- Canada

- /

- Hospitality

- /

- TSX:AW

TSX Growth Companies With High Insider Ownership In May 2025

Reviewed by Simply Wall St

With Canada's election now behind it, policymakers are poised to address key economic issues such as trade and fiscal policy, while the Bank of Canada considers potential interest rate cuts to bolster household consumption. Amidst this backdrop of economic recalibration and evolving trade dynamics, growth companies with high insider ownership can be particularly appealing due to their alignment with shareholder interests and potential resilience in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 36% |

| Robex Resources (TSXV:RBX) | 25.6% | 147.4% |

| Allied Gold (TSX:AAUC) | 17% | 63.2% |

| Almonty Industries (TSX:AII) | 11.7% | 49.8% |

| Enterprise Group (TSX:E) | 32.2% | 50.5% |

| Aritzia (TSX:ATZ) | 17.5% | 22.4% |

| Intermap Technologies (TSX:IMP) | 14.5% | 78.8% |

| VersaBank (TSX:VBNK) | 10.4% | 53.5% |

| Burcon NutraScience (TSX:BU) | 16.4% | 152.2% |

| SolarBank (NEOE:SUNN) | 17.6% | 178.3% |

We'll examine a selection from our screener results.

Almonty Industries (TSX:AII)

Simply Wall St Growth Rating: ★★★★★★

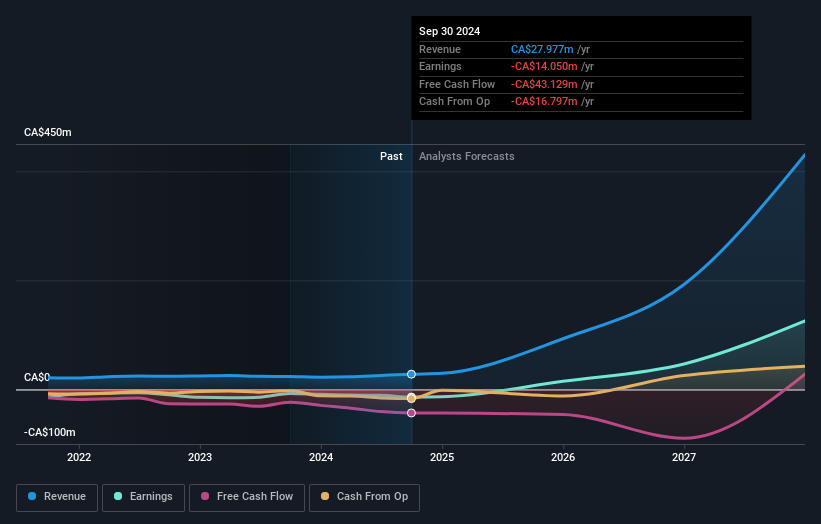

Overview: Almonty Industries Inc. is involved in the mining, processing, and shipping of tungsten concentrate with a market cap of CA$687.65 million.

Operations: The company's revenue is derived from two main segments: Woulfe, contributing CA$0.03 million, and Panasquiera, contributing CA$28.81 million.

Insider Ownership: 11.7%

Earnings Growth Forecast: 49.8% p.a.

Almonty Industries is poised for significant growth, with revenue expected to increase by 42.7% annually, outpacing the Canadian market. Despite recent volatility and a net loss of C$16.3 million in 2024, analysts anticipate a 92.1% stock price rise as profitability improves over the next three years. The company's strategic partnership with American Defense International strengthens its position in critical metals, while high insider ownership reflects confidence in Almonty's long-term potential.

- Navigate through the intricacies of Almonty Industries with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Almonty Industries implies its share price may be lower than expected.

A & W Food Services of Canada (TSX:AW)

Simply Wall St Growth Rating: ★★★★☆☆

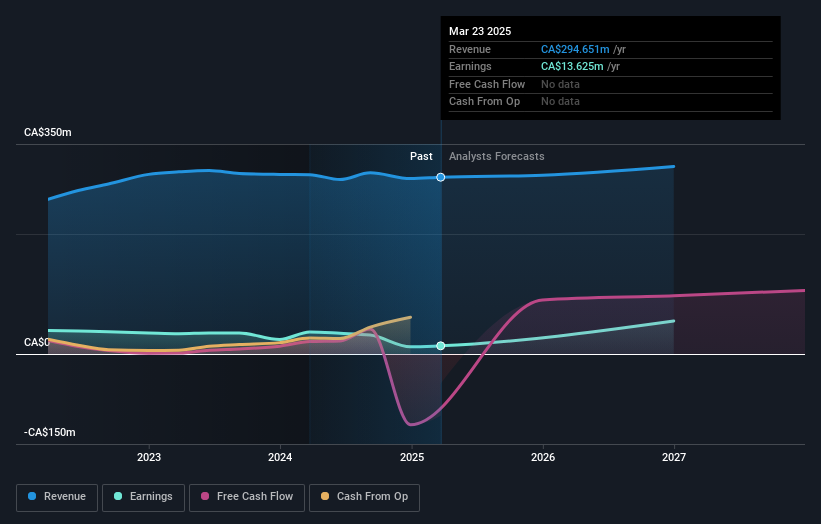

Overview: A & W Food Services of Canada Inc. operates and franchises quick service restaurants across Canada, with a market cap of CA$791.93 million.

Operations: A & W Food Services of Canada Inc. generates revenue primarily through the development, operation, and franchising of quick service restaurants within the Canadian market.

Insider Ownership: 37.7%

Earnings Growth Forecast: 58.0% p.a.

A & W Food Services of Canada demonstrates potential for growth, with earnings forecasted to increase significantly at 58% annually, surpassing the Canadian market. Recent Q1 results show improved net income of C$9.26 million despite a slight decline in sales. The company's high insider ownership and recent substantial insider buying suggest confidence in its future prospects. However, profit margins have decreased from last year, and the dividend yield is not well covered by free cash flows.

- Unlock comprehensive insights into our analysis of A & W Food Services of Canada stock in this growth report.

- The valuation report we've compiled suggests that A & W Food Services of Canada's current price could be inflated.

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★★

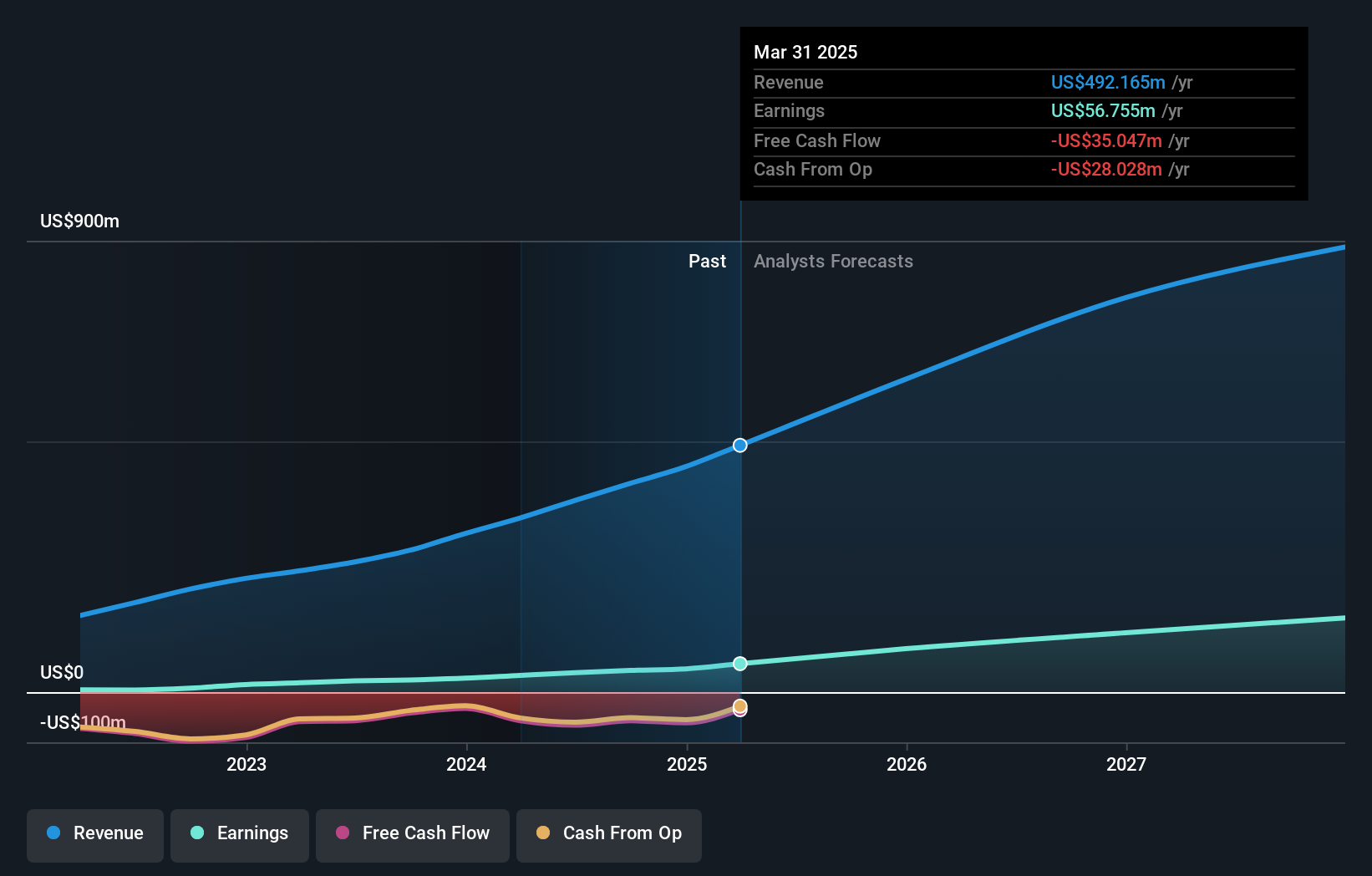

Overview: Propel Holdings Inc. is a financial technology company that operates through its subsidiaries, with a market capitalization of CA$1.14 billion.

Operations: The company's revenue is primarily derived from providing lending-related services to borrowers, banks, and other institutions, amounting to $449.73 million.

Insider Ownership: 36.5%

Earnings Growth Forecast: 36% p.a.

Propel Holdings exhibits strong growth potential, with earnings projected to grow significantly at 36% annually, outpacing the Canadian market. Revenue is also expected to rise rapidly at 22.7% per year. Recent debt refinancing has reduced interest costs, enhancing financial flexibility. Despite high non-cash earnings and debt not being well covered by operating cash flow, insider buying indicates confidence in future performance. Trading below fair value estimates suggests potential upside in stock price.

- Click here and access our complete growth analysis report to understand the dynamics of Propel Holdings.

- The analysis detailed in our Propel Holdings valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Reveal the 36 hidden gems among our Fast Growing TSX Companies With High Insider Ownership screener with a single click here.

- Curious About Other Options? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AW

A & W Food Services of Canada

Engages in the development, operation, and franchises of quick service restaurants in Canada.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives