Chemtrade Logistics Income Fund (TSE:CHE.UN) Will Pay A Dividend Of CA$0.05

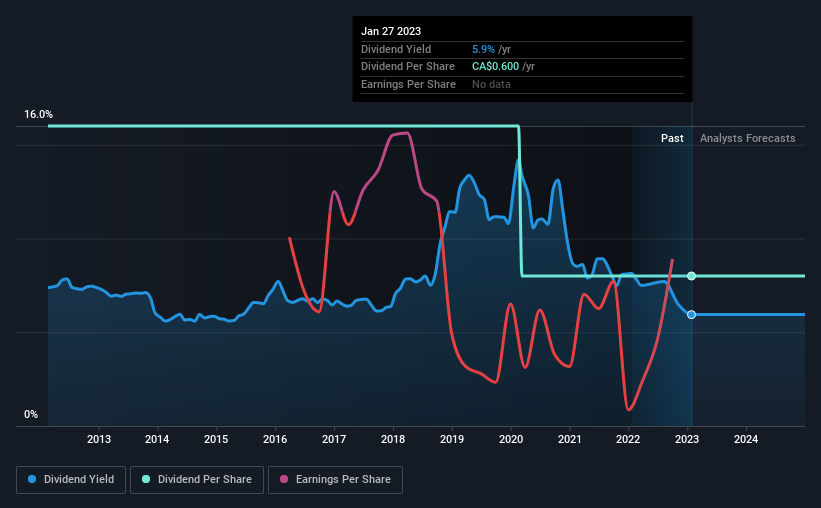

Chemtrade Logistics Income Fund's (TSE:CHE.UN) investors are due to receive a payment of CA$0.05 per share on 23rd of February. This means the annual payment is 5.9% of the current stock price, which is above the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Chemtrade Logistics Income Fund's stock price has increased by 42% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Chemtrade Logistics Income Fund

Chemtrade Logistics Income Fund's Distributions May Be Difficult To Sustain

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even though Chemtrade Logistics Income Fund isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Looking forward, earnings per share is forecast to fall by 41.5% over the next year. This means that the company will be unprofitable, but cash flows are more important when considering the dividend and as the current cash payout ratio is pretty healthy, we don't think there is too much reason to worry.

Chemtrade Logistics Income Fund's Track Record Isn't Great

While the company's dividend hasn't been very volatile, it has been decreasing over time, which isn't ideal. The dividend has gone from an annual total of CA$1.20 in 2013 to the most recent total annual payment of CA$0.60. This works out to be a decline of approximately 6.7% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Chemtrade Logistics Income Fund's EPS has fallen by approximately 30% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

An additional note is that the company has been raising capital by issuing stock equal to 11% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for Chemtrade Logistics Income Fund (1 is concerning!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CHE.UN

Chemtrade Logistics Income Fund

Offers industrial chemicals and services in Canada, the United States, and South America.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives