- Canada

- /

- Metals and Mining

- /

- TSX:ALS

A Look at Altius Minerals (TSX:ALS) Valuation After Material Boost From Nevada Royalty Deal

Reviewed by Kshitija Bhandaru

Altius Minerals (TSX:ALS) just secured a material boost to its royalty portfolio after finalizing a deal involving Nevada’s Firenze gold project. The agreement provides immediate cash as well as a 1.5% net smelter return royalty on future output.

See our latest analysis for Altius Minerals.

Altius Minerals has been gaining momentum, with a one-day share price move of 3.18% and a 90-day gain of almost 22%, helped in part by the fresh boost from its Nevada deal. In the broader context, investors have seen a 27.56% total shareholder return over the past year and a notable 230% return over the last five years. These figures reflect both recent catalysts and Altius's long-term value creation.

If you’re intrigued by how major moves can fuel long-term outperformance, consider exploring fast growing stocks with high insider ownership.

Yet with shares still trading at a modest discount to analyst price targets, investors are left wondering whether Altius remains undervalued or if the market has already priced in its new catalysts and long-term growth potential.

Price-to-Earnings of 15.6x: Is it justified?

Altius Minerals trades on a price-to-earnings ratio of 15.6x, which places the company at a more moderate valuation compared to many of its industry peers. The latest closing price of CA$33.39 suggests shareholders are willing to pay a premium for its earnings profile.

The price-to-earnings (P/E) ratio measures how much investors are paying for every dollar of the company’s earnings. This metric is often used to assess whether the market is expecting strong profit growth, relatively stable earnings power, or some unique quality in the business model. For Altius, the P/E ratio also reflects investor expectations for its future cash flows from royalties and organic growth.

Compared to the Canadian Metals and Mining industry average of 24x, Altius's P/E signals a potential discount. However, this valuation remains well above the estimated fair price-to-earnings ratio of 5.7x, which suggests the market has elevated expectations that could be vulnerable if anticipated growth does not materialize as projected. The fair ratio represents a level the broader market could return to if enthusiasm fades or fundamentals shift.

Explore the SWS fair ratio for Altius Minerals

Result: Price-to-Earnings of 15.6x (OVERVALUED)

However, Altius's near-term profit growth may lag if royalty streams slow or if revenue growth does not meet recent expectations.

Find out about the key risks to this Altius Minerals narrative.

Another View: Discounted Cash Flow

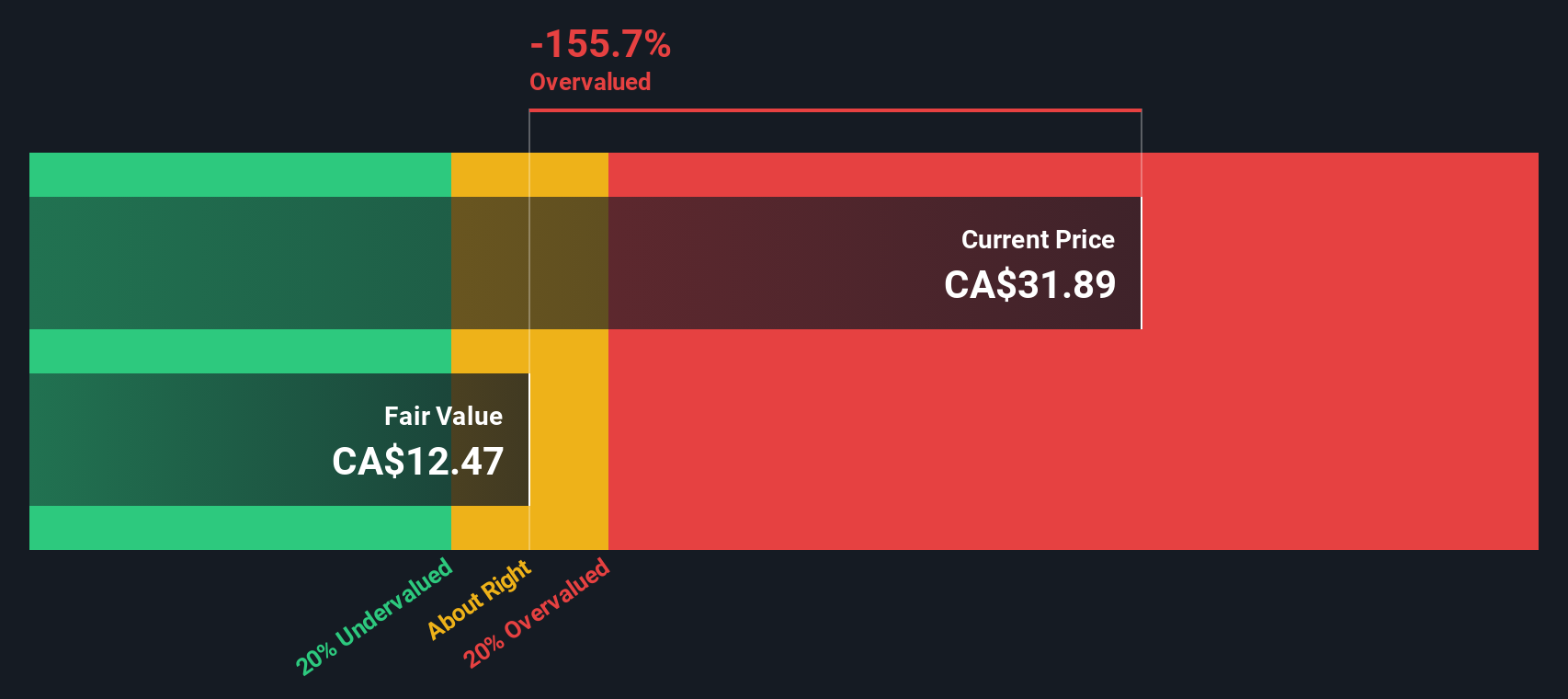

While the price-to-earnings approach suggests Altius Minerals may be pricey, the SWS DCF model offers a starker contrast. It estimates the company’s fair value at just CA$12.10 per share, which is far below the market price. Does this gap highlight a real opportunity or a risk of over-optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Altius Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Altius Minerals Narrative

If you’re keen to see the numbers for yourself and draw your own conclusions, it takes just a few minutes to explore and build a personal perspective. Do it your way.

A great starting point for your Altius Minerals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stick to just one opportunity when there is a world of smart stocks waiting for your attention? Let Simply Wall Street help you seize them faster.

- Tap into tomorrow’s technology advances by reviewing these 25 AI penny stocks, which are powering breakthroughs in artificial intelligence.

- Unlock consistent income streams for your portfolio with these 18 dividend stocks with yields > 3%, offering strong yields above 3 percent.

- Catch hidden gems trading below their true value by using these 877 undervalued stocks based on cash flows, which is based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALS

Altius Minerals

Engages in the mineral and renewable royalties and project generation businesses in Canada, Brazil, and the United States.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives