- Canada

- /

- Metals and Mining

- /

- TSX:AYA

Assessing Aya Gold & Silver (TSX:AYA)’s Valuation After Boumadine Breakthroughs and New Cash Flow Source

Reviewed by Simply Wall St

Aya Gold & Silver (TSX:AYA) just reported its strongest drill intercept yet at Boumadine, along with a new high grade parallel structure, while quietly turning a legacy stockpile into fresh cash flow and environmental cleanup.

See our latest analysis for Aya Gold & Silver.

Those Boumadine milestones seem to be resonating with investors, with a 30 day share price return of 25.73 percent and a year to date share price gain of 73.20 percent. This points to strengthening momentum backed by solid multi year total shareholder returns.

If this kind of re rating story has your attention, it is also worth exploring other miners and explorers that are accelerating. You could start with fast growing stocks with high insider ownership.

Yet with Aya trading near record highs, but still at a notable discount to analyst and intrinsic value estimates, is this simply momentum chasing or a rare chance to buy into Boumadine’s future growth before it is fully priced in?

Most Popular Narrative: 16% Undervalued

With Aya Gold & Silver last closing at CA$19.45 against a narrative fair value of CA$23.08, the story leans toward meaningful upside if its growth plan delivers.

The upcoming Boumadine PEA (scheduled for Q4 2025) is expected to establish Boumadine as a Tier 1 asset and set the stage for transformational growth, expanding Aya's production profile and potentially attracting a higher valuation relative to peers with less project visibility, ultimately improving future cash flow and profitability.

Want to see what is baked into that upside case? The narrative leans on aggressive revenue expansion, soaring margins, and a future earnings multiple usually reserved for market darlings. Curious which assumptions really move the needle here? Read on to uncover the full valuation playbook behind that fair value target.

Result: Fair Value of $23.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if Boumadine’s metallurgy proves more difficult than expected or if silver prices retreat after recent strength.

Find out about the key risks to this Aya Gold & Silver narrative.

Another Lens on Value

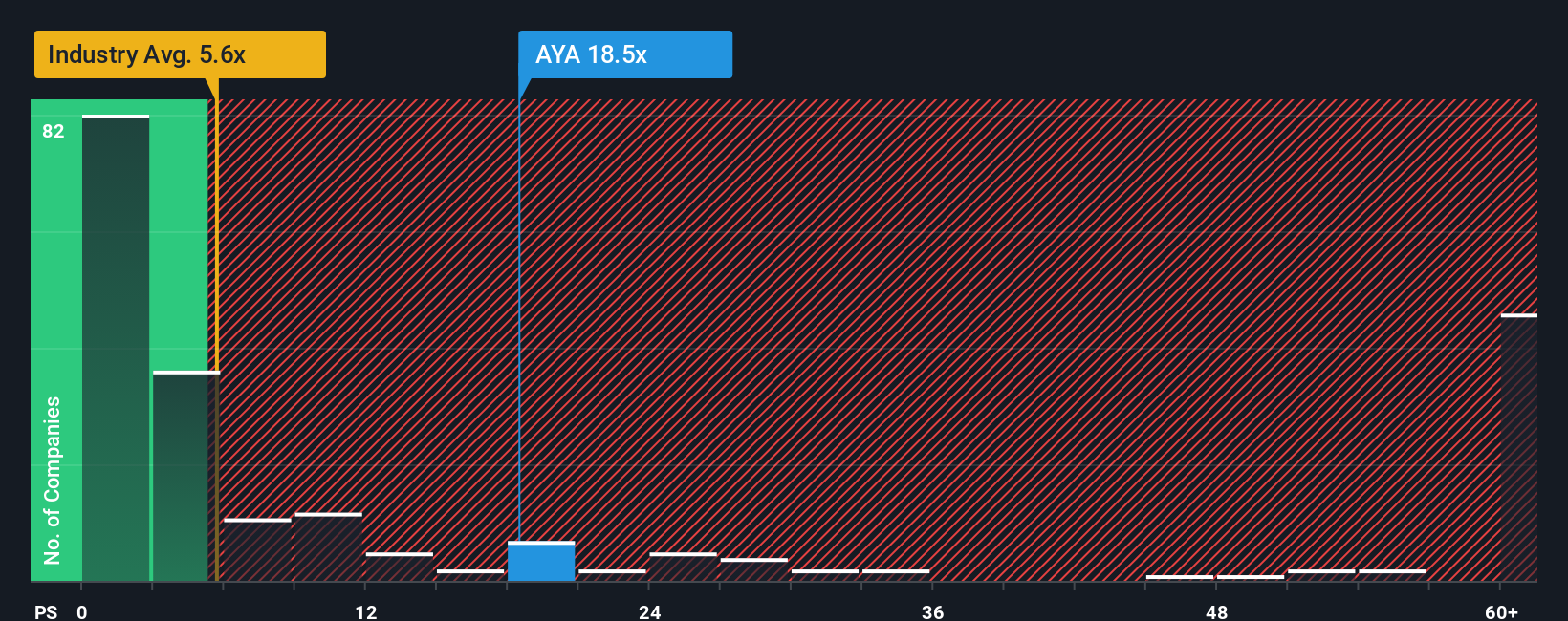

Step away from narratives and the numbers look stark. Aya trades on a Price to Sales ratio of 14.5 times, more than double the Canadian metals and mining average of 6.3 times and well above peers at 7.4 times, compared with a fair ratio of 3.6 times. Is sentiment running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aya Gold & Silver Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Aya Gold & Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more opportunities?

Do not stop at a single story when the market is full of them. Use the Simply Wall Street Screener to uncover your next smart idea today.

- Capitalize on mispriced businesses by checking out these 933 undervalued stocks based on cash flows that balance strong fundamentals with attractive entry points.

- Ride structural growth in finance and technology by scanning these 81 cryptocurrency and blockchain stocks shaping the evolution of digital assets and blockchain infrastructure.

- Strengthen your income strategy by reviewing these 14 dividend stocks with yields > 3% that pair reliable cash flows with yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026