- Canada

- /

- Metals and Mining

- /

- TSX:GAU

Is Asanko’s Expanded Drill Spend And Stronger Gold Prices Altering The Investment Case For Galiano Gold (TSX:GAU)?

Reviewed by Sasha Jovanovic

- Galiano Gold recently reported further positive exploration results at the Asanko Gold Mine in Ghana and approved an additional US$3.10 million to fund 11,000 meters of drilling aimed at better defining high-grade ore shoots and converting inferred resources.

- This combination of encouraging drill data and an expanded exploration budget comes as gold prices strengthen, potentially increasing the importance of any future resource upgrades for Galiano’s long-term production and cash flow profile.

- We’ll now explore how the expanded US$3.10 million drilling program at Asanko could reshape Galiano Gold’s existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Galiano Gold Investment Narrative Recap

To own Galiano Gold, you need to believe that the Asanko Gold Mine can convert its high grade exploration success into longer mine life and stronger cash generation from a single core asset. The expanded US$3.10 million drilling campaign at Abore strengthens the near term growth catalyst of resource upgrades, but it does not remove the key risk that the business still depends heavily on one mine in Ghana with rising local cost pressures.

The recent update to 2025 production guidance, reaffirming a 130,000 to 150,000 ounce target at all in sustaining costs of US$1,750 to US$1,950 per ounce, is an important reference point for this new exploration spend. Any future resource conversion at Abore will likely be judged against the ability to improve margins and extend Asanko’s economic life within that cost framework.

Yet while the drilling news is encouraging, investors should be aware that Galiano still relies on a single asset in Ghana where ...

Read the full narrative on Galiano Gold (it's free!)

Galiano Gold's narrative projects $612.9 million revenue and $157.4 million earnings by 2028. This requires 25.6% yearly revenue growth and a $162.8 million earnings increase from -$5.4 million today.

Uncover how Galiano Gold's forecasts yield a CA$4.80 fair value, a 46% upside to its current price.

Exploring Other Perspectives

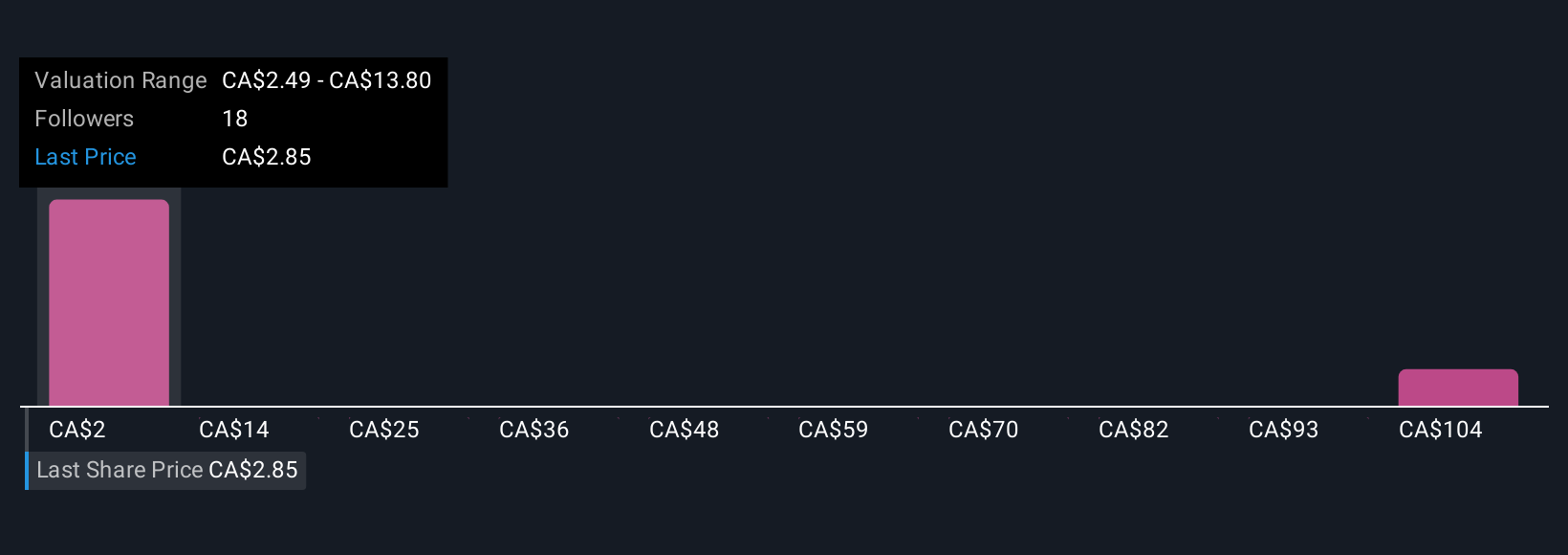

Seven members of the Simply Wall St Community currently estimate Galiano’s fair value between CA$2.49 and CA$58.63, highlighting sharply different views. When you set those wide ranges against the company’s single mine risk in Ghana, it becomes even more important to compare several perspectives before deciding how this story might fit in your portfolio.

Explore 7 other fair value estimates on Galiano Gold - why the stock might be a potential multi-bagger!

Build Your Own Galiano Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Galiano Gold research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Galiano Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Galiano Gold's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GAU

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026