- Canada

- /

- Metals and Mining

- /

- TSX:AG

First Majestic Silver (TSX:AG) Valuation in Focus After Silver Price Rally and Los Gatos Exploration Results

Reviewed by Kshitija Bhandaru

If you are trying to decide what to do with First Majestic Silver (TSX:AG), you are not alone. The stock just surged to a record high, driven by a combination of silver prices reaching all-time highs and some positive exploration results from its Los Gatos Silver Mine in Mexico. Both factors have captured the market's imagination, increasing investor demand for shares and bringing First Majestic firmly into the spotlight.

This is not the first major move for First Majestic Silver, but it is one of the strongest rallies the company has experienced in recent times. Over the past year, the shares have nearly doubled, with much of this momentum accelerating in the last few months. In addition to the excitement around silver, the company’s recent updates, including the $500 million shelf registration filing, suggest management is preparing for future opportunities or strategic changes. These developments have contributed to the perception that First Majestic is at a significant turning point.

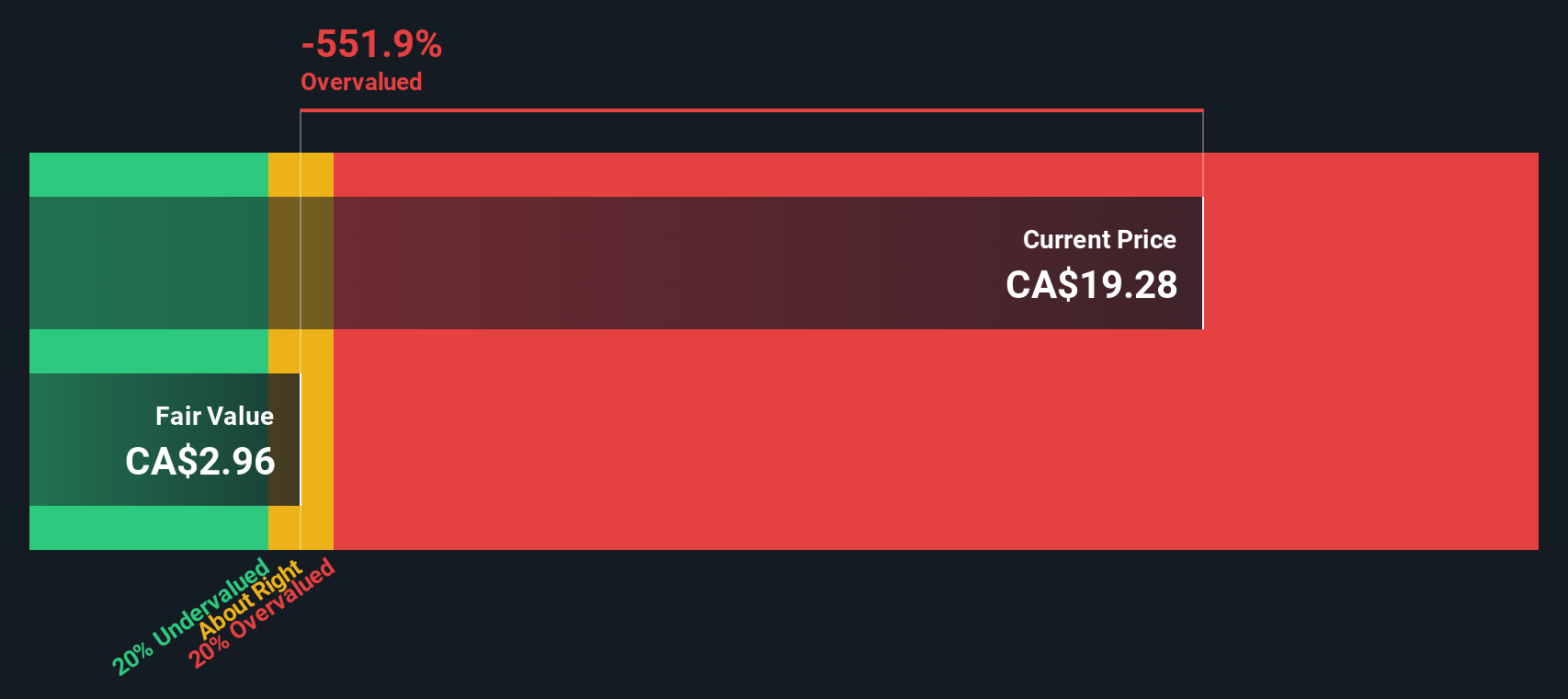

After such a strong rally, the main question is whether First Majestic Silver is still undervalued or if the market has already factored in all the future growth investors can realistically expect.

Most Popular Narrative: 5.8% Overvalued

The most widely followed narrative currently sees First Majestic Silver as slightly overvalued, with its share price running just ahead of calculated fair value based on forward projections.

Robust year-over-year growth in silver production (up 76%) and record revenue (up 94%), combined with expanded exploration and accelerated mine development, position the company to capture higher sales volumes and benefit from potential increases in industrial and investment demand for silver. This directly supports future revenue growth.

What is really driving talk around this latest surge? There is a bold quantitative assumption powering the current valuation, mixing dramatically higher production with ambitious revenue and margin forecasts. Want the full scoop on which figures the narrative is betting on? There are a few surprises in how much future growth they are expecting, and just how richly this stock is valued against those targets.

Result: Fair Value of $16.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cost increases or production setbacks at key mines could rapidly erode margins, which would challenge even optimistic forecasts for First Majestic’s future growth.

Find out about the key risks to this First Majestic Silver narrative.Another View: DCF Model Suggests a Very Different Story

The SWS DCF model paints a much more optimistic picture, assessing First Majestic Silver as undervalued compared to its current share price. This challenges the previous verdict and raises the question of whether the market could be missing something.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Majestic Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Majestic Silver Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own narrative in just a few minutes: Do it your way.

A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by, especially when there are so many standout stocks just waiting to be uncovered. Take action and expand your investing horizons with these handpicked ideas from the Simply Wall Street Screener:

- Unlock the potential of small-cap innovators by scanning the market for penny stocks with strong financials, which could lead tomorrow’s growth stories.

- Tap into companies fueling the AI healthcare revolution with our handpicked list of healthcare AI stocks that are pushing the boundaries of medical technology.

- Get ahead of the trend by finding dividend stocks with yields > 3% offering attractive yields and reliable income for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives