Fortuna Silver Mines Inc. (TSE:FVI) is a stock with outstanding fundamental characteristics. When we build an investment case, we need to look at the stock with a holistic perspective. In the case of FVI, it is a financially-healthy company with a an impressive track record of performance, trading at a discount. Below, I've touched on some key aspects you should know on a high level. For those interested in digger a bit deeper into my commentary, take a look at the report on Fortuna Silver Mines here.

Undervalued with solid track record

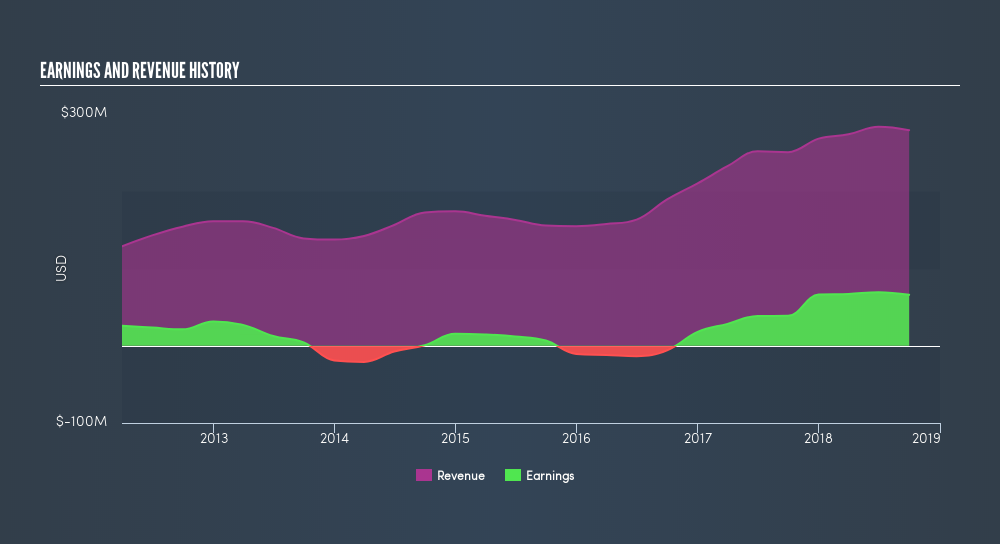

FVI delivered a bottom-line expansion of 70% in the prior year, with its most recent earnings level surpassing its average level over the last five years. Not only did FVI outperformed its past performance, its growth also exceeded the Metals and Mining industry expansion, which generated a 1.9% earnings growth. This is an notable feat for the company. FVI's strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This suggests prudent control over cash and cost by management, which is a key determinant of the company’s health. FVI appears to have made good use of debt, producing operating cash levels of 2.23x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated.

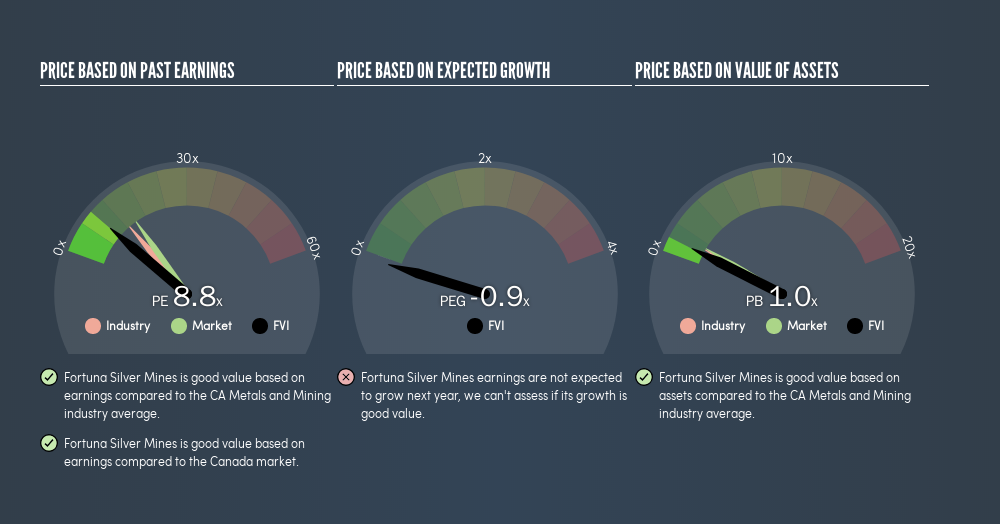

FVI is currently trading below its true value, which means the market is undervaluing the company's expected cash flow going forward. This mispricing gives investors the opportunity to buy into the stock at a cheap price compared to the value they will be receiving, should analysts' consensus forecast growth be correct. Also, relative to the rest of its peers with similar levels of earnings, FVI's share price is trading below the group's average. This bolsters the proposition that FVI's price is currently discounted.

Next Steps:

For Fortuna Silver Mines, there are three important aspects you should further research:

- Future Outlook: What are well-informed industry analysts predicting for FVI’s future growth? Take a look at our free research report of analyst consensus for FVI’s outlook.

- Dividend Income vs Capital Gains: Does FVI return gains to shareholders through reinvesting in itself and growing earnings, or redistribute a decent portion of earnings as dividends? Our historical dividend yield visualization quickly tells you what your can expect from FVI as an investment.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of FVI? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>