Last Update 02 Dec 25

Fair value Increased 0.42%GAU: Strong Drilling Results Will Drive Future Outperformance Despite Operational Setbacks

Analysts have slightly raised their price target for Galiano Gold, increasing it from $4.78 to $4.80. This reflects modest improvements in the company's projected value based on updated financial metrics.

What's in the News

- Galiano Gold reported strong drilling results at the 2025 Abore program, with multiple significant high-grade gold intercepts in newly identified ore shoots below existing Mineral Resource. The company approved an additional 11,000 meters of drilling and a $3.1M budget to expand the campaign. (Company Statement)

- The latest drill highlights at Abore include 4.7 grams per tonne gold over 28 meters in the Main Pit, 3.5 grams per tonne gold over 20 meters in the South Pit, and further step-out intercepts indicating the mineralization remains open in all directions. (Company Statement)

- Galiano Gold announced gold production of 32,533 ounces for the third quarter of 2025, representing a 7% increase over the previous quarter. Year-to-date production reached 83,617 ounces as of September 30, 2025. (Operating Results)

- An incident at the Asanko Gold Mine in the Amansie South District of Ghana resulted in civil unrest, a fatality, and damage to contractor equipment. Operations at the Esaase deposit were temporarily suspended. Abore and the processing plant remain unaffected. (Company Statement)

Valuation Changes

- Fair Value per Share has risen slightly, increasing from CA$4.78 to CA$4.80.

- Discount Rate has edged up from 7.19% to 7.22%.

- Revenue Growth estimate remains unchanged at approximately 23.89%.

- Net Profit Margin is stable, holding steady at 27.51%.

- Future P/E Ratio has increased marginally, moving from 6.07x to 6.12x.

Key Takeaways

- Higher gold prices and ongoing process plant upgrades are expected to boost revenues, margins, and profitability amid increasing investor demand for gold.

- Significant exploration success and a strong cash position enable mine life extension, future production growth, and investment flexibility.

- Heavy dependence on a single asset, rising regulatory and operational costs, limited exploration growth, and ESG pressures threaten profitability and long-term sustainability.

Catalysts

About Galiano Gold- A mining, development, and exploration company.

- Increasing global instability and ongoing economic uncertainty are fueling investor flows into gold as a safe-haven and inflation-hedging asset. With Galiano highly leveraged to the gold price, sustained or higher gold prices will directly support higher realized revenues and strengthen operating cash flows.

- Successful step-out and deep drilling at Abore has intercepted significant widths and grades of mineralization below current reserves, confirming the deposit is open at depth and along strike. This creates significant reserve and resource expansion potential, supporting future production growth and longer-term revenue visibility.

- Commissioning of the secondary crusher and other process plant upgrades is expected to enable higher mill throughput (5.8 Mtpa design), making harder ore sources economic to process, reducing per-unit processing costs, and driving improved net margins and earnings as production increases.

- Sustained cost optimization and operational discipline, including a 10% reduction in all-in sustaining costs (AISC) and strong control over fixed costs, are setting the stage for improved operating margins and enhanced profitability as production ramps up.

- A strong, debt-free balance sheet with $115 million in cash enables accelerated investment in mine life extension and future growth projects, while maintaining optionality for shareholder returns or opportunistic acquisitions-laying the foundation for long-term free cash flow and EPS growth.

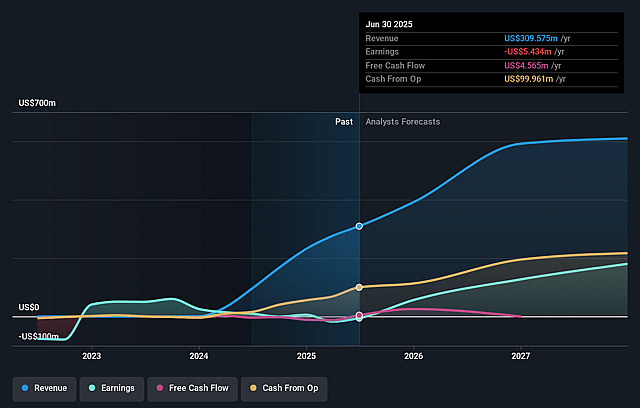

Galiano Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Galiano Gold's revenue will grow by 25.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.8% today to 25.7% in 3 years time.

- Analysts expect earnings to reach $157.4 million (and earnings per share of $0.84) by about September 2028, up from $-5.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $253.3 million in earnings, and the most bearish expecting $107.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.2x on those 2028 earnings, up from -118.2x today. This future PE is lower than the current PE for the US Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

Galiano Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Galiano Gold's continued reliance on a single asset-the Asanko Gold Mine in Ghana-means that any operational, geological, or regulatory disruptions at this site could directly and substantially impact future revenues and net margins, especially as current mine life and resource expansion are still being defined.

- Increasing government royalties and levies in Ghana, including a new 2% growth and sustainability levy applied from April, are driving up all-in sustaining costs (AISC) by an estimated $100/oz at current gold prices and could erode net earnings and reduce shareholder returns if regulatory costs continue to rise.

- Sustained local currency (cedi) appreciation against the U.S. dollar, as noted in Q2, may add additional upward pressure to cost structures, potentially reducing operating margins and free cash flow despite predominantly U.S. dollar-based expenses.

- The company's still-limited organic exploration pipeline, with near-term growth almost exclusively focused on Abore, raises concerns about long-term production growth and reserve replacement, which could threaten future top-line revenues if new discoveries or reserve expansions do not materialize as expected.

- Ongoing global investor focus on ESG and the potential for heightened scrutiny of gold mining operations may increase Galiano Gold's cost of capital or limit access to funding if the company cannot demonstrate continued progress on sustainability and environmental best practices, ultimately impacting future investment and growth opportunities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$4.263 for Galiano Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.87, and the most bearish reporting a price target of just CA$2.49.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $612.9 million, earnings will come to $157.4 million, and it would be trading on a PE ratio of 6.2x, assuming you use a discount rate of 6.6%.

- Given the current share price of CA$3.43, the analyst price target of CA$4.26 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Galiano Gold?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.