- Canada

- /

- Diversified Financial

- /

- TSX:NVEI

3 TSX Growth Companies With High Insider Ownership Expecting 96% Earnings Growth

Reviewed by Simply Wall St

The Canadian market has shown resilience with a 1.0% increase over the past week and an impressive 22% rise over the last year, while earnings are projected to grow by 15% annually. In this flourishing environment, growth companies with substantial insider ownership can be particularly appealing as they often align management interests with shareholder value and may capitalize on anticipated earnings growth.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 76.5% |

| VersaBank (TSX:VBNK) | 13.3% | 30.4% |

| Aritzia (TSX:ATZ) | 18.9% | 60.4% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 71.4% |

| Allied Gold (TSX:AAUC) | 17.7% | 73% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

We're going to check out a few of the best picks from our screener tool.

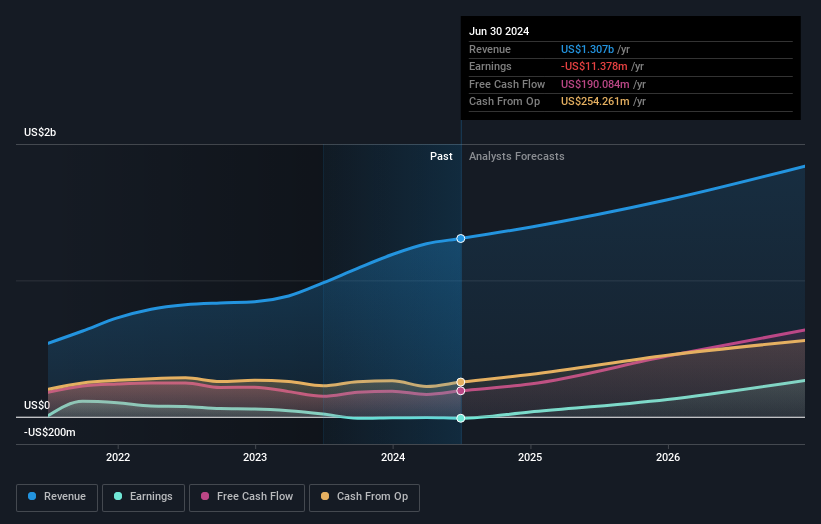

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. is involved in the exploration, evaluation, and development of precious metals projects in Morocco and has a market cap of CA$2.27 billion.

Operations: Aya Gold & Silver's revenue primarily comes from the production at the Zgounder Silver Mine in Morocco, generating $41.54 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 71.4% p.a.

Aya Gold & Silver is experiencing rapid growth, with forecasted annual revenue and earnings growth of 46.7% and 71.4%, respectively, outpacing the Canadian market averages. Despite past shareholder dilution, its high insider ownership aligns management interests with shareholders. Recent exploration at Morocco's Boumadine site extended mineralized zones, enhancing resource potential. Additionally, Aya's strategic spinout of the Amizmiz project into Mx2 Mining aims to unlock further value while maintaining significant influence in this new venture.

- Take a closer look at Aya Gold & Silver's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Aya Gold & Silver shares in the market.

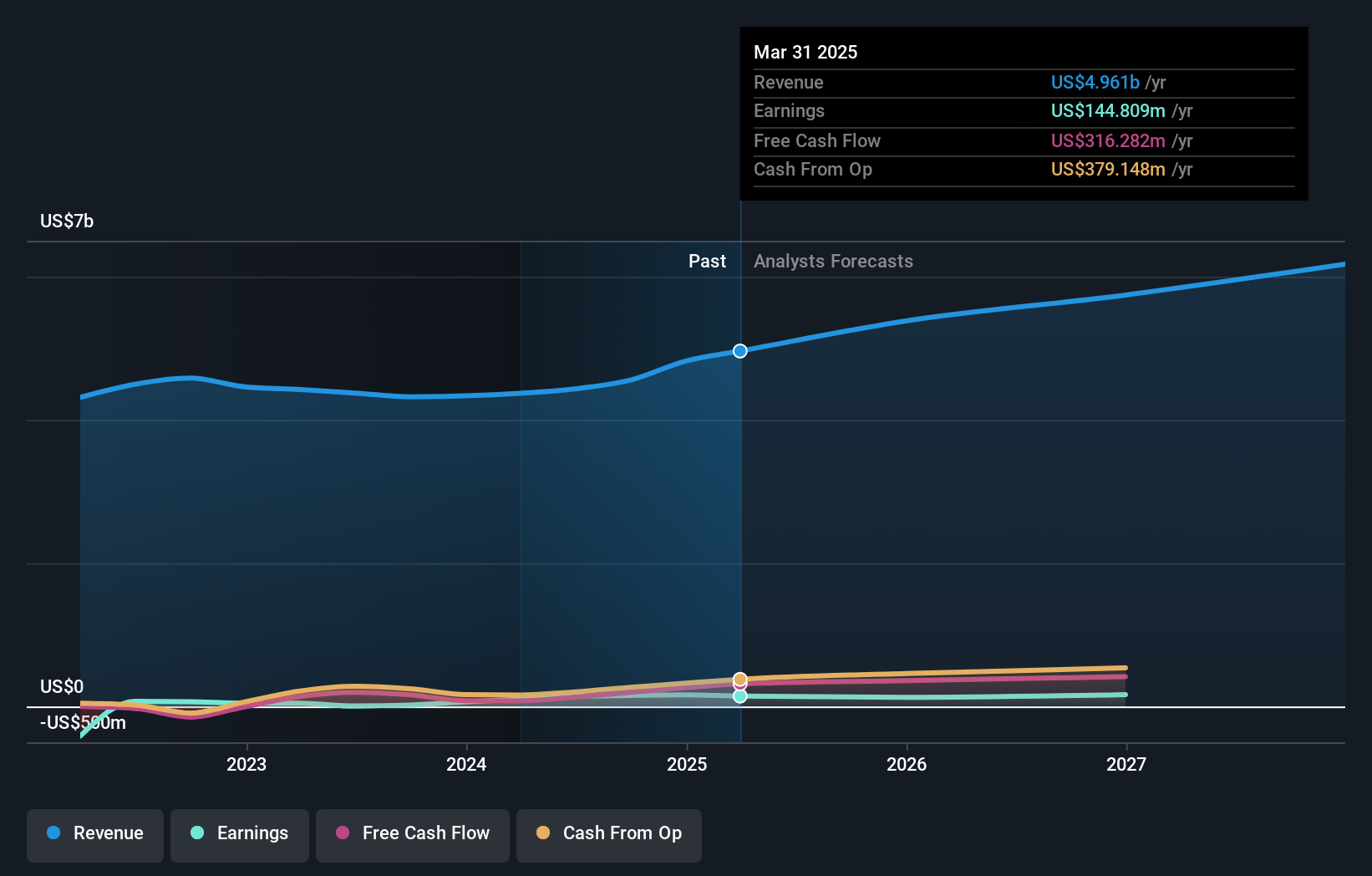

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. offers commercial real estate and investment management services to corporate and institutional clients across various regions, with a market cap of CA$10.33 billion.

Operations: The company's revenue is primarily derived from its operations in the Americas ($2.59 billion), Europe, Middle East & Africa (EMEA) ($734.93 million), Asia Pacific ($614.55 million), and its Investment Management segment ($496.42 million).

Insider Ownership: 14.1%

Earnings Growth Forecast: 20.8% p.a.

Colliers International Group shows promising growth potential, with earnings forecasted to grow significantly at 20.8% annually, surpassing the Canadian market average. Recent financials highlight a turnaround, reporting net income of US$36.72 million in Q2 2024 compared to a loss last year. Despite past shareholder dilution and substantial insider selling over the last quarter, insider ownership remains high, aligning management interests with shareholders and supporting its growth trajectory in the real estate sector.

- Click here and access our complete growth analysis report to understand the dynamics of Colliers International Group.

- Our valuation report unveils the possibility Colliers International Group's shares may be trading at a premium.

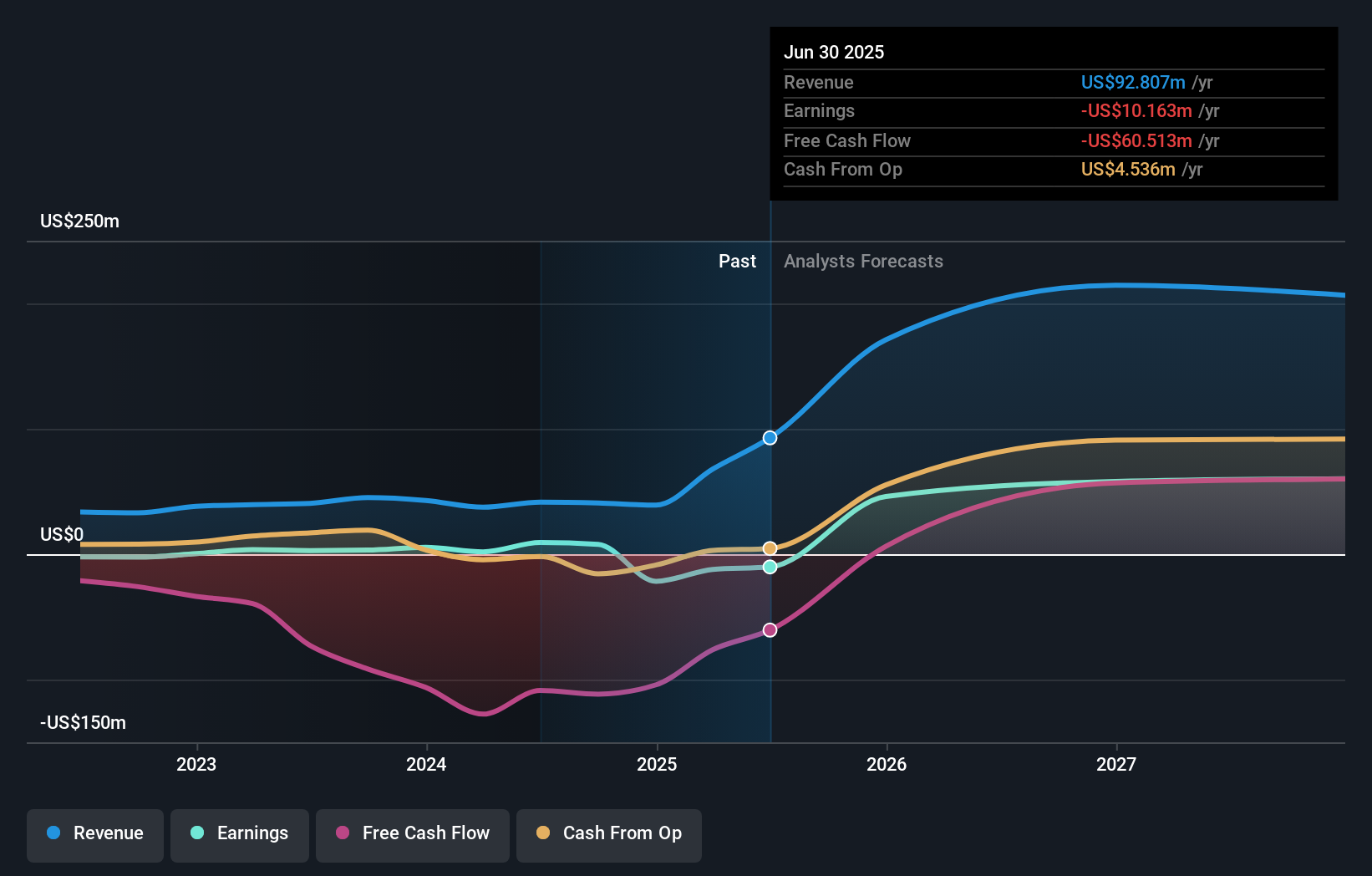

Nuvei (TSX:NVEI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuvei Corporation offers payment technology solutions to merchants and partners across multiple regions including North America, Europe, the Middle East and Africa, Latin America, and the Asia Pacific, with a market cap of CA$6.51 billion.

Operations: The company's revenue primarily comes from providing payment technology solutions to merchants and partners, totaling $1.31 billion.

Insider Ownership: 20.1%

Earnings Growth Forecast: 96.7% p.a.

Nuvei's forecasted revenue growth of 13.7% annually outpaces the Canadian market, although it has diluted shareholders recently. The company is expected to become profitable within three years, with earnings projected to grow significantly at 96.72% per year. Recent partnerships, such as with JCB International in APAC and Scanco Software, enhance its strategic position in eCommerce and ERP systems. Despite low forecasted return on equity (18.2%), these developments support Nuvei's growth potential in fintech solutions.

- Navigate through the intricacies of Nuvei with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Nuvei's share price might be on the expensive side.

Where To Now?

- Delve into our full catalog of 35 Fast Growing TSX Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nuvei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NVEI

Nuvei

Provides payment technology solutions to merchants and partners in North America, Europe, the Middle East and Africa, Latin America, and the Asia Pacific.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives