- Canada

- /

- Metals and Mining

- /

- TSX:AYA

Aya Gold & Silver (TSX:AYA) Is Up 16.1% After Record Silver Output and Major Equity Raise—Has the Bull Case Changed?

Reviewed by Simply Wall St

- Aya Gold & Silver recently reported a record silver production milestone, reaching 10 million ounces since April 2020 with 1,042,000 ounces produced in the second quarter of 2025, while also strengthening its financial position through a CAD 140 million equity raise.

- Despite ongoing challenges with ore grade dilution and delays in exploration results, the company remains confident in meeting its full-year production guidance and expects further operational improvements in the latter half of the year.

- We'll explore how record quarterly silver output and a reinforced balance sheet may influence Aya Gold & Silver's investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Aya Gold & Silver Investment Narrative Recap

To invest in Aya Gold & Silver, you have to believe in the company's ability to convert robust production growth into lasting profitability, despite persistent operational challenges and reliance on Moroccan assets. The recent record silver output and CAD 140 million equity raise support the view that strong short-term production remains a key catalyst, while grade dilution and exploration delays are still the most pressing risks, neither risk nor catalyst appears materially changed by this news, but execution remains critical. Among recent developments, the high-grade drill results announced in July 2025 at Boumadine highlight ongoing exploration success and reinforce Aya's long-term growth pipeline, directly tied to the company's ambition to expand reserves and future production. These results are particularly significant given the importance of resource conversion and production scale to Aya’s growth strategy. However, even with these positives, investors should watch for ongoing risks around ore grade dilution, as persistent issues here could...

Read the full narrative on Aya Gold & Silver (it's free!)

Aya Gold & Silver's outlook forecasts $266.9 million in revenue and $92.6 million in earnings by 2028. This projection is based on a 42.2% annual revenue growth rate and a $102.8 million improvement in earnings from the current level of -$10.2 million.

Uncover how Aya Gold & Silver's forecasts yield a CA$19.53 fair value, a 31% upside to its current price.

Exploring Other Perspectives

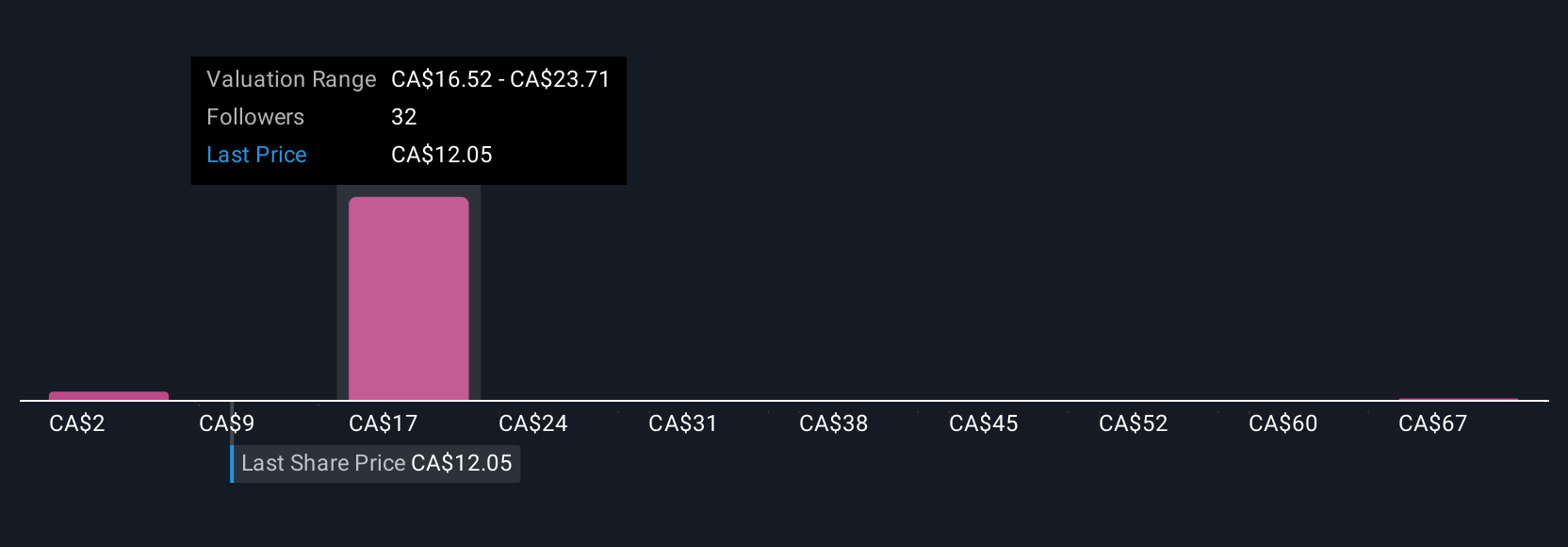

Seven individual fair value estimates from the Simply Wall St Community put Aya Gold & Silver between CA$9 and CA$74 a share. As optimism about operational improvements grows, you might find widely different outlooks and questions about how far production gains can offset key risks.

Explore 7 other fair value estimates on Aya Gold & Silver - why the stock might be worth over 4x more than the current price!

Build Your Own Aya Gold & Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aya Gold & Silver research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Aya Gold & Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aya Gold & Silver's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives