- Canada

- /

- Metals and Mining

- /

- TSX:AG

Is It Too Late to Consider First Majestic Silver After Its 152% Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether First Majestic Silver is still good value after its big run, or if you are late to the party, this breakdown focuses squarely on what the current price really implies.

- The stock has cooled slightly over the last week with a roughly -1.2% move. That follows a powerful 30.0% jump over the past month and a 152.0% gain year to date, with 129.5% over the last year.

- Recent price action has been driven by renewed enthusiasm for precious metals and shifting expectations around interest rates, which tend to move sentiment quickly for silver focused miners like First Majestic. In addition, investors have been paying close attention to production updates, project development progress, and broader commodity market commentary, all of which help frame both the upside narrative and the risks.

- Even after this rally, First Majestic Silver only scores a 2/6 valuation score. In what follows, we look at what different valuation methods are suggesting about the stock today and then finish with a more nuanced way to think about fair value that goes beyond any single model.

First Majestic Silver scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: First Majestic Silver Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting its future cash flows and discounting them back to today to reflect risk and the time value of money.

For First Majestic Silver, the latest twelve month Free Cash Flow is about $116.6 Million. Analysts and extrapolated estimates see this rising sharply over the next decade, with projected Free Cash Flow reaching roughly $896.2 Million by 2035. The near term is informed by analyst forecasts. Later years are extended by Simply Wall St using a 2 Stage Free Cash Flow to Equity approach that tapers growth over time.

Based on these cash flow projections, the DCF model arrives at an intrinsic value of about $42.84 per share. With the current share price implying a 49.5% discount to this estimate, the model suggests the stock is meaningfully undervalued rather than just modestly mispriced.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests First Majestic Silver is undervalued by 49.5%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: First Majestic Silver Price vs Earnings

For profitable companies, the Price to Earnings ratio, or PE, is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. It naturally ties valuation to the bottom line, and it also reflects what the market expects those earnings to do in the future.

