Key Takeaways

- Ahead-of-schedule mining and richer-than-expected resource discoveries may accelerate revenue growth, increase operating cash flow, and extend mine life.

- Strong gold price leverage, disciplined financial management, and leading ESG standards position the company to attract capital and drive sustained shareholder value.

- Heavy reliance on volatile gold prices, operational challenges, and single-asset exposure in Ghana heighten risks to future profitability, cash flow, and access to capital.

Catalysts

About Galiano Gold- A mining, development, and exploration company.

- While analysts broadly agree that improved mining and cost clarity at Nkran will enhance efficiency, the company's ahead-of-schedule stripping and mobilization of additional mining fleet point toward the potential for production volumes and grades to exceed current guidance, accelerating near-term revenue and cash flow beyond consensus expectations.

- Analyst consensus sees ongoing exploration at Abore as potentially expanding the resource base, but the deeper drilling reveals mineralization significantly richer than existing models, opening the possibility for a transformational underground operation that could extend mine life and deliver a step change in long-term earnings power.

- With gold prices at record highs and Galiano highly leveraged to further gold price appreciation, the company is uniquely positioned to benefit from continued global demand for gold as a hedge against macro and geopolitical uncertainty, which could substantially elevate realized revenues.

- Galiano's industry-leading safety performance and commitment to responsible mining practices, evidenced by zero lost-time injuries and robust ESG standards, align it to attract greater institutional and ESG-focused capital, allowing for a lower cost of capital and potential multiple expansion in its valuation.

- Management's disciplined capital allocation, strong net cash position, and consistent reduction in all-in sustaining costs create the optionality for accelerated reinvestment, possible M&A activity, and, as operating cash flow builds, shareholder returns, all of which could drive sustained growth in net margins and shareholder value.

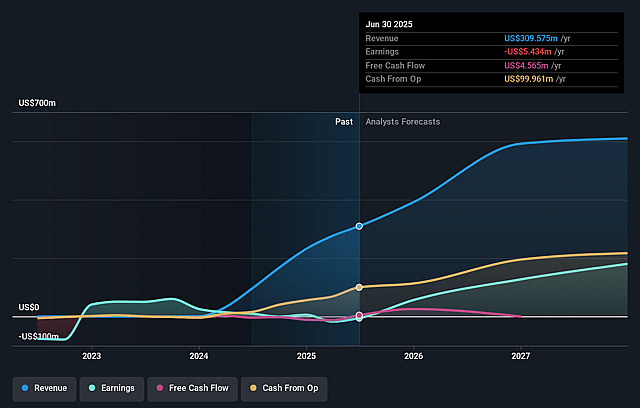

Galiano Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Galiano Gold compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Galiano Gold's revenue will grow by 30.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -1.8% today to 47.6% in 3 years time.

- The bullish analysts expect earnings to reach $324.2 million (and earnings per share of $1.26) by about September 2028, up from $-5.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 4.1x on those 2028 earnings, up from -121.8x today. This future PE is lower than the current PE for the US Metals and Mining industry at 18.6x.

- Analysts expect the number of shares outstanding to grow by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.64%, as per the Simply Wall St company report.

Galiano Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company remains highly leveraged to the gold price, meaning that any sustained decline in gold demand or price-driven by global shifts toward digital and low-carbon economies-could materially reduce future revenues and operating margins.

- All-in sustaining costs are subject to upward pressure from external factors including increased Ghanaian royalties, newly introduced sustainability levies, currency fluctuations, and potentially higher future regulatory costs, risking long-term compression of net earnings and cash flow.

- The long-term production outlook is uncertain, as existing growth depends on successful exploration and development at Abore and Nkran; failure to replace or expand resources at current grade and cost could result in declining output and lower revenues in future years.

- Galiano's status as a single-asset, mid-tier gold producer exposes it to elevated geopolitical, fiscal, and operational risks in Ghana, including possible resource nationalism, higher taxation, or local currency devaluation, which could reduce profitability and introduce volatility into reported results.

- As ESG considerations and investor skepticism of smaller, single-mine operators intensify, Galiano Gold may face higher costs of capital and lower valuation multiples, making it more difficult to fund growth or maintain strong net asset value over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Galiano Gold is CA$5.85, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Galiano Gold's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.85, and the most bearish reporting a price target of just CA$2.49.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $681.3 million, earnings will come to $324.2 million, and it would be trading on a PE ratio of 4.1x, assuming you use a discount rate of 6.6%.

- Given the current share price of CA$3.55, the bullish analyst price target of CA$5.85 is 39.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.