- Canada

- /

- Metals and Mining

- /

- TSX:EQX

Equinox Gold (TSX:EQX) Ramps Up Valentine Processing Will This Transform Its Long-Term Growth Outlook?

Reviewed by Simply Wall St

- Equinox Gold recently began processing ore at its Valentine Gold Mine in Newfoundland and Labrador, marking a major operational milestone with first gold production expected within a month and targeting 175,000 to 200,000 ounces annually over the initial 12 years of mine life.

- This move positions Valentine as not only Equinox Gold's second-largest mine but also the largest gold operation in Atlantic Canada, underscoring its significance for both the company and the regional economy.

- We’ll now explore how the commencement of ore processing at Valentine influences Equinox Gold’s long-term investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Equinox Gold Investment Narrative Recap

To hold Equinox Gold shares, investors generally need confidence in the company's ability to deliver on ramping up new cornerstone mines, achieve targeted production growth, and manage costs across its portfolio. The start of ore processing at Valentine is a welcome step forward and supports the major short-term catalyst of bringing new, high-margin ounces online. However, it does not resolve the most pressing risk: uncertainty at the Los Filos mine remains a potential drag on overall production and earnings stability.

Among recent announcements, the Q2 2025 production report is especially relevant. With year-to-date gold production at 401,211 ounces (excluding Los Filos and Castle Mountain) and a raised 2025 guidance of 785,000 to 915,000 ounces, portfolio growth potential is underpinned by operational milestones at Valentine, yet future volumes still depend on addressing recurring issues at other assets.

By contrast, uncertainty around stakeholder and community agreements at Los Filos continues to be a key issue that investors should be aware of...

Read the full narrative on Equinox Gold (it's free!)

Equinox Gold's outlook anticipates $4.7 billion in revenue and $1.7 billion in earnings by 2028. This reflects a 35.0% annual revenue growth rate and a $1.72 billion increase in earnings from the current level of -$23.1 million.

Uncover how Equinox Gold's forecasts yield a CA$12.37 fair value, in line with its current price.

Exploring Other Perspectives

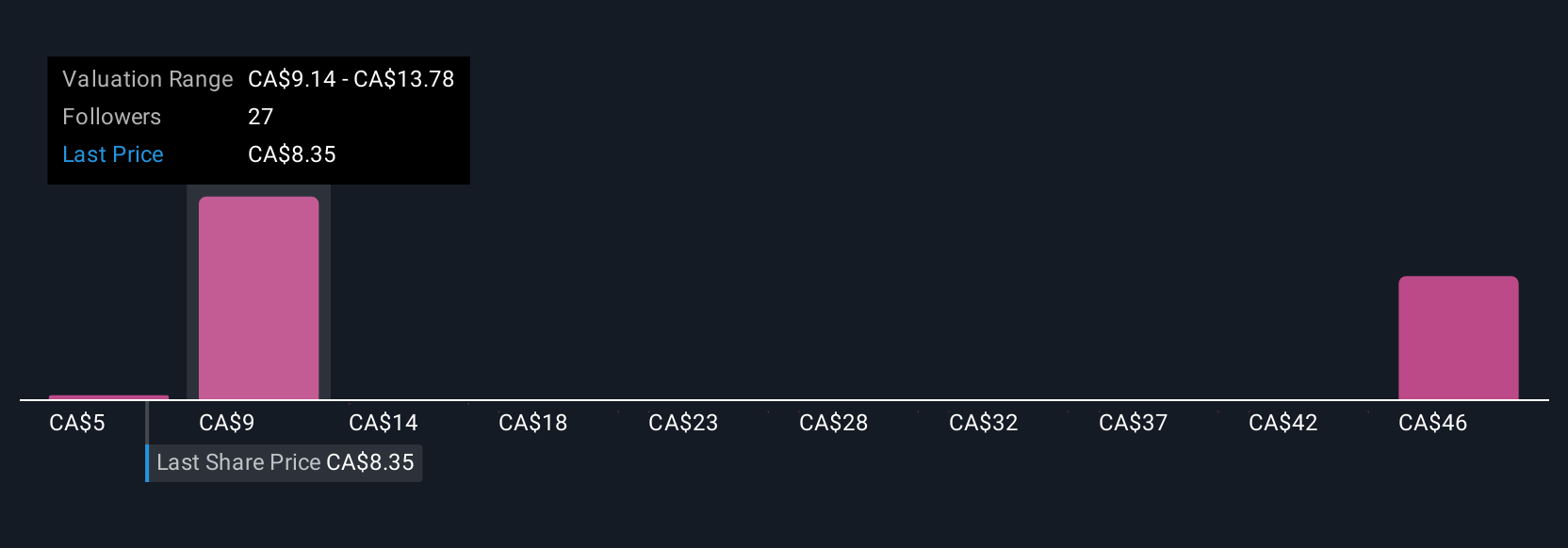

Community fair value estimates span from CA$4.50 to CA$48.23, reflecting input from 11 Simply Wall St Community members. While some see considerable upside following the successful ramp-up of Valentine, others remain cautious given unresolved risks at assets like Los Filos, showing why it pays to review multiple viewpoints.

Explore 11 other fair value estimates on Equinox Gold - why the stock might be worth over 3x more than the current price!

Build Your Own Equinox Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equinox Gold research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equinox Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equinox Gold's overall financial health at a glance.

No Opportunity In Equinox Gold?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives