The Canadian market has been navigating a landscape of uncertainty due to ongoing trade negotiations and heightened volatility, with the TSX experiencing significant fluctuations. Amidst this backdrop, investors are increasingly drawn to opportunities that promise both resilience and potential growth. Penny stocks, while an older term, remain relevant as they often represent smaller or newer companies that can offer unique value propositions. By focusing on those with strong financials and clear growth paths, these stocks can present compelling opportunities for investors seeking under-the-radar gems in a turbulent market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$62.71M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.66 | CA$75.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$1.70 | CA$106.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.26 | CA$598.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$285.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.76 | CA$169.26M | ✅ 3 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.85 | CA$168.97M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.57 | CA$521.69M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.61 | CA$69.58M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.18M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 932 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, with a market cap of CA$134.89 million, offers mineral exploration drilling services to mining companies in West Africa, Egypt, Chile, and Peru.

Operations: Geodrill's revenue is primarily derived from its Business Services segment, which generated $143.05 million.

Market Cap: CA$134.89M

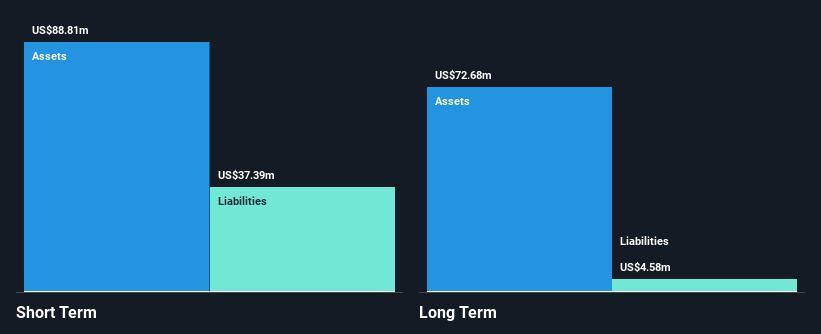

Geodrill Limited, with a market cap of CA$134.89 million, has demonstrated significant profit growth, with earnings rising by 137.3% over the past year, outpacing its industry peers. The company's financial health is robust, as evidenced by its coverage of interest payments and liabilities through strong cash flow and short-term assets exceeding liabilities. Despite a low return on equity of 7.6%, Geodrill's high-quality earnings and seasoned management team enhance its investment appeal. Recent presentations at international conferences may further bolster investor interest in this company trading below analyst price targets with potential revenue growth ahead.

- Dive into the specifics of Geodrill here with our thorough balance sheet health report.

- Understand Geodrill's earnings outlook by examining our growth report.

Loncor Gold (TSX:LN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Loncor Gold Inc. is a gold exploration company focused on acquiring, exploring, and developing precious metal projects in the Ngayu greenstone belt in the Democratic Republic of the Congo and Canada, with a market cap of CA$94.31 million.

Operations: Loncor Gold Inc. does not report any revenue segments.

Market Cap: CA$94.31M

Loncor Gold Inc., with a market cap of CA$94.31 million, is a pre-revenue gold exploration company focused on its Adumbi deposit in the Democratic Republic of the Congo. Recent drilling results have been encouraging, revealing significant mineralization at depth and supporting the potential expansion of its 3.66 million ounce resource towards a Tier 1 project. Despite reporting a net loss reduction to US$4.16 million for 2024, Loncor's financial position is constrained by less than one year of cash runway and no debt obligations, highlighting both opportunity and risk typical for companies in this stage within the mining sector.

- Take a closer look at Loncor Gold's potential here in our financial health report.

- Review our historical performance report to gain insights into Loncor Gold's track record.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

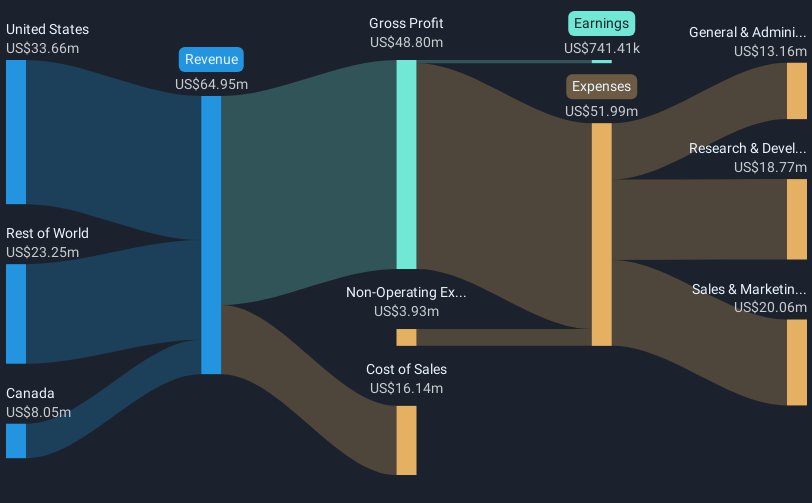

Overview: Thinkific Labs Inc. develops, markets, and supports a cloud-based platform for online course creation and management in Canada, the United States, and internationally with a market cap of CA$172.24 million.

Operations: The company generates revenue of $66.94 million from the development, marketing, and support management of its cloud-based platform for online course creation and management.

Market Cap: CA$172.24M

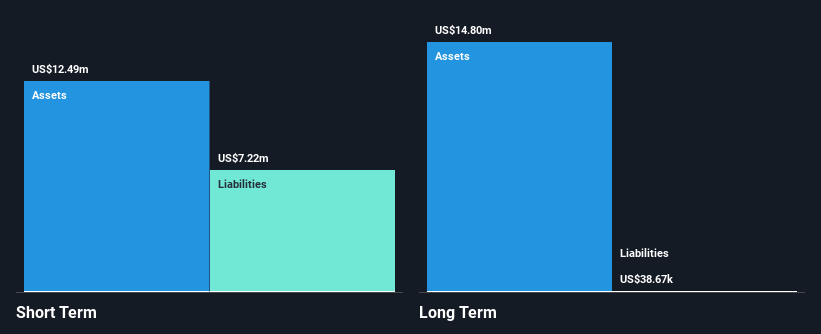

Thinkific Labs Inc., with a market cap of CA$172.24 million, reported revenue growth to US$66.94 million in 2024, up from US$59.05 million the previous year, despite remaining unprofitable with a net loss of US$0.237 million. The company projects first-quarter 2025 revenue between $17.5 million and $17.8 million, indicating continued growth momentum. Although its management team and board are relatively new, Thinkific maintains a strong cash position with short-term assets surpassing liabilities significantly and no debt burden, providing financial stability amidst its ongoing efforts to achieve profitability in the competitive software industry for online course platforms.

- Navigate through the intricacies of Thinkific Labs with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Thinkific Labs' future.

Turning Ideas Into Actions

- Explore the 932 names from our TSX Penny Stocks screener here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Thinkific Labs, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Thinkific Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:THNC

Thinkific Labs

Engages in the development, marketing, and support management of cloud-based platform in Canada, the United States, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives