- Canada

- /

- Paper and Forestry Products

- /

- TSX:CFP

Canfor (TSE:CFP investor three-year losses grow to 44% as the stock sheds CA$107m this past week

While it may not be enough for some shareholders, we think it is good to see the Canfor Corporation (TSE:CFP) share price up 20% in a single quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 44% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

With the stock having lost 5.1% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Canfor

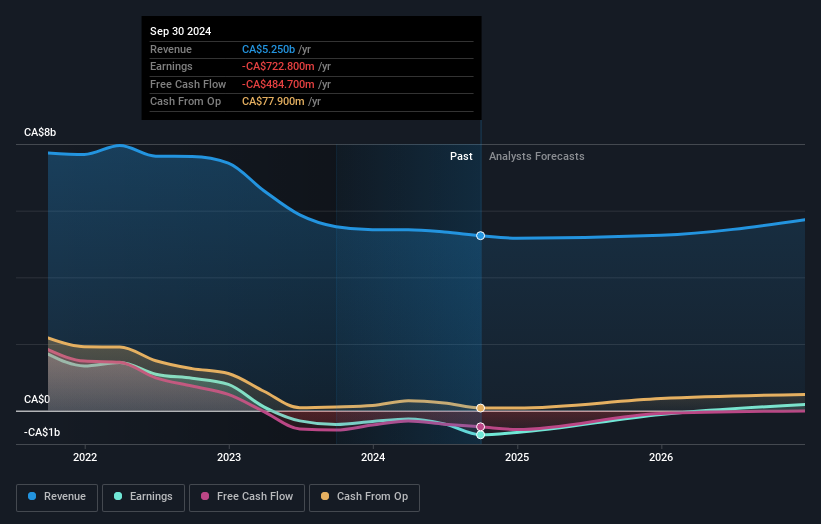

Given that Canfor didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years Canfor saw its revenue shrink by 16% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 13% compound, over three years is well justified by the fundamental deterioration. It would probably be worth asking whether the company can fund itself to profitability. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Canfor's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Canfor provided a TSR of 8.2% over the last twelve months. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 1.7% per year over five year. This suggests the company might be improving over time. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CFP

Canfor

Operates as an integrated forest products company in the United States, Asia, Canada, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives