- Canada

- /

- Paper and Forestry Products

- /

- TSX:CFP

Undervalued Small Caps With Insider Buying In Global For March 2025

Reviewed by Simply Wall St

In March 2025, global markets are navigating a complex landscape marked by tariff uncertainties, inflationary pressures, and fluctuating growth prospects. This environment has led to significant declines in major U.S. indices such as the S&P MidCap 400 and Russell 2000, highlighting the challenges faced by small-cap stocks amid broader market volatility. In such times, identifying promising small-cap opportunities often involves looking for companies with strong fundamentals that can weather economic shifts and benefit from strategic insider buying signals.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 5.4x | 2.8x | 24.53% | ★★★★★★ |

| Speedy Hire | NA | 0.2x | 27.56% | ★★★★★☆ |

| Robert Walters | NA | 0.2x | 48.38% | ★★★★★☆ |

| Chorus Aviation | NA | 0.4x | 7.21% | ★★★★★☆ |

| Hong Leong Asia | 9.1x | 0.2x | 45.59% | ★★★★☆☆ |

| Gamma Communications | 21.7x | 2.2x | 37.89% | ★★★★☆☆ |

| Franchise Brands | 39.1x | 2.0x | 25.63% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 35.99% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.21% | ★★★★☆☆ |

| Saturn Oil & Gas | 1.8x | 0.5x | -64.13% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

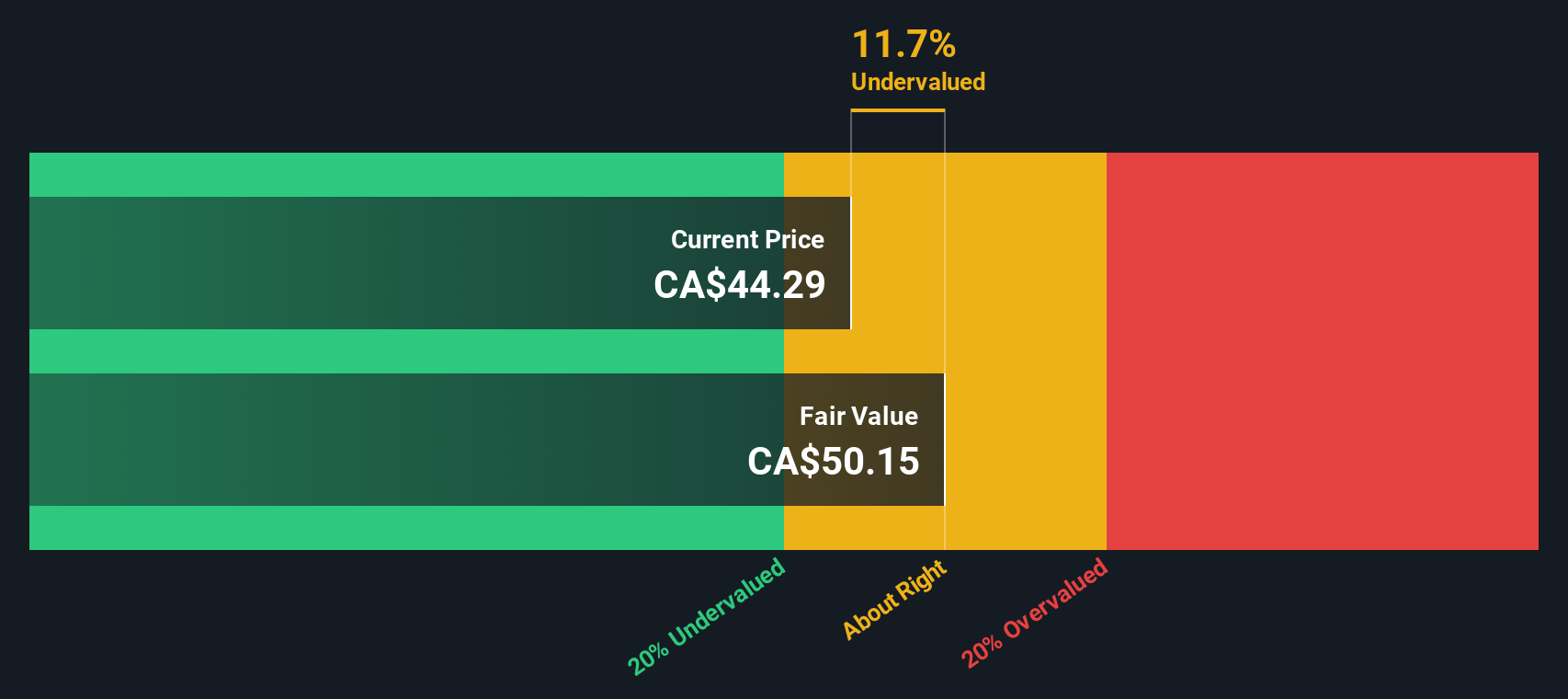

Canfor (TSX:CFP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Canfor is a leading integrated forest products company that produces and sells lumber, pulp, and paper products with a market capitalization of approximately CA$2.91 billion.

Operations: The company's revenue primarily stems from its lumber and pulp & paper segments, with lumber generating CA$4.58 billion and pulp & paper contributing CA$798.60 million. The gross profit margin has experienced fluctuations, reaching a high of 47.75% in June 2021 before declining to 18.02% by December 2023.

PE: -2.7x

Canfor, a smaller player in the market, recently reported fourth-quarter sales of C$1.29 billion, slightly up from last year. Despite a net loss of C$63.3 million for the quarter, this was an improvement from the previous year's loss of C$117.1 million. Insider confidence is evident with recent share purchases by executives earlier this year, suggesting optimism about future growth prospects as earnings are forecasted to grow 75% annually despite current challenges with external borrowing dependency.

- Click here and access our complete valuation analysis report to understand the dynamics of Canfor.

Examine Canfor's past performance report to understand how it has performed in the past.

BSR Real Estate Investment Trust (TSX:HOM.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BSR Real Estate Investment Trust is a company focused on the ownership and management of residential properties, with a market cap of $1.08 billion.

Operations: BSR Real Estate Investment Trust generates revenue primarily from its residential real estate holdings, with a recent gross profit margin of 54.51%. Over time, the company's net income has fluctuated significantly due to varying non-operating expenses, impacting its net profit margins.

PE: -10.1x

BSR Real Estate Investment Trust, a smaller player in the real estate sector, has recently shown signs of potential value. Their net loss shrank significantly to US$40.24 million from US$210.87 million the previous year, indicating improved financial health. The acquisition of a Class A multifamily community for US$61 million highlights strategic growth moves in vibrant markets like Dallas/Fort Worth. Insider confidence is evident as they continue to support their positions, suggesting optimism about future prospects despite reliance on external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of BSR Real Estate Investment Trust.

Understand BSR Real Estate Investment Trust's track record by examining our Past report.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★★

Overview: Winpak is a company specializing in the manufacturing of flexible packaging, rigid packaging and flexible lidding, and packaging machinery, with a market cap of approximately C$2.5 billion.

Operations: Winpak generates revenue primarily through its Flexible Packaging and Rigid Packaging & Flexible Lidding segments, with a smaller contribution from Packaging Machinery. The company's gross profit margin has shown an upward trend, reaching 31.98% in the latest period. Operating expenses have consistently included significant allocations to sales & marketing and research & development efforts.

PE: 11.2x

Winpak, a smaller company in its sector, reported a slight increase in quarterly net income to US$36.62 million and annual earnings per share rising to US$2.35. Despite an impairment loss of US$1 million on goodwill, the company shows potential with projected sales volume growth between 5% and 7% for 2025. Insider confidence is evident as they have repurchased shares worth CAD 148.17 million since February 2024, suggesting belief in future performance despite reliance on higher-risk external borrowing for funding.

- Unlock comprehensive insights into our analysis of Winpak stock in this valuation report.

Gain insights into Winpak's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 144 Undervalued Global Small Caps With Insider Buying selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Canfor, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CFP

Canfor

Operates as an integrated forest products company in the United States, Asia, Canada, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives