- Canada

- /

- Metals and Mining

- /

- TSX:EDR

A Look at Endeavour Silver (TSX:EDR) Valuation After Q3 Production Surge and Terronera Growth Milestone

Reviewed by Kshitija Bhandaru

Endeavour Silver (TSX:EDR) just unveiled a big jump in third-quarter silver production, supported by higher output at existing mines and the ramp-up of Kolpa. With the Terronera project nearly online, investors are eyeing new growth ahead.

See our latest analysis for Endeavour Silver.

Endeavour Silver’s production boost and updates on the Terronera project have supercharged investor sentiment, with the stock posting a 30.4% one-month share price return and a massive 85% jump year-to-date. Supported by a 77.3% one-year total shareholder return and strong multi-year gains, momentum is clearly building as the market bets on further growth ahead.

If this kind of turnaround has you curious about what else is gaining steam, now’s a great moment to widen your search and discover fast growing stocks with high insider ownership

But with Endeavour Silver’s shares soaring and production set to climb further, is the current price still attractive? Or has the market already factored in the company’s next growth phase and left little room for upside?

Most Popular Narrative: 12.5% Undervalued

With Endeavour Silver closing at CA$10.64 while the most widely followed narrative estimates fair value at CA$12.17, there is a notable gap between today’s price and what growth assumptions could justify. The latest narrative reveals more than just silver output, pointing to potentially transformative changes in production and margins.

With the Terronera mine nearing commercial production and optimization of recoveries on track, Endeavour is poised for a significant, step-change increase in production and operating cash flows. This should drive revenue and margin expansion as the mine transitions from commissioning losses to full contribution.

Want to unravel the secret behind this bullish valuation? The narrative hinges on a bold profit turnaround, ambitious expansion, and a margin leap. One key operating shift is at the heart of these estimates. Craving the numbers and the logic that connect the dots? Read on to see what is fueling the case for upside.

Result: Fair Value of $12.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as delays in ramping up Terronera or ongoing integration challenges at Kolpa could quickly alter the case for further gains.

Find out about the key risks to this Endeavour Silver narrative.

Another View: How Sales-Based Valuation Stacks Up

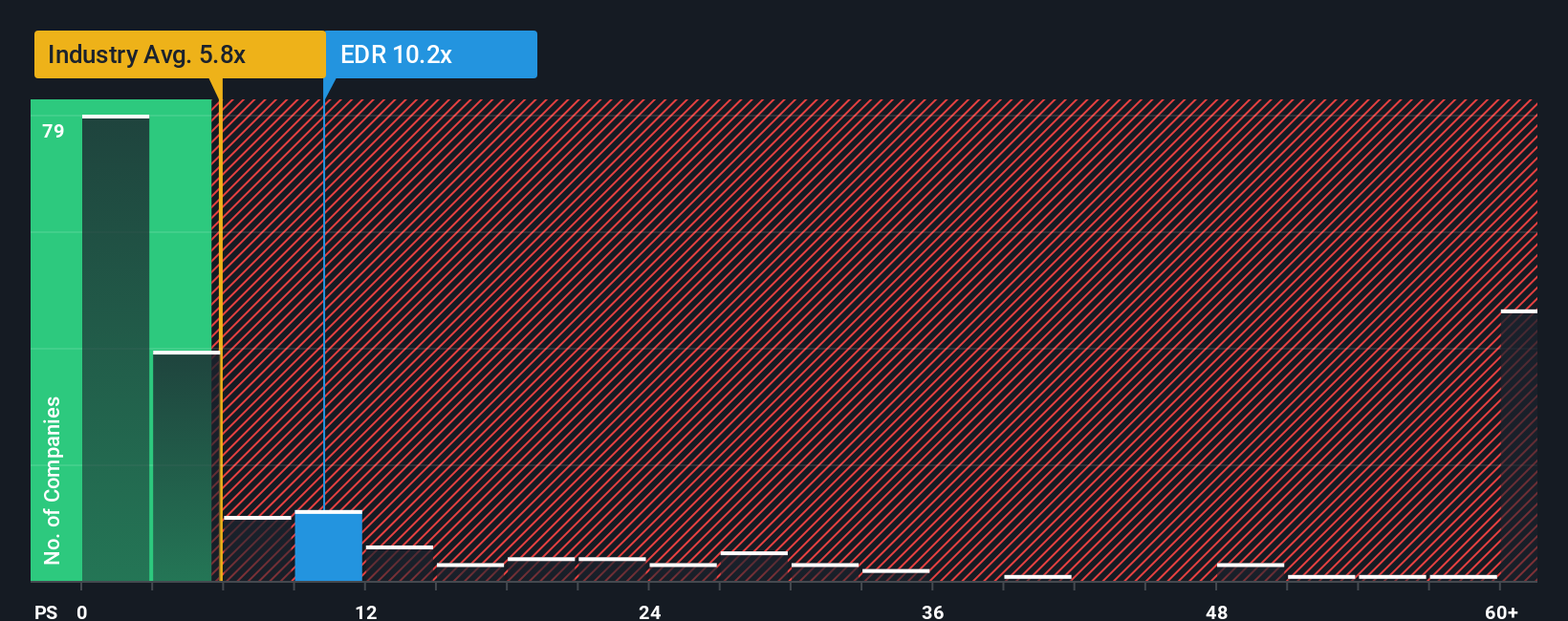

While bullish narratives suggest Endeavour Silver’s shares are undervalued, our sales-based measure tells a different story. The company trades at 8.9 times sales, higher than both the Canadian industry average of 6.3x and a fair ratio of 6.6x, hinting at a premium price. Peers sit even higher at 10.4x, reflecting a hot sector. Are investors paying up too soon, or could momentum carry this valuation higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Endeavour Silver Narrative

If the story above doesn't quite match your outlook or you want to back your own analysis, you can quickly build your own narrative from scratch: Do it your way

A great starting point for your Endeavour Silver research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

You are not limited to mining stocks. Potential market leaders are just a click away. Tap into more opportunities with these curated stock lists for growth, innovation, and long-term returns.

- Capitalize on untapped value by checking out these 897 undervalued stocks based on cash flows with the potential for a turnaround, based on powerful fundamentals and discounted price-to-cash-flow signals.

- Ride the artificial intelligence wave and boost your portfolio’s future with these 25 AI penny stocks that are pushing boundaries in automation, machine learning, and smarter business solutions.

- Maximize income and cushion volatility when you explore these 18 dividend stocks with yields > 3%, which deliver consistent yields above 3% and the potential for stable compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDR

Endeavour Silver

A silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Mexico, Chile, Peru, and the United States.

Exceptional growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives