- Canada

- /

- Paper and Forestry Products

- /

- TSX:CFF

Conifex Timber's (TSE:CFF) Wonderful 394% Share Price Increase Shows How Capitalism Can Build Wealth

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, the Conifex Timber Inc. (TSE:CFF) share price rocketed moonwards 394% in just one year. And in the last month, the share price has gained 18%. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report. Zooming out, the stock is actually down 72% in the last three years.

View our latest analysis for Conifex Timber

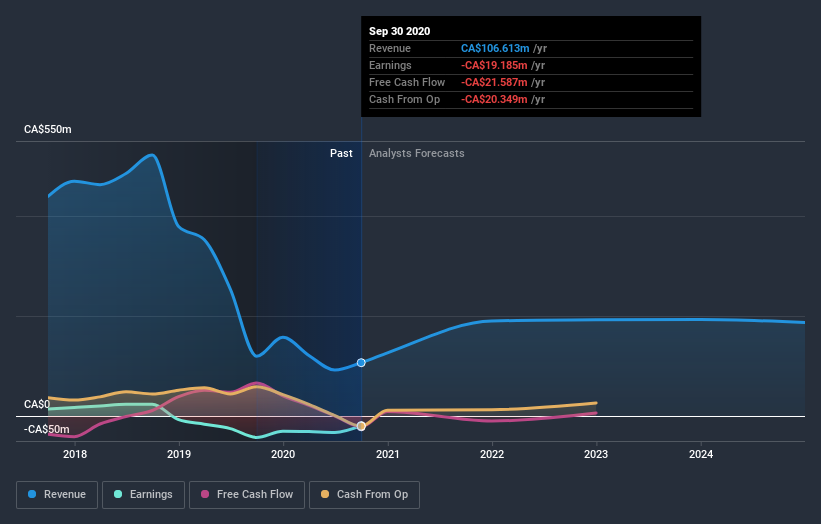

Given that Conifex Timber didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Conifex Timber saw its revenue shrink by 11%. So it's very confusing to see that the share price gained a whopping 394%. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. While this gain looks like speculative buying to us, sometimes speculation pays off.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Conifex Timber's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Conifex Timber shareholders have received a total shareholder return of 394% over the last year. There's no doubt those recent returns are much better than the TSR loss of 5% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Conifex Timber has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course Conifex Timber may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Conifex Timber, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:CFF

Conifex Timber

Manufactures, sells, and distributes lumber in the United States, Canada, Japan, and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives