- Canada

- /

- Metals and Mining

- /

- TSX:CG

Will Centerra Gold's (TSX:CG) Detailed Mine Report Reshape Perceptions of Its Operational Strength?

Reviewed by Sasha Jovanovic

- On October 21, 2025, Centerra Gold filed a comprehensive technical report for its Mount Milligan Mine in British Columbia, adhering to National Instrument 43-101 standards and supporting earlier operational disclosures.

- This updated report enhances transparency for stakeholders, providing in-depth technical insights into the mine’s reserves, production outlook, and operational risks.

- We will examine how Centerra’s detailed technical reporting on Mount Milligan informs its investment narrative and future operating outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Centerra Gold Investment Narrative Recap

To be a shareholder in Centerra Gold, you need to believe the company can successfully extend the life and productivity of Mount Milligan through improved technical understanding and disciplined operations, while offsetting cost pressures at other assets. The recent NI 43-101 technical report for Mount Milligan enhances transparency, but does not impact the most important short-term catalyst, the delivery and credibility of production guidance amid ore grade variability. The biggest risk remains ongoing geological unpredictability at Mount Milligan, which could still challenge future guidance despite this report.

Of the latest company announcements, Centerra’s update on ongoing drilling at the QCM property is most relevant to its longer-term narrative. This program represents continued investment in British Columbia exploration and could support future project optionality if successful, but does not change the near-term focus on stabilizing Mount Milligan’s output and demonstrating mine plan reliability.

However, investors should also be aware that if further resource estimates at Mount Milligan disappoint or infill drilling fails to clarify grade predictability, the company's revenue visibility could remain exposed to ...

Read the full narrative on Centerra Gold (it's free!)

Centerra Gold’s outlook anticipates $1.6 billion in revenue and $106.3 million in earnings by 2028. This reflects a projected annual revenue growth rate of 9.2% and an earnings increase of $31 million from current earnings of $75.3 million.

Uncover how Centerra Gold's forecasts yield a CA$16.59 fair value, a 5% upside to its current price.

Exploring Other Perspectives

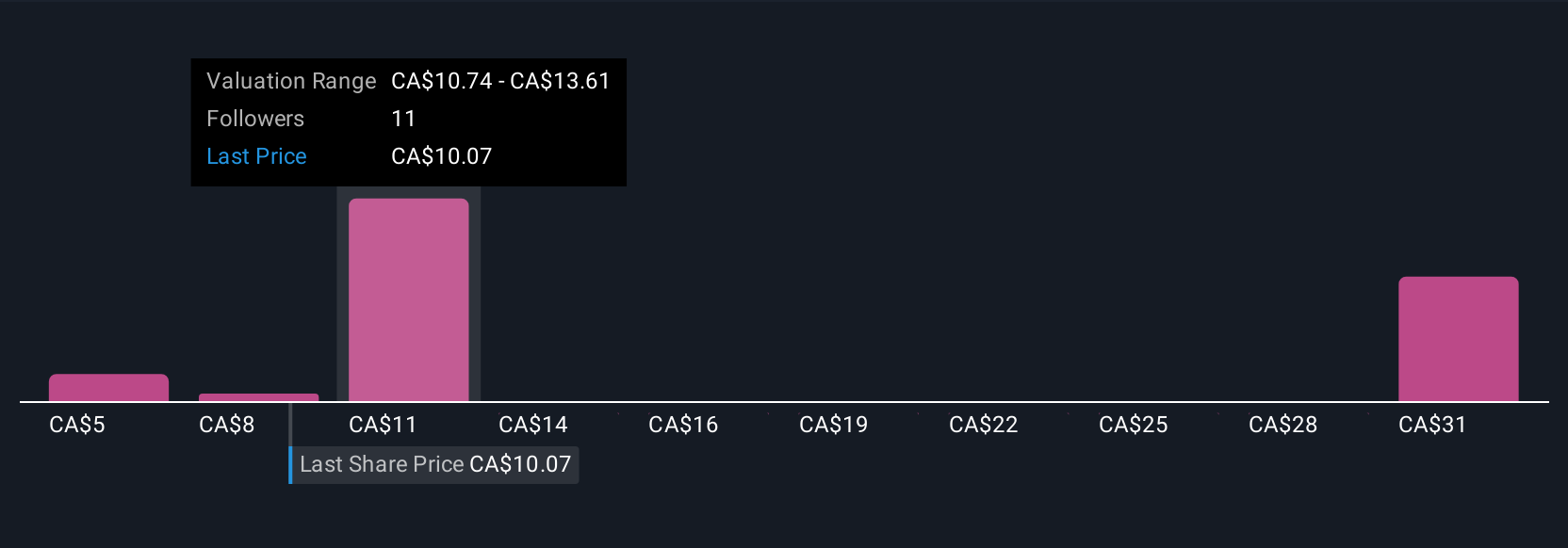

Eight contributors from the Simply Wall St Community estimate Centerra Gold’s fair value between CA$6.78 and CA$17.05 per share. With grade variability at Mount Milligan still a central risk, broad market opinion can reflect real uncertainty about future performance, check multiple viewpoints before forming your own judgment.

Explore 8 other fair value estimates on Centerra Gold - why the stock might be worth as much as 8% more than the current price!

Build Your Own Centerra Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centerra Gold research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Centerra Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centerra Gold's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives