong future growth. Whether this premium is justified depends on the company delivering on ambitious financial forecasts.

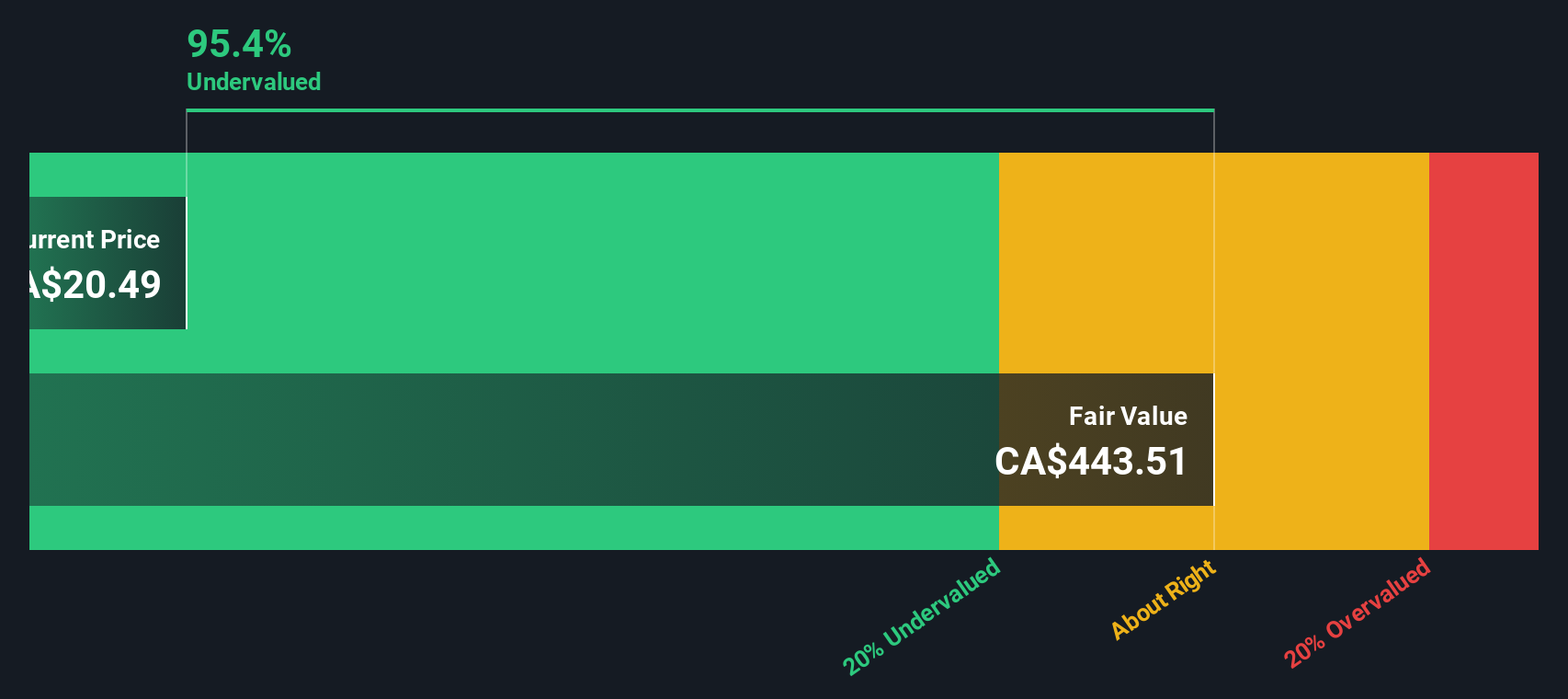

Result: Fair Value of $29.50 (UNDERVALUED)

See our latest analysis for G Mining Ventures.However, slowing revenue growth or a sudden drop in gold prices could quickly alter this bullish outlook for G Mining Ventures.

Find out about the key risks to this G Mining Ventures narrative.Another View: What Does Our DCF Model Say?

While multiples point to good value, our DCF model offers a different perspective. This approach, which estimates the worth of future cash flows, also suggests G Mining Ventures is significantly undervalued. However, the question remains whether this positive outlook can hold up under changing market dynamics.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own G Mining Ventures Narrative

If you see things differently or want to analyze the numbers on your own terms, you can build a personalized view in just a few minutes. So why not do it your way?

A great starting point for your G Mining Ventures research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Grow your portfolio with confidence by tapping into uniquely positioned stocks that may offer outsized returns and hidden gems often overlooked by the market. Don’t miss the chance to spot exceptional opportunities that savvy investors are acting on right now. These next moves could shape your financial future.

- Access big income potential and strengthen your strategy by tracking dividend stocks with yields > 3% in sectors with robust, reliable payouts.

- Spot the momentum around groundbreaking technological leaps by following AI penny stocks that are advancing artificial intelligence across industries.

- Pinpoint solid financial performers in the value zone by screening for undervalued stocks based on cash flows trading at compelling prices compared to their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GMIN

G Mining Ventures

A mining company, engages in the acquisition, exploration, and development of precious metal projects.

Undervalued with high growth potential.

Market Insights

Community Narratives