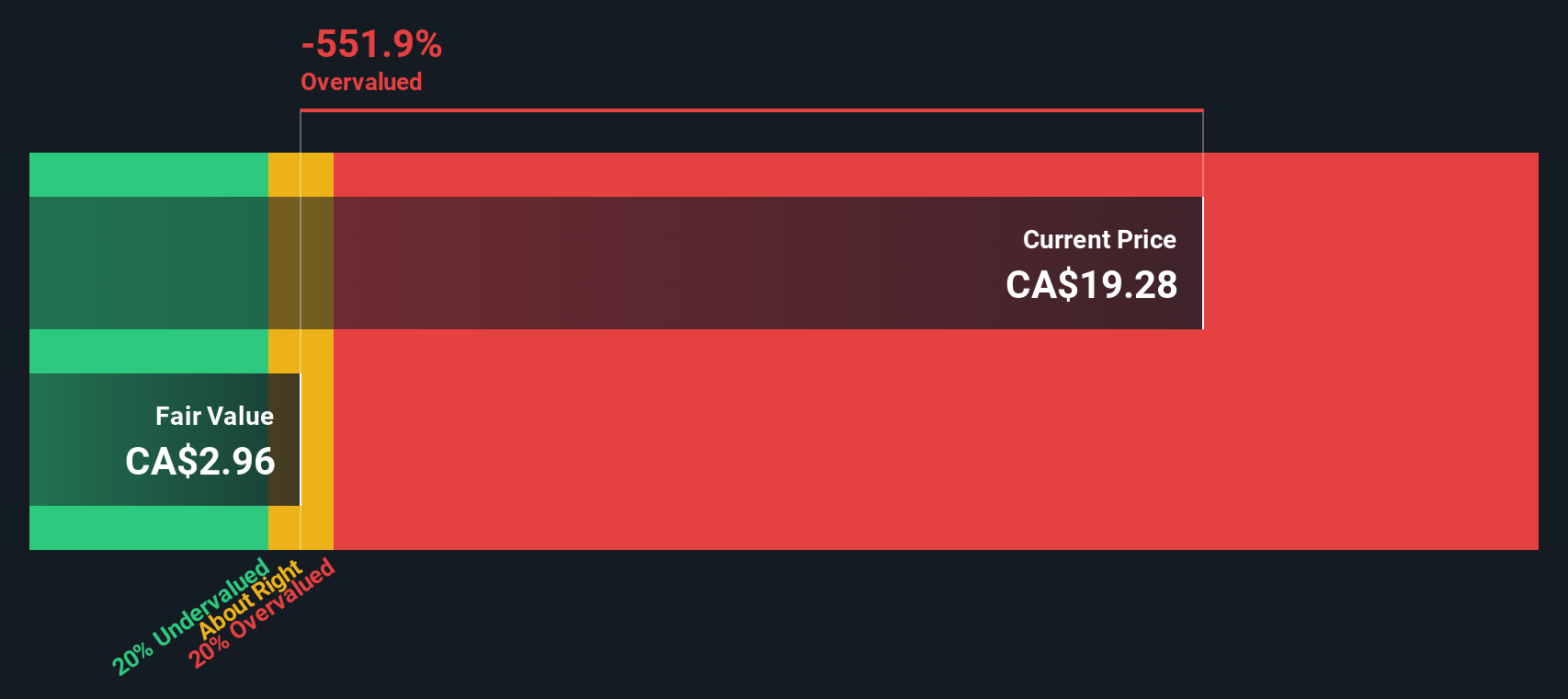

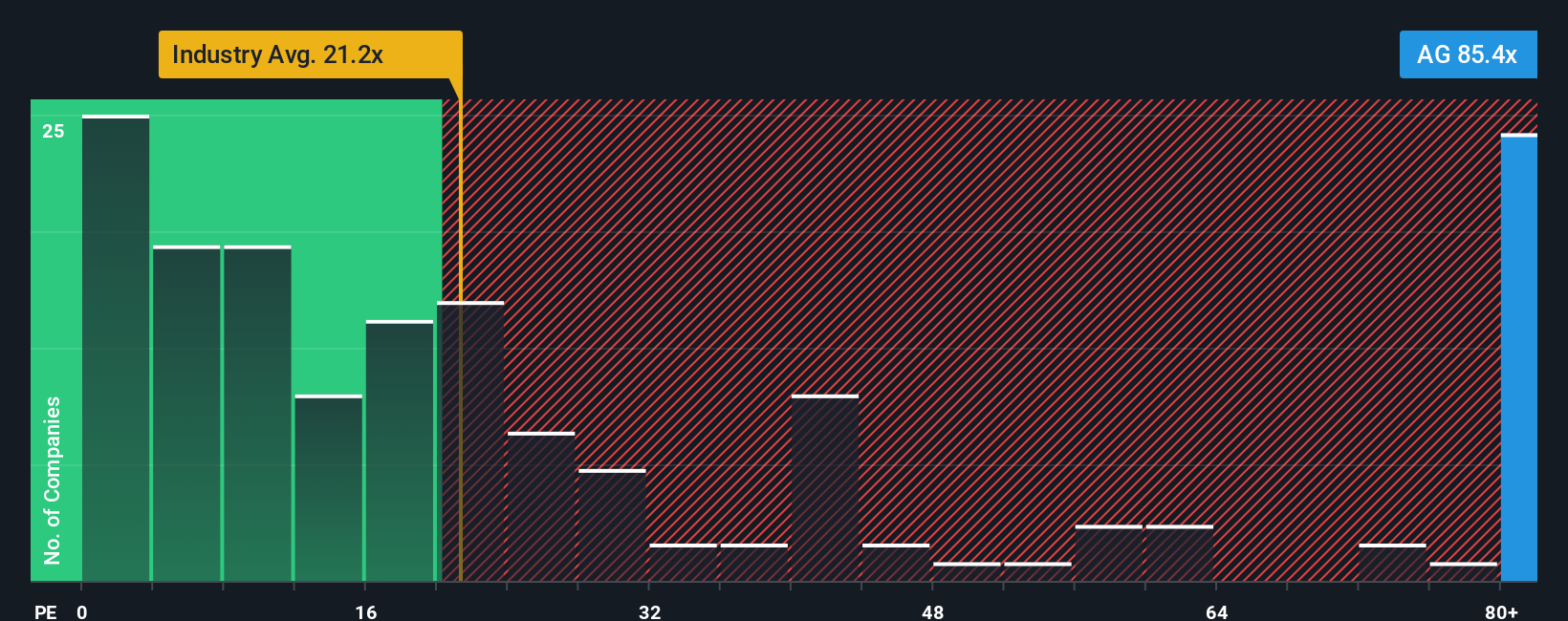

In general, faster growth and lower perceived risk justify a higher PE ratio, while slower growth or higher risk should translate into a lower multiple. First Majestic Silver currently trades on a lofty 112.84x PE, which is well above the broader Metals and Mining industry average of roughly 20.91x and also higher than the 50.43x average of its closer peers. That gap indicates investors are already baking in strong growth and a fair amount of optimism.

To refine this view, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE you would reasonably expect for First Majestic Silver given its earnings growth profile, profit margins, industry, market cap and risk factors. This tailored approach is more informative than simply lining the stock up against peers, because it explicitly adjusts for the company’s specific strengths and weaknesses. On this basis, First Majestic Silver’s Fair PE is 46.02x, well below the current 112.84x, suggesting the shares are priced ahead of fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Majestic Silver Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you attach a clear story to your own assumptions about First Majestic Silver’s future revenue, earnings, margins, and ultimately fair value. You can then compare that fair value to today’s price to decide if you want to buy, hold, or sell. A Narrative connects three pieces: your view of the business, the financial forecast that view implies, and the fair value that emerges at the end. Because it lives on the platform used by millions of investors, it updates dynamically as fresh news, earnings, or guidance arrive. For First Majestic Silver, one investor might build a bullish Narrative around accelerating production, successful exploration and buybacks, landing near the CA$21 fair value. Another might plug in more cautious assumptions about costs, regional risk and dilution to arrive at a much lower fair value. Both perspectives can coexist side by side so you can see exactly which story you agree with before you act.

Do you think there's more to the story for First Majestic Silver? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026