- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Avino Silver & Gold Mines (TSX:ASM) Reports Robust Rise In Q1 2025 Earnings

Reviewed by Simply Wall St

Avino Silver & Gold Mines (TSX:ASM) recently reported a robust earnings announcement, showcasing a significant rise in sales and net income for Q1 2025. This financial growth likely influenced the company's stock price, which surged by 83.33% over the last quarter. This impressive performance comes amid a mixed market backdrop, with the Dow Jones and S&P 500 experiencing volatility due to a U.S. credit rating downgrade and rising treasury yields. Avino's increase in precious metals production would further support its favorable trajectory in the market, counterbalancing broader economic uncertainties impacting investor confidence.

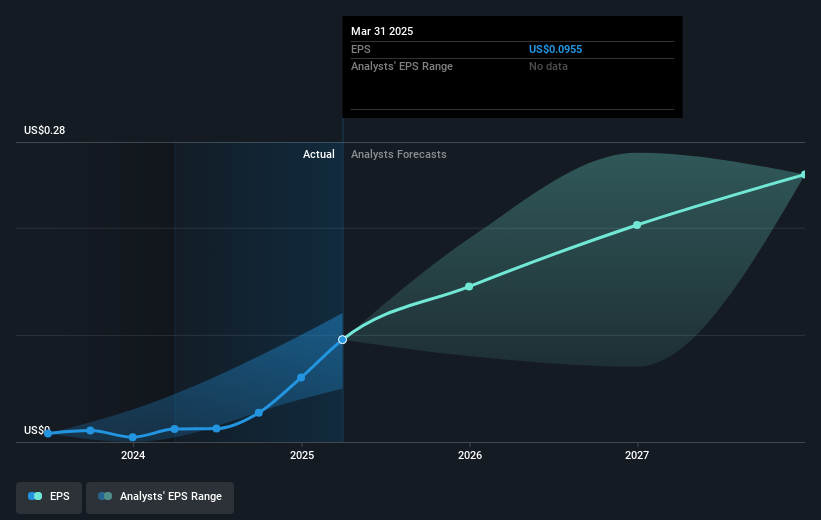

Avino Silver & Gold Mines' impressive quarterly earnings report is a potential catalyst for continued momentum in its financial performance. The detailed financial growth and increase in precious metals production could positively influence both revenue and earnings forecasts. This growth narrative, supported by the commencement of underground development at La Preciosa, suggests a favorable outlook. Analysts expect the improved operational efficiencies and strong metal prices to continue bolstering the company's margins. However, the company's performance remains highly susceptible to metal price volatility and currency fluctuations, which could impact its future profitability.

Over the past three years, Avino's total shareholder return, including share price appreciation and dividends, was 340%. This substantial return highlights the robust performance of the company in a challenging market environment. Over the past year, Avino's performance exceeded the Canadian market's return as well as the Canadian Metals and Mining industry. In this context, the recent price surge and positive earnings announcements point towards a potential alignment with analysts' price targets. The company's shares are currently trading at a CA$0.41 discount to the consensus analyst price target of CA$4.12, indicating potential upside if the positive performance continues. As always, it's crucial for investors to consider both the opportunities and risks associated with Avino's reliance on external factors such as metal prices and currency movements when evaluating its future prospects.

Learn about Avino Silver & Gold Mines' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives