- Canada

- /

- Metals and Mining

- /

- TSX:CG

Centerra Gold (TSX:CG) Valuation in Focus After QCM Drilling Results Confirm Historic Gold Intercepts

Reviewed by Simply Wall St

Centerra Gold (TSX:CG) has caught investor attention after its recent drilling update at the QCM property in British Columbia, where new assay results confirm key historical gold intervals and set the stage for further exploration news.

See our latest analysis for Centerra Gold.

After a string of upbeat exploration updates, Centerra Gold’s share price has seen powerful momentum, with a 30-day share price return of 15.7% and a stunning 48.2% over the past three months. Despite a sharp one-day pullback following the latest news, long-term holders have enjoyed a 49.1% total shareholder return in the last year. Enthusiasm remains strong as investors weigh recent resource results against the company’s growth prospects.

If you’re curious about what other growth stories might be gaining traction, now’s a great time to broaden your scope and discover fast growing stocks with high insider ownership

With exploration results sparking renewed optimism and shares rallying, the big question now is whether Centerra Gold remains undervalued with further upside, or if the recent surge already reflects its potential for future growth.

Most Popular Narrative: 8% Undervalued

Centerra Gold’s most widely followed valuation narrative pegs fair value at CA$16.59, which is about 8% above the latest close of CA$15.19. This optimistic gap is attracting renewed interest from momentum investors after recent operational updates.

The company's ongoing focus on operational efficiency and cost management, exemplified by mine-to-mill integration and targeted capex on process upgrades, aim to mitigate industry cost inflation and reinforce net margins even as all-in sustaining costs rise sector-wide.

Want to know the bold financial projections fueling this upside? This narrative hinges on a rare blend of margin expansion and value-driven capital moves, projecting stronger profit dynamics than many expect. See the essential numbers and growth logic that analysts are betting on. What could they know that the market doesn't?

Result: Fair Value of $16.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent production challenges at Mount Milligan and rising cost pressures could present significant headwinds that may limit Centerra Gold's upside from this point forward.

Find out about the key risks to this Centerra Gold narrative.

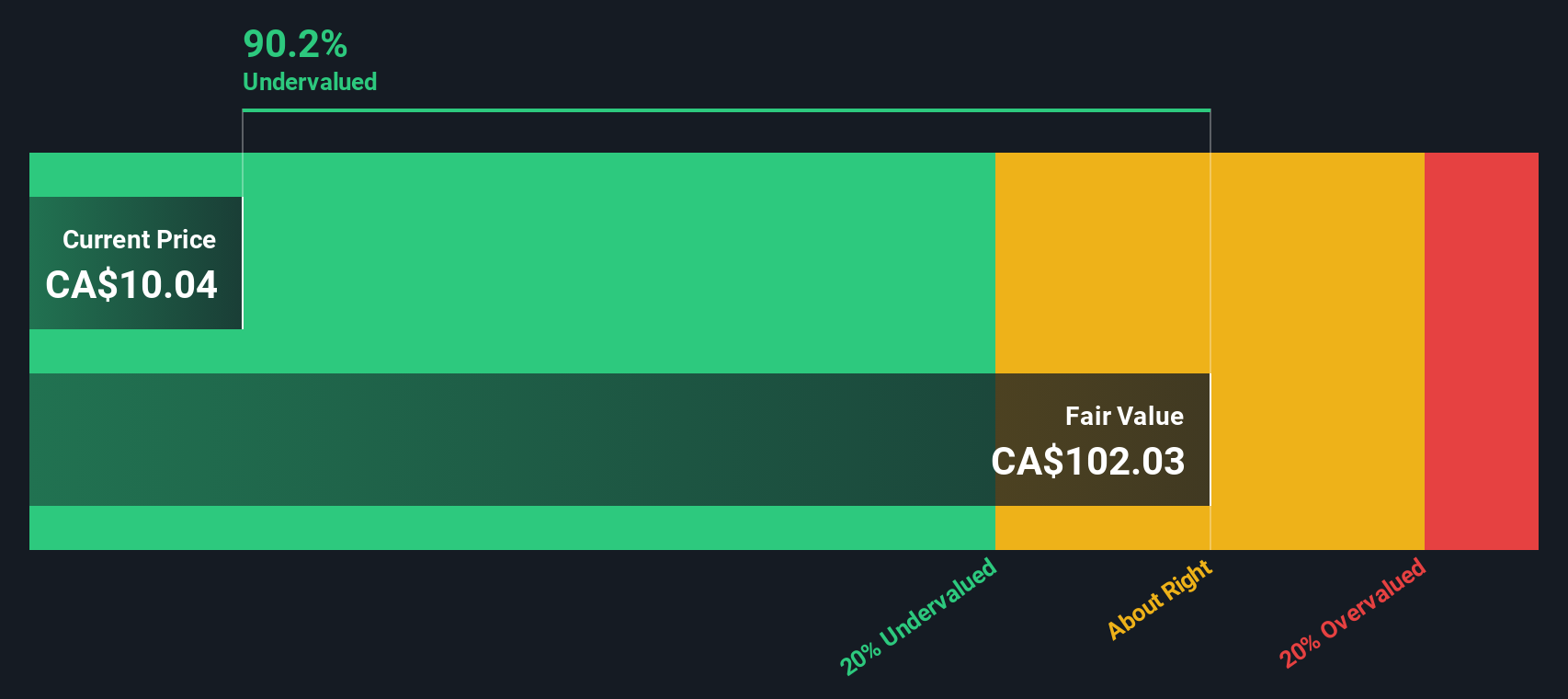

Another View: SWS DCF Model Suggests a Very Different Story

While multiples analysis suggests Centerra Gold offers value versus peers, our DCF model estimates a fair value far below the current share price, at just CA$6.80. This implies that by traditional cash flow standards, shares may be significantly overvalued. Could the market be relying too much on optimistic expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Centerra Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Centerra Gold Narrative

If you think there's another angle to this story or want to take a closer look at the numbers yourself, you can quickly shape your perspective and Do it your way

A great starting point for your Centerra Gold research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a single opportunity slip by you. Expand your watchlist and get in early on themes the market is watching closely right now.

- Spot remarkable cash flow value and keep an edge with these 879 undervalued stocks based on cash flows before others catch on.

- Secure future income streams by targeting stability with these 17 dividend stocks with yields > 3% offering yields above 3%.

- Get ahead on healthcare innovation trends and access these 33 healthcare AI stocks as it revolutionizes medicine with AI breakthroughs and smarter diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives