- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Franco-Nevada Corporation's (TSE:FNV) CEO Will Probably Struggle To See A Pay Rise This Year

Key Insights

- Franco-Nevada's Annual General Meeting to take place on 1st of May

- Salary of US$679.3k is part of CEO Paul Brink's total remuneration

- Total compensation is 37% below industry average

- Over the past three years, Franco-Nevada's EPS fell by 15% and over the past three years, the total loss to shareholders 0.7%

Performance at Franco-Nevada Corporation (TSE:FNV) has not been particularly rosy recently and shareholders will likely be holding CEO Paul Brink and the board accountable for this. At the upcoming AGM on 1st of May, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

View our latest analysis for Franco-Nevada

Comparing Franco-Nevada Corporation's CEO Compensation With The Industry

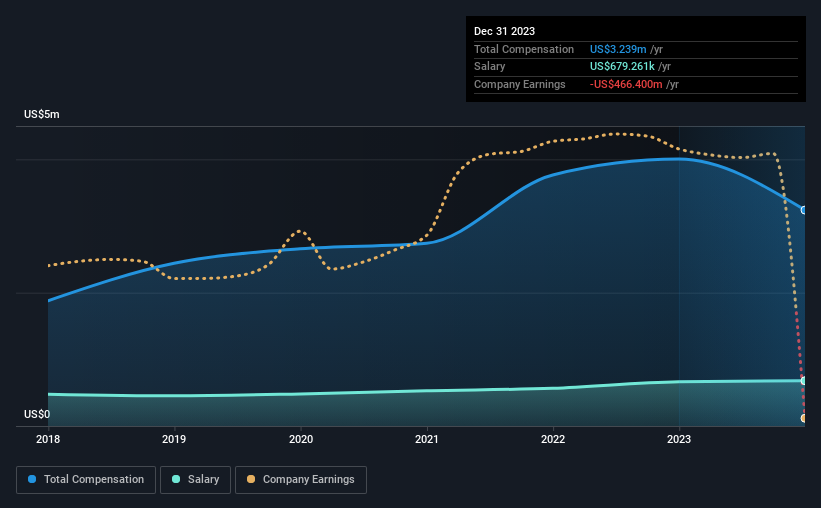

Our data indicates that Franco-Nevada Corporation has a market capitalization of CA$32b, and total annual CEO compensation was reported as US$3.2m for the year to December 2023. Notably, that's a decrease of 19% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at US$679k.

For comparison, other companies in the Canadian Metals and Mining industry with market capitalizations above CA$11b, reported a median total CEO compensation of US$5.1m. In other words, Franco-Nevada pays its CEO lower than the industry median. What's more, Paul Brink holds CA$41m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$679k | US$665k | 21% |

| Other | US$2.6m | US$3.3m | 79% |

| Total Compensation | US$3.2m | US$4.0m | 100% |

Speaking on an industry level, nearly 94% of total compensation represents salary, while the remainder of 6% is other remuneration. It's interesting to note that Franco-Nevada allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Franco-Nevada Corporation's Growth Numbers

Over the last three years, Franco-Nevada Corporation has shrunk its earnings per share by 15% per year. In the last year, its revenue is down 7.4%.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Franco-Nevada Corporation Been A Good Investment?

Given the total shareholder loss of 0.7% over three years, many shareholders in Franco-Nevada Corporation are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

Whatever your view on compensation, you might want to check if insiders are buying or selling Franco-Nevada shares (free trial).

Important note: Franco-Nevada is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FNV

Franco-Nevada

Operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives