- Canada

- /

- Metals and Mining

- /

- TSX:CGG

Swelling losses haven't held back gains for China Gold International Resources (TSE:CGG) shareholders since they're up 809% over 5 years

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. To wit, the China Gold International Resources Corp. Ltd. (TSE:CGG) share price has soared 667% over five years. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 22% over the last quarter. It really delights us to see such great share price performance for investors.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for China Gold International Resources

Given that China Gold International Resources didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last half decade China Gold International Resources' revenue has actually been trending down at about 5.9% per year. So it's pretty surprising to see that the share price is up 50% per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. I think it's fair to say there is probably a fair bit of excitement in the price.

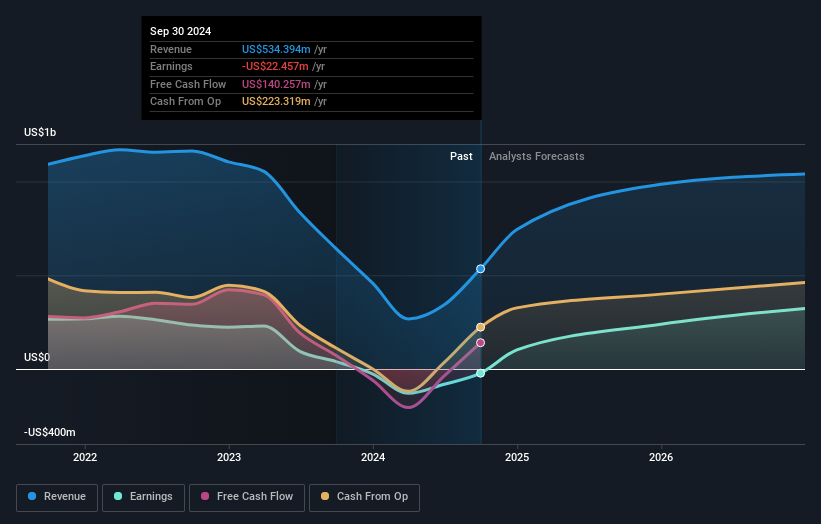

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on China Gold International Resources' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between China Gold International Resources' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for China Gold International Resources shareholders, and that cash payout contributed to why its TSR of 809%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that China Gold International Resources shareholders have received a total shareholder return of 51% over one year. However, that falls short of the 56% TSR per annum it has made for shareholders, each year, over five years. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: China Gold International Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CGG

China Gold International Resources

A gold and base metal mining company, acquires, explores, develops, and mines mineral resources in the People’s Republic of China and Canada.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives