Investors in CCL Industries (TSE:CCL.B) have unfortunately lost 17% over the last year

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in CCL Industries Inc. (TSE:CCL.B) have tasted that bitter downside in the last year, as the share price dropped 18%. That contrasts poorly with the market return of 19%. On the other hand, the stock is actually up 4.3% over three years. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for CCL Industries

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the CCL Industries share price fell, it actually saw its earnings per share (EPS) improve by 12%. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

Given the yield is quite low, at 1.6%, we doubt the dividend can shed much light on the share price. CCL Industries managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

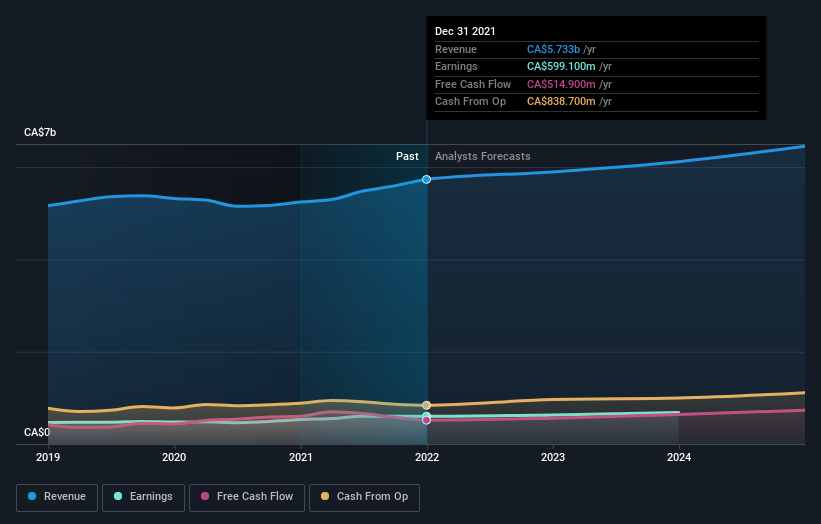

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling CCL Industries stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 19% in the last year, CCL Industries shareholders lost 17% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 0.2% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

CCL Industries is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CCL.B

CCL Industries

Manufactures and sells labels, consumer printable media products, technology-driven label solutions, polymer banknote substrates, and specialty films.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives