- Canada

- /

- Metals and Mining

- /

- TSX:FVI

Fortuna Mining (TSX:FVI): Evaluating Valuation Following Diamba Sud Permit Milestone and Séguéla Production Update

Reviewed by Kshitija Bhandaru

Fortuna Mining (TSX:FVI) has filed its Environmental and Social Impact Assessment for the Diamba Sud gold project in Senegal. This marks a crucial step forward in the project's permitting process and future development timeline.

At the same time, the company has updated investors with robust production figures from the Séguéla Mine. This reaffirms annual production guidance and has sparked greater optimism for Fortuna’s growth strategy in West Africa and beyond.

See our latest analysis for Fortuna Mining.

Fortuna Mining’s share price has had a huge run lately, jumping 6.7% in a single day and delivering a 21% return over the past month as investors responded enthusiastically to the company’s flurry of project milestones and new joint venture in Guinea. With 2025 off to a roaring start and total shareholder return now up 112% over the past year, momentum is clearly building as the market reassesses Fortuna’s growth prospects and pipeline of West African projects.

If you’re inspired by Fortuna’s surge, it might be the perfect moment to discover fast growing stocks with high insider ownership

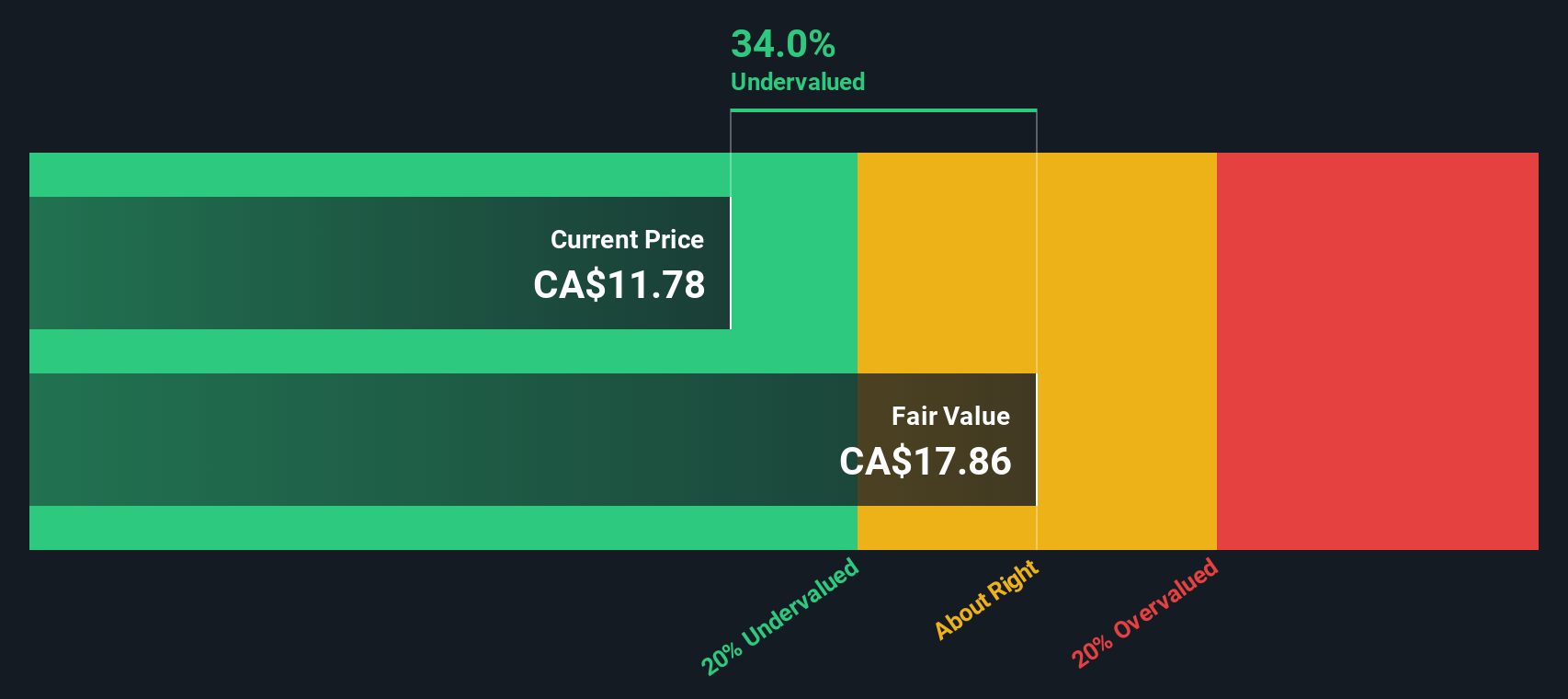

With shares soaring on recent project breakthroughs, investors are left to wonder if Fortuna Mining is still undervalued or if all of this future growth is already reflected in the stock price. Could there still be a real buying opportunity?

Most Popular Narrative: 24% Overvalued

Fortuna Mining's current share price stands above the fair value estimated in the most widely followed narrative, suggesting market optimism exceeds the consensus analyst projection right now. This sets the stage for a deeper look into the drivers and bold assumptions shaping the latest fair value estimate.

Expansion at Seguela and the development of Diamba Sud position Fortuna to restore and surpass its previous production levels, with higher-margin and longer-life ounces. This aligns with anticipated increases in global demand for gold and other strategic metals, supporting future revenue and cash flow growth.

Fortuna's ongoing operational efficiency and cost optimization initiatives are expected to deliver between $50 and $70 million in cumulative savings over the next three years, which should drive consolidated all-in sustaining costs significantly lower and bolster net margins and profitability.

What forecasts let Fortuna punch so far above analyst fair value? The secret lies in forthright assumptions about revenue paths and profit margins. Want to discover which single expectation unlocks the entire current price debate and what skeptics are missing about long-term potential? See how one number changes everything in the full narrative.

Result: Fair Value of $10.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in permitting at Diamba Sud or rising production costs at Seguela could quickly challenge these optimistic projections and change investor sentiment.

Find out about the key risks to this Fortuna Mining narrative.

Another View: Our DCF Model’s Take

Looking through the lens of our SWS DCF model, Fortuna Mining appears to be somewhat overvalued at current prices. The model estimates fair value at CA$12.30, while shares are trading above this level. Could market optimism be running too far ahead, or is there something the DCF is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fortuna Mining Narrative

If you see the story differently, or want to dig into the numbers yourself, crafting your own perspective takes just a few minutes. Do it your way

A great starting point for your Fortuna Mining research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead while others hesitate and unlock the next big trend. Don’t limit your potential to just one stock when there is a world of opportunities waiting. Use the tools below to spark your next move and gain a true edge in today’s fast-moving markets.

- Supercharge your income strategy by tapping into these 19 dividend stocks with yields > 3%, which offers solid yields and reliable returns from established leaders.

- Ride the surge in artificial intelligence innovation by pinpointing tomorrow’s winners using these 25 AI penny stocks. Get in early on transformative disruption.

- Zero in on companies trading below fair value and unlock fresh bargains and long-term upside through these 891 undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives