The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to Fortuna Silver Mines Inc.'s (TSE:FVI), to help you decide if the stock is worth further research. What is Fortuna Silver Mines's P/E ratio? Well, based on the last twelve months it is 23.88. That corresponds to an earnings yield of approximately 4.2%.

Check out our latest analysis for Fortuna Silver Mines

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price (in reporting currency) ÷ Earnings per Share (EPS)

Or for Fortuna Silver Mines:

P/E of 23.88 = CA$3.22 (Note: this is the share price in the reporting currency, namely, USD ) ÷ CA$0.14 (Based on the year to June 2019.)

Is A High P/E Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Does Fortuna Silver Mines's P/E Ratio Compare To Its Peers?

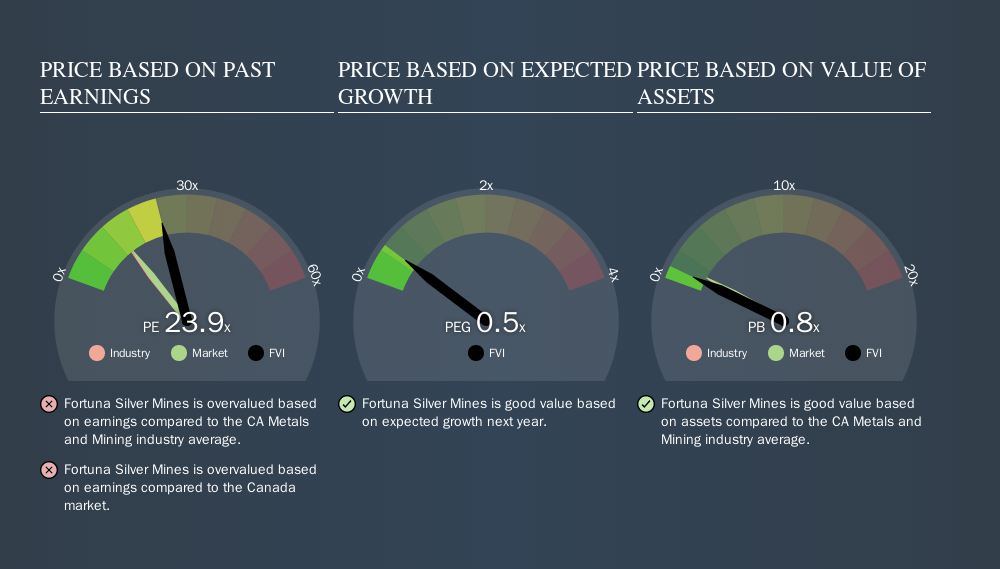

We can get an indication of market expectations by looking at the P/E ratio. As you can see below, Fortuna Silver Mines has a higher P/E than the average company (14.7) in the metals and mining industry.

That means that the market expects Fortuna Silver Mines will outperform other companies in its industry.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. Then, a lower P/E should attract more buyers, pushing the share price up.

Fortuna Silver Mines's earnings per share fell by 69% in the last twelve months. If the company can grow EPS strongly, the market may improve its opinion of it. I would further inform my view by checking insider buying and selling., among other things.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. So it won't reflect the advantage of cash, or disadvantage of debt. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

So What Does Fortuna Silver Mines's Balance Sheet Tell Us?

Since Fortuna Silver Mines holds net cash of US$6.8m, it can spend on growth, justifying a higher P/E ratio than otherwise.

The Verdict On Fortuna Silver Mines's P/E Ratio

Fortuna Silver Mines's P/E is 23.9 which is above average (14.2) in its market. The recent drop in earnings per share would make some investors cautious, but the healthy balance sheet means the company retains potential for future growth. If fails to eventuate, the current high P/E could prove to be temporary, as the share price falls.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course you might be able to find a better stock than Fortuna Silver Mines. So you may wish to see this free collection of other companies that have grown earnings strongly.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)