- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Is It Too Late to Consider Franco-Nevada After Its 66.6% Surge in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Franco-Nevada is still a smart buy after such a strong run, or if you are late to the party, this breakdown is designed to help you decide whether the current price makes sense.

- The stock is up 66.6% over the past year and 62.4% year to date, even after a recent 2.8% dip over the last week and a 7.1% gain in the past month. This suggests investors are quickly repricing its prospects.

- Much of this momentum has been driven by renewed interest in gold and royalty companies generally, as investors look for ways to hedge inflation and geopolitical uncertainty. In that context, Franco-Nevada has been back in the spotlight as a relatively lower risk way to gain exposure to commodity upside without taking on direct mining risk.

- Despite this enthusiasm, Franco-Nevada only scores 1/6 on our valuation checks, which raises a fair question about how much upside is really left. Next, we will unpack what different valuation approaches say about the stock today, and later in the article we will look at an even more powerful way to make sense of its fair value.

Franco-Nevada scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Franco-Nevada Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting its future cash flows and then discounting those back to their value in today’s dollars.

Franco-Nevada currently generates around $38.9 Million in free cash flow, but analysts expect this to ramp up significantly, with projections reaching roughly $1.83 Billion by 2026 and $1.55 Billion by 2028. Beyond the formal analyst window, Simply Wall St extrapolates these figures further, assuming more moderate growth and gradually slowing expansion over the next decade.

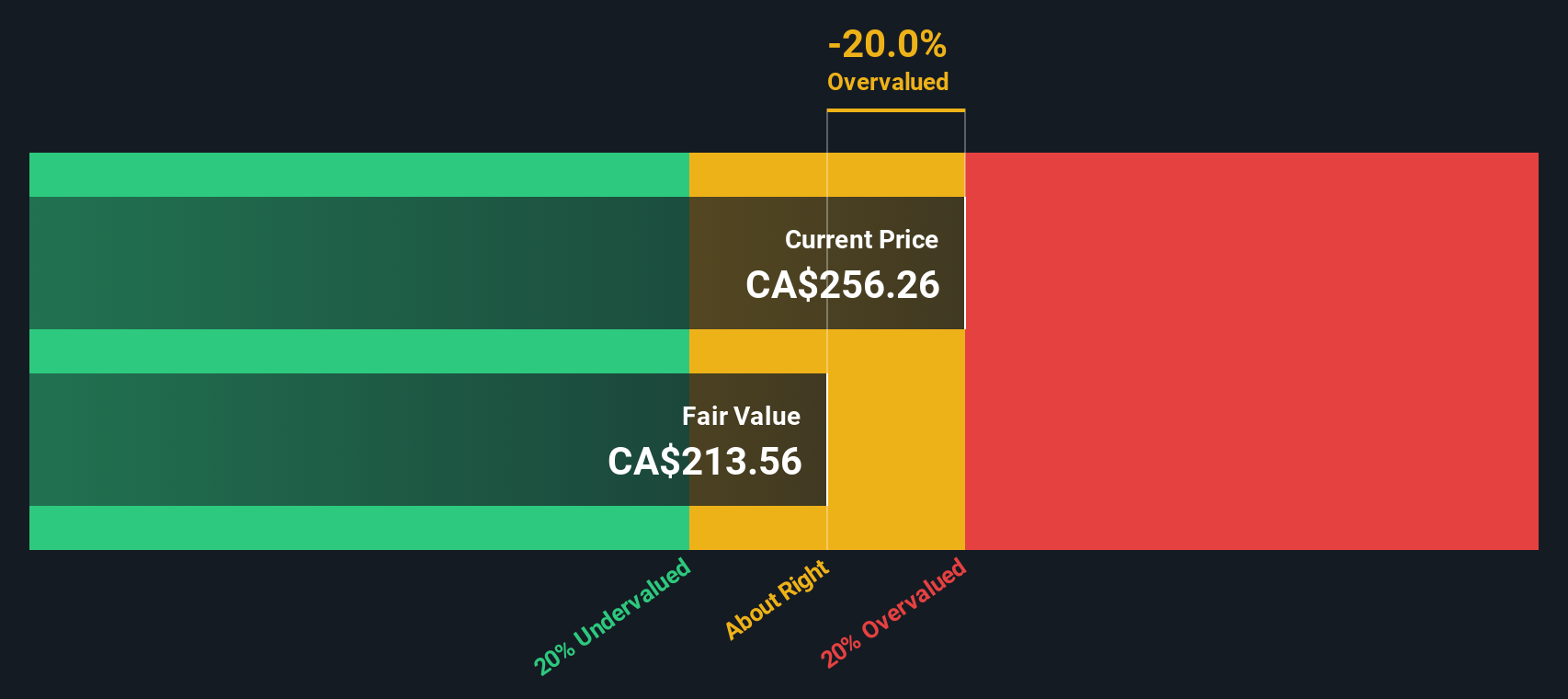

When all of those projected cash flows are discounted back using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out at about $208.70 per share. Compared to the current market price, that implies the stock is roughly 35.7% overvalued and indicates that a substantial amount of expected future growth may already be reflected in the price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Franco-Nevada may be overvalued by 35.7%. Discover 918 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Franco-Nevada Price vs Earnings

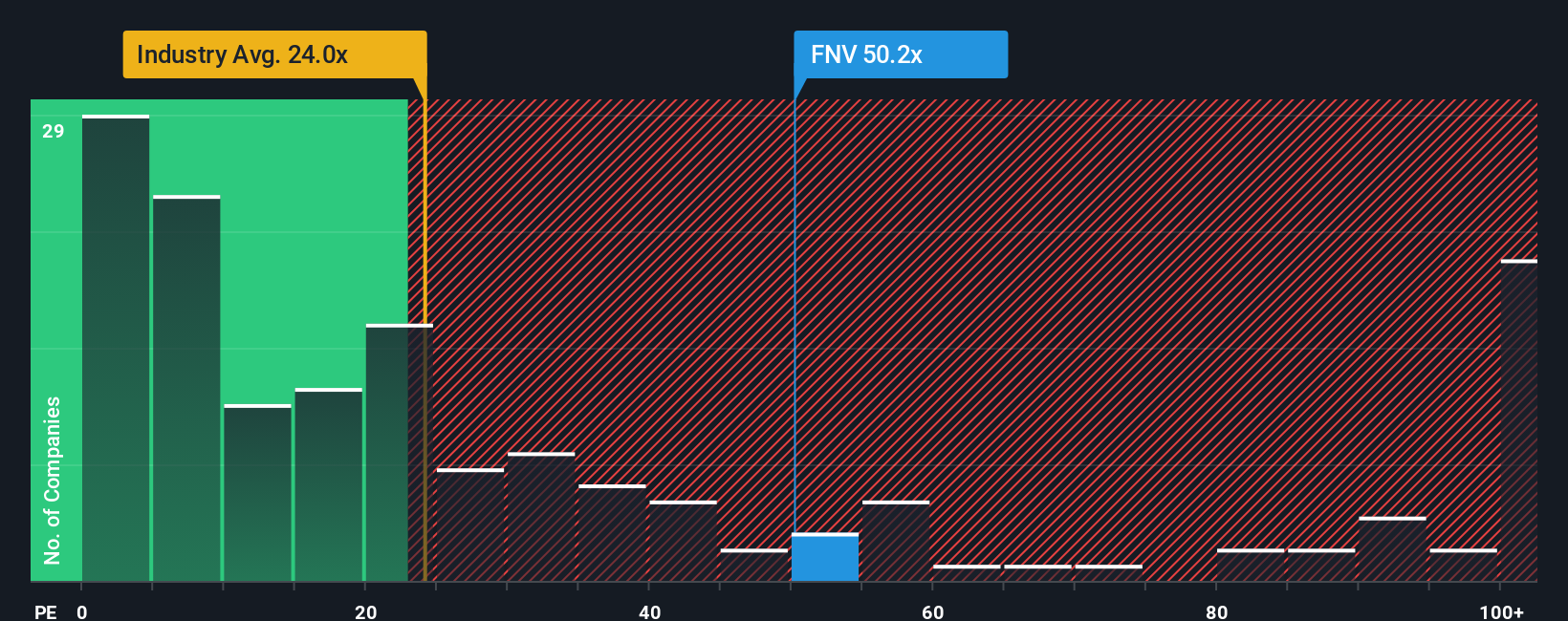

For a consistently profitable business like Franco-Nevada, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, companies with faster, more reliable growth and lower perceived risk tend to justify a higher PE, while slower growth or higher risk should pull that multiple down toward or below the market and industry norms.

Franco-Nevada currently trades on a PE of about 42.6x, well above both the Metals and Mining industry average of roughly 21.2x and a peer average of around 28.6x. Simply Wall St’s proprietary Fair Ratio, which estimates what a reasonable PE should be after accounting for the company’s earnings growth outlook, profit margins, risk profile, industry and market cap, sits lower at about 22.9x. This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for Franco-Nevada’s specific fundamentals rather than assuming that all miners deserve similar valuations.

With the actual PE of 42.6x sitting materially above the Fair Ratio of 22.9x, the stock appears expensive on an earnings multiple basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Franco-Nevada Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St this takes the form of Narratives, which let you attach a clear story about Franco-Nevada’s future to the numbers you think are reasonable for its revenue, earnings, margins and fair value.

A Narrative is simply your view of how the business is likely to evolve, translated into a financial forecast that then produces a fair value estimate. This can make it easier to see whether the current share price looks high, low, or about right.

These Narratives live in the Community section of Simply Wall St, are used by millions of investors, and update dynamically as new information like earnings releases, project news or gold price moves come in. This means your fair value can adjust with the story rather than staying frozen in time.

For example, one Franco-Nevada Narrative might assume robust metal prices, steady 7.6% revenue growth and a premium future PE near 46x to justify a fair value around CA$343. A more cautious Narrative could lean toward the low end of analysts’ targets near CA$265, highlighting how different perspectives on the same company can lead to very different conclusions.

Do you think there's more to the story for Franco-Nevada? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026