- Canada

- /

- Metals and Mining

- /

- TSX:CG

What Centerra Gold (TSX:CG)'s US$25M Crane Creek Earn-In Option Means For Shareholders

Reviewed by Sasha Jovanovic

- Headwater Gold recently announced a definitive earn-in agreement allowing a Centerra Gold subsidiary to spend up to US$25,000,000 to earn as much as a 70% interest in the fully permitted Crane Creek gold project in Idaho.

- The staged earn-in, which includes a firm US$2,500,000 exploration commitment and a path to 70% ownership via a preliminary economic assessment, deepens Centerra’s North American exploration pipeline and project optionality.

- We’ll now examine how Centerra’s option to fund up to US$25,000,000 at Crane Creek could reshape its investment narrative and growth balance.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Centerra Gold Investment Narrative Recap

To own Centerra Gold, you need to believe its producing mines and project pipeline can convert a strong balance sheet into durable, cash-generative growth, despite cost and geological pressures. The Crane Creek earn in does not materially change the near term story, which still hinges on Mount Milligan’s operating consistency and execution on projects like Goldfield, while high all in sustaining costs and Turkey royalty exposure remain key risks.

Among recent announcements, the Board’s approval and ongoing use of a sizable share buyback program, alongside regular dividends, is most relevant here. It highlights how Centerra is allocating capital between returning cash to shareholders and funding incremental growth options such as Crane Creek, a balance that could matter if large project capex or cost pressures at Mount Milligan or Oksut start to tighten financial flexibility.

Yet investors should also be aware that Centerra’s elevated all in sustaining costs could quickly squeeze margins if gold prices soften, especially when...

Read the full narrative on Centerra Gold (it's free!)

Centerra Gold’s narrative projects $1.6 billion revenue and $106.3 million earnings by 2028. This requires 9.2% yearly revenue growth and about a $31 million earnings increase from $75.3 million today.

Uncover how Centerra Gold's forecasts yield a CA$18.53 fair value, in line with its current price.

Exploring Other Perspectives

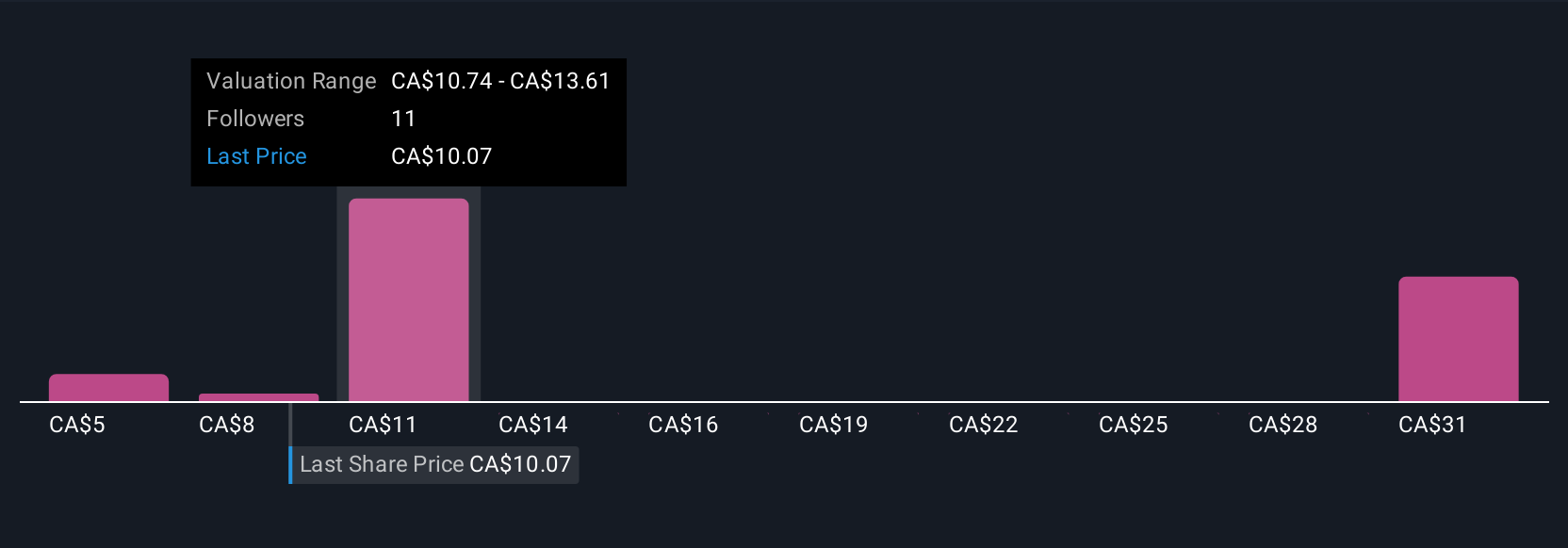

Eight members of the Simply Wall St Community currently estimate Centerra’s fair value between CA$7.07 and CA$37.68, reflecting very different expectations. You can compare these views with the execution risk around Mount Milligan’s ore grade variability and consider how that uncertainty might shape future operating performance.

Explore 8 other fair value estimates on Centerra Gold - why the stock might be worth less than half the current price!

Build Your Own Centerra Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centerra Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centerra Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centerra Gold's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026