- Canada

- /

- Oil and Gas

- /

- TSX:FRU

3 Canadian Small Cap Gems Poised For Potential Growth

Reviewed by Simply Wall St

The Canadian market, like its U.S. counterpart, is navigating a complex landscape of potential tariffs and trade uncertainties that could impact economic growth and inflation. Despite these challenges, the fundamental backdrop remains supportive with above-trend economic growth and rising corporate profits. In this environment, identifying small-cap stocks with strong fundamentals and potential for growth can be a strategic move for investors looking to diversify their portfolios amidst increased market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★★★

Overview: Centerra Gold Inc. is a gold mining company involved in the acquisition, exploration, development, and operation of gold and copper properties across North America, Turkey, and internationally with a market cap of approximately CA$2.05 billion.

Operations: Centerra Gold derives its revenue primarily from three segments: Öksüt ($559.44 million), Mount Milligan ($460.21 million), and Molybdenum ($232.42 million).

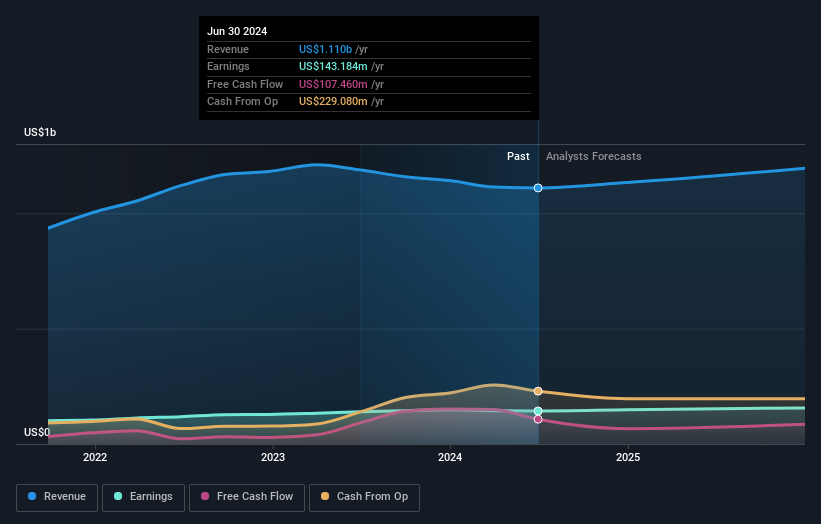

Centerra Gold, a Canadian mining company, has recently turned profitable and is trading at 66.2% below its estimated fair value, indicating potential undervaluation. The firm boasts high-quality earnings and no debt, a significant improvement from five years ago when its debt-to-equity ratio was 4.6%. Centerra's free cash flow is positive, suggesting strong financial health. The company's involvement in the Cherry Creek property drill program in Nevada highlights its strategic exploration initiatives aimed at uncovering mineralized porphyry systems. With earnings forecasted to grow by 7.75% annually, Centerra seems poised for future growth within the industry context.

- Click here and access our complete health analysis report to understand the dynamics of Centerra Gold.

Gain insights into Centerra Gold's historical performance by reviewing our past performance report.

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Freehold Royalties Ltd. focuses on acquiring and managing royalty interests in crude oil, natural gas, natural gas liquids, and potash properties across Western Canada and the United States, with a market cap of CA$2.07 billion.

Operations: Freehold Royalties Ltd. generates revenue primarily from its oil and gas exploration and production segment, with reported earnings of CA$312.68 million. The company operates within a market cap of CA$2.07 billion, focusing on royalty interests in energy resources across North America.

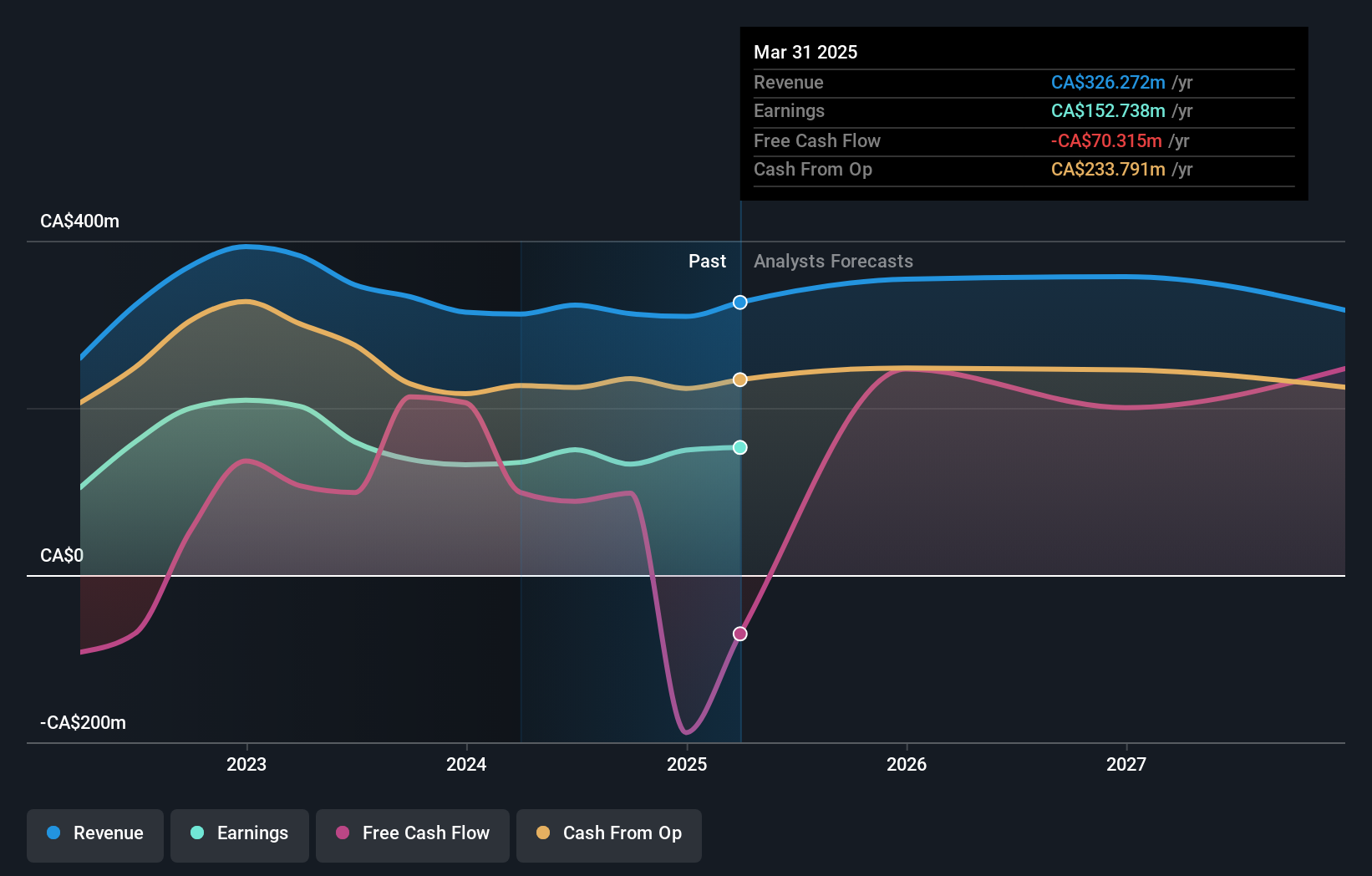

Freehold Royalties, a Canadian royalty company, offers an intriguing investment case with its current trading price at 65% below the estimated fair value. Despite a challenging year with earnings growth at -4.1%, it outpaced the broader Oil and Gas sector's average of -21.1%. The company's debt to equity ratio has climbed from 16.1% to 22.7% over five years, yet remains satisfactory under industry standards. With interest payments well covered by EBIT at 13.7x and positive free cash flow reported recently, Freehold appears financially stable and poised for potential future growth amidst its strategic financial maneuvers like increasing credit facilities and equity offerings totaling CAD 150 million in late 2024.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★★

Overview: Winpak Ltd. is a company that manufactures and distributes packaging materials and related machinery across the United States, Canada, and Mexico, with a market capitalization of CA$2.63 billion.

Operations: Winpak generates revenue primarily from three segments: Flexible Packaging ($592.07 million), Rigid Packaging and Flexible Lidding ($494.74 million), and Packaging Machinery ($34.58 million).

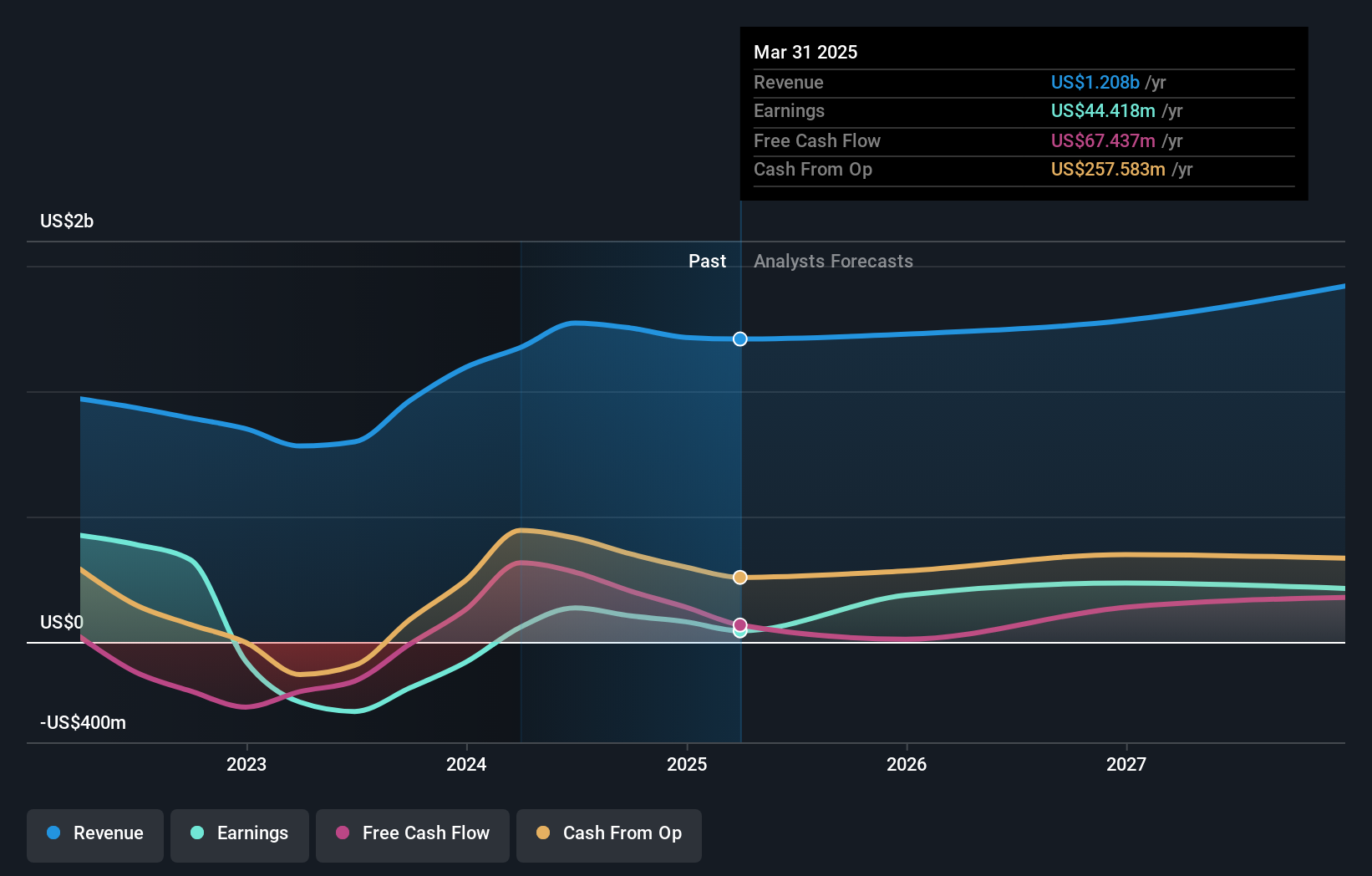

Winpak, a Canadian packaging player, has been catching some attention with its solid financial footing and recent shareholder-friendly moves. The company boasts a debt-free status for the past five years, highlighting its robust balance sheet. Over this period, Winpak's earnings have grown at an annual rate of 7.6%, although last year's growth of 2.3% lagged behind the industry average of 10.3%. Trading at 34% below estimated fair value suggests potential upside for investors. In December 2024, Winpak declared both regular and special dividends totaling C$3.05 per share, signaling confidence in its cash flow generation capabilities.

- Delve into the full analysis health report here for a deeper understanding of Winpak.

Gain insights into Winpak's past trends and performance with our Past report.

Taking Advantage

- Reveal the 44 hidden gems among our TSX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Engages in the acquiring and managing royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Western Canada and the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives