- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Eldorado Gold (TSX:ELD): Assessing Valuation After Surge and Skouries Mine Progress

Reviewed by Kshitija Bhandaru

For investors keeping an eye on the gold sector, it’s hard to ignore Eldorado Gold (TSX:ELD) right now. The company is in the spotlight as excitement builds around the upcoming commercial launch of its Skouries mine in Greece and the promise of ramped-up gold production through 2027. This anticipation, combined with clear signs of financial strength and an earnings-driven approach to reinvestment, has fueled renewed market interest, making Eldorado a stock that is drawing attention for all the right reasons.

The numbers tell the story of a breakout year. Eldorado Gold’s stock has soared 47% in the past three months alone, outpacing not just the broader market but many gold peers. Over the past year, the stock has delivered a 69% total return, supported by double-digit annual growth in both revenue and net income. With this backdrop, momentum appears to be building as the company prepares for its next phase of expansion.

With the market clearly rewarding Eldorado’s progress so far, the question is whether there is more upside ahead. Is the stock still undervalued, or are investors already pricing in future growth?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Eldorado Gold is currently trading close to its estimated fair value. Recent analyst consensus places only a small premium on the share price when compared to projected long-term earnings and revenue growth.

The approaching commissioning of the Skouries copper-gold project, slated for Q1 2026 and on schedule, is expected to be transformative. This development may materially increase production volumes, diversify the revenue mix, and expand EBITDA margins due to the asset's high grades and lower costs relative to existing operations.

Curious how soaring margins, ambitious growth projects, and a unique asset mix could redefine Eldorado Gold’s worth? Hungry to uncover the bold assumptions that push this valuation into fair territory? The full narrative reveals the underlying math and pivotal catalysts powering the story. Get ready for some numbers that might surprise even industry insiders.

Result: Fair Value of $36.53 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, particularly around rising operational costs and possible delays in the Skouries project, which could challenge Eldorado Gold’s positive outlook.

Find out about the key risks to this Eldorado Gold narrative.Another View: Discounted Cash Flow Tells a Different Story

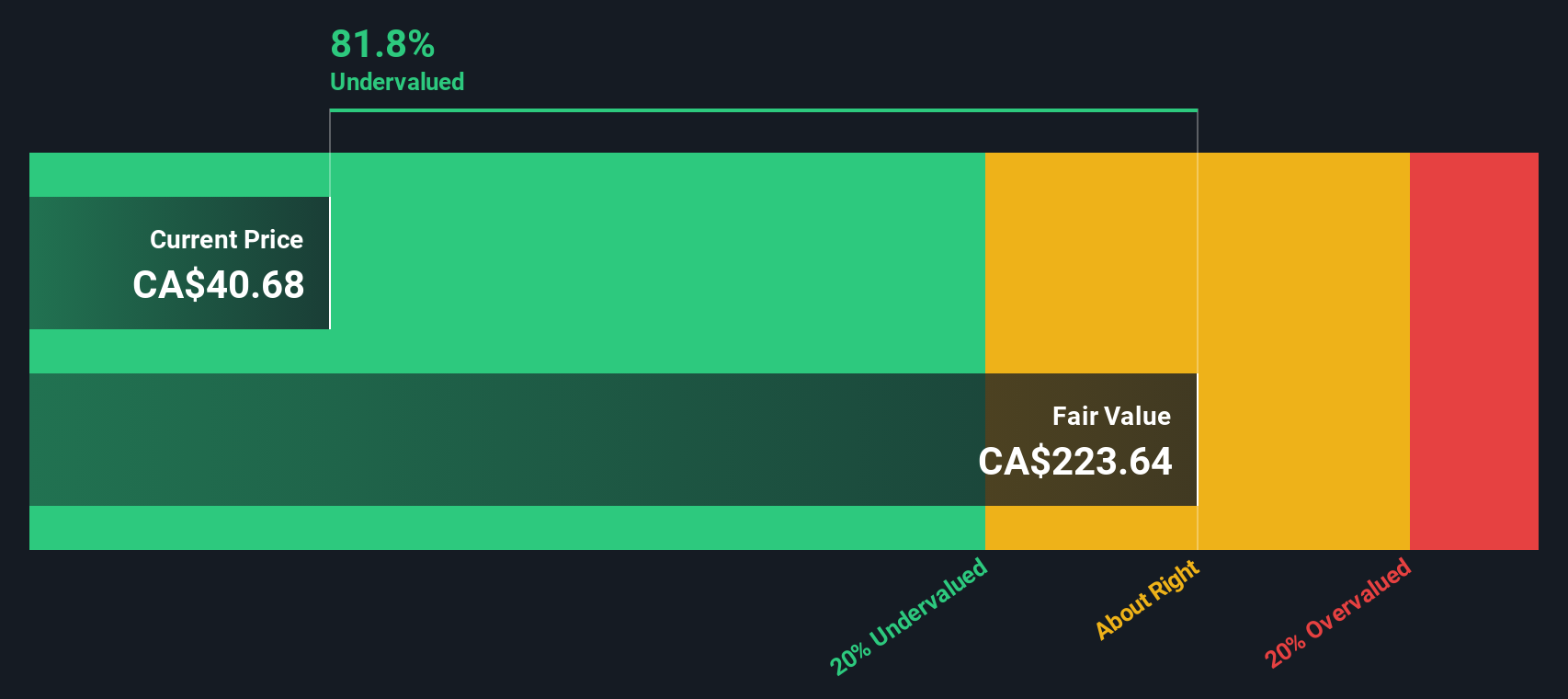

Our DCF model offers a strikingly different perspective and suggests Eldorado Gold is significantly undervalued in the market today. Could this gap signal hidden upside, or does it reflect risk that multiples overlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eldorado Gold Narrative

If you think the numbers tell a different story, or are keen to investigate your own angle, shaping your own narrative takes just minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Eldorado Gold.

Looking for More Winning Ideas?

If you want to seize the best opportunities on the market, don’t just stop at gold. The Simply Wall St Screener makes it easy to find bold investments beyond the obvious. Smart investors never ignore what comes next.

- Spot undervalued gems that the crowd is missing by unlocking undervalued stocks based on cash flows. Get ahead of the market before others catch on.

- Secure reliable portfolio income faster by tracking dividend stocks with yields > 3%. This connects you with companies delivering high-yield payouts above 3%.

- Tap into transformative healthcare advances and fuel your growth potential with healthcare AI stocks. This highlights innovators at the intersection of medicine and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives