This article will reflect on the compensation paid to Don Bubar who has served as CEO of Avalon Advanced Materials Inc. (TSE:AVL) since 1995. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Avalon Advanced Materials

Comparing Avalon Advanced Materials Inc.'s CEO Compensation With the industry

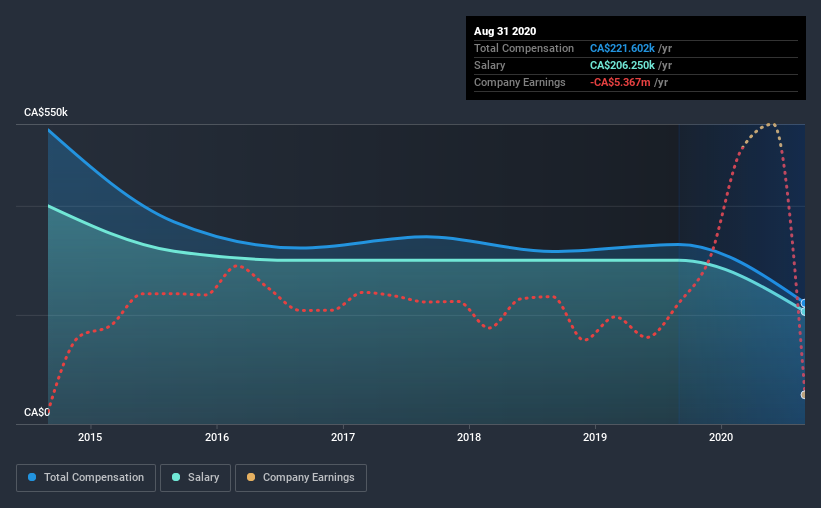

Our data indicates that Avalon Advanced Materials Inc. has a market capitalization of CA$31m, and total annual CEO compensation was reported as CA$222k for the year to August 2020. That's a notable decrease of 33% on last year. We note that the salary portion, which stands at CA$206.3k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below CA$260m, reported a median total CEO compensation of CA$154k. This suggests that Don Bubar is paid more than the median for the industry. Moreover, Don Bubar also holds CA$658k worth of Avalon Advanced Materials stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$206k | CA$300k | 93% |

| Other | CA$15k | CA$29k | 7% |

| Total Compensation | CA$222k | CA$329k | 100% |

On an industry level, around 89% of total compensation represents salary and 11% is other remuneration. There isn't a significant difference between Avalon Advanced Materials and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Avalon Advanced Materials Inc.'s Growth

Avalon Advanced Materials Inc. has seen its earnings per share (EPS) increase by 35% a year over the past three years. It achieved revenue growth of 1,099% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Avalon Advanced Materials Inc. Been A Good Investment?

Since shareholders would have lost about 25% over three years, some Avalon Advanced Materials Inc. investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, Avalon Advanced Materials Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, we must not forget that the EPS growth has been very strong, but we cannot say the same about the uninspiring shareholder returns (over the last three years). Although we don't think the CEO pay is too high, considering negative investor returns, it is more generous than modest.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 5 warning signs (and 2 which are significant) in Avalon Advanced Materials we think you should know about.

Important note: Avalon Advanced Materials is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Avalon Advanced Materials or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:AVL

Avalon Advanced Materials

Engages in the acquisition, exploration, evaluation, and development of specialty and critical minerals properties in Canada.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion