- Canada

- /

- Metals and Mining

- /

- TSX:AII

Almonty Industries (TSX:AII): Exploring Valuation After Legal Action to Defend Its Reputation

Reviewed by Kshitija Bhandaru

Almonty Industries (TSX:AII) has taken legal action against Pure Tungsten Inc., aiming to stop what it describes as false and misleading statements about the company, its Sangdong Mine, and a former executive. This court filing reflects Almonty’s firm stance on protecting its reputation and shareholder interests.

See our latest analysis for Almonty Industries.

This legal dispute comes on the heels of an extraordinary run for Almonty Industries, with its latest share price at $10.86 and a 1-year total shareholder return of 722.73%. Momentum has clearly been building, highlighted by a remarkable 75.73% 1-month share price return, as investors respond to both operational developments and shifting risk perceptions.

If you’re in the mood to spot more fast-moving opportunities, now’s a great time to discover fast growing stocks with high insider ownership

With such sharp gains and investor excitement running high, the big question is whether Almonty Industries is trading below its true worth or if investors have already priced in every bit of its future potential.

Price-to-Book Ratio of 233.3x: Is it justified?

At its last close of CA$10.86, Almonty Industries is trading at a sky-high price-to-book ratio of 233.3 times, far outpacing both peer and industry benchmarks. This suggests investors are pricing in significant future value. However, the premium is extraordinary compared to norms.

The price-to-book ratio reflects how much investors are paying for each dollar of net assets on the company’s balance sheet. For metals and mining companies, this ratio often indicates how much confidence the market has in asset quality and future profitability. In Almonty’s case, such an elevated multiple may suggest expectations for rapid growth or a unique strategic advantage, but it is well above what is typical in this sector.

Compared to its Canadian Metals and Mining industry peers, which average a far lower 2.7x, Almonty’s valuation looks especially steep. While some premium can be justified by growth prospects, such a gap signals the market is either extremely bullish or that risks are being overlooked.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 233.3x (OVERVALUED)

However, weaker-than-expected earnings or a correction in growth expectations could quickly reduce the current optimism surrounding Almonty Industries.

Find out about the key risks to this Almonty Industries narrative.

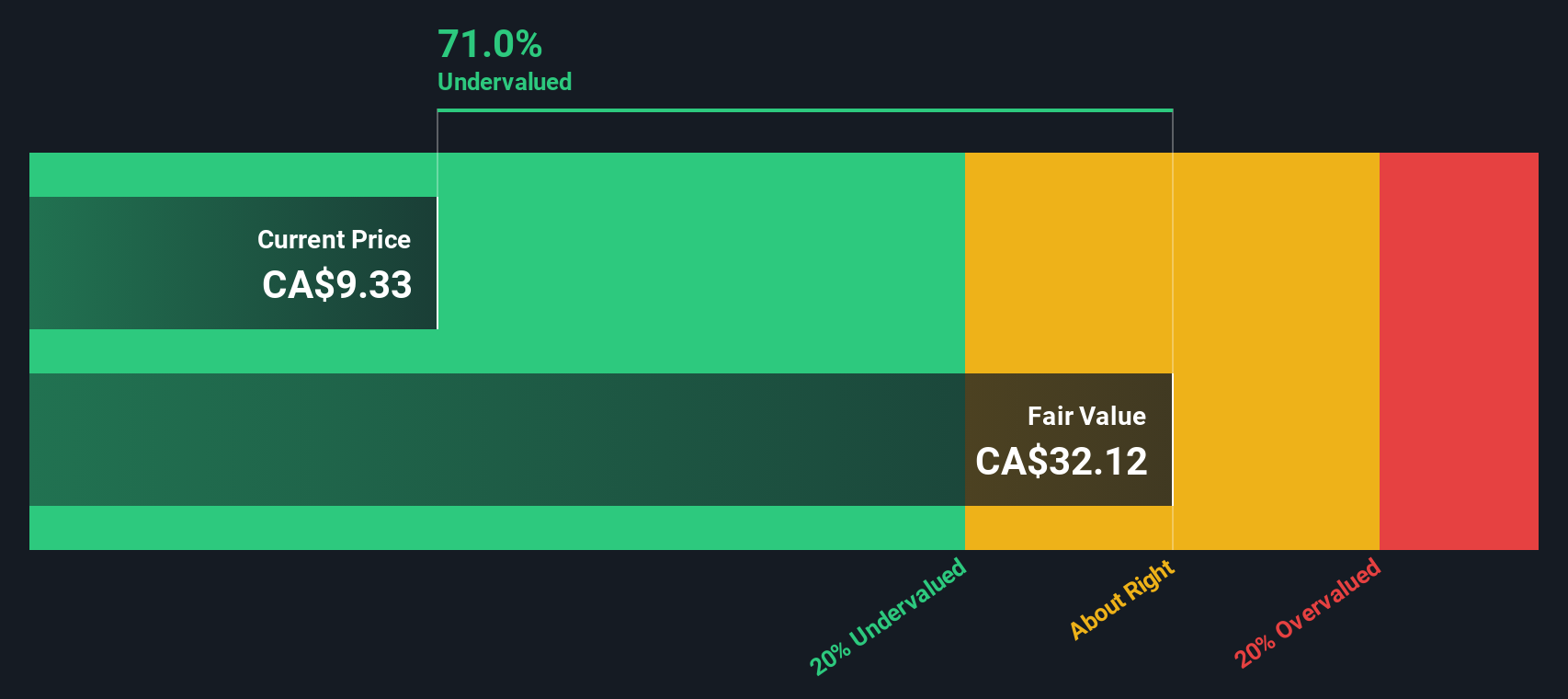

Another View: DCF Model Points to Undervaluation

While the price-to-book ratio presents Almonty Industries as highly overvalued, our DCF model offers a sharply contrasting perspective. It suggests shares are trading about 66% below their estimated fair value, which indicates there could be significant upside if assumptions hold true. Could the market be underestimating future potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Almonty Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Almonty Industries Narrative

If you see things differently or want to dive into the numbers yourself, it only takes a few minutes to create your own perspective. Why not Do it your way

A great starting point for your Almonty Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means staying ahead of the curve. Don’t miss your chance to spot fresh opportunities that others may overlook by using these powerful stock search tools:

- Maximize your potential for high returns as you compare market movers with these 3587 penny stocks with strong financials that consistently show strength in their financials.

- Start building a future-focused portfolio by tapping into the latest trends with these 24 AI penny stocks at the heart of artificial intelligence innovation.

- Boost your passive income by targeting companies known for strong yields when you check out these 19 dividend stocks with yields > 3% that deliver reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AII

Almonty Industries

Engages in mining, processing, and shipping of tungsten concentrate.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives