- Canada

- /

- Metals and Mining

- /

- TSX:AG

Does First Majestic Silver’s US$500 Million Shelf Filing Signal a New Growth Chapter for TSX:AG?

Reviewed by Sasha Jovanovic

- First Majestic Silver Corp. recently filed a shelf registration for up to US$500 million, allowing the company flexibility to issue common shares, warrants, or units as needed in the future.

- This move provides the company with significant financial optionality as demand for silver is boosted by growth in green technologies and ongoing operational momentum.

- We'll explore how First Majestic's new US$500 million shelf registration may impact its investment narrative amid rising silver sector demand.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

First Majestic Silver Investment Narrative Recap

For anyone considering First Majestic Silver, the core thesis centers on rising silver demand tied to green technologies and the company's drive for production expansion. The recent US$500 million shelf registration filing provides First Majestic with added financial flexibility, but it does not materially change the near-term catalyst, which remains continued growth in silver output and operational performance, nor does it alter the foremost risk: escalating costs potentially outpacing silver price gains.

Among recent announcements, the positive drilling results at the San Dimas Silver/Gold Mine stand out. These findings highlight ongoing success in expanding and upgrading mineral resources, supporting First Majestic’s production growth ambitions at a time when access to capital could be helpful if the company opts to fund further development and exploration.

However, as encouraging as these developments may be, investors should also keep a close eye on the possibility that higher operational and capital spending could pressure margins if silver prices...

Read the full narrative on First Majestic Silver (it's free!)

First Majestic Silver's narrative projects $1.2 billion in revenue and $94.0 million in earnings by 2028. This requires 12.2% yearly revenue growth and a $79.3 million increase in earnings from $14.7 million today.

Uncover how First Majestic Silver's forecasts yield a CA$16.00 fair value, a 11% downside to its current price.

Exploring Other Perspectives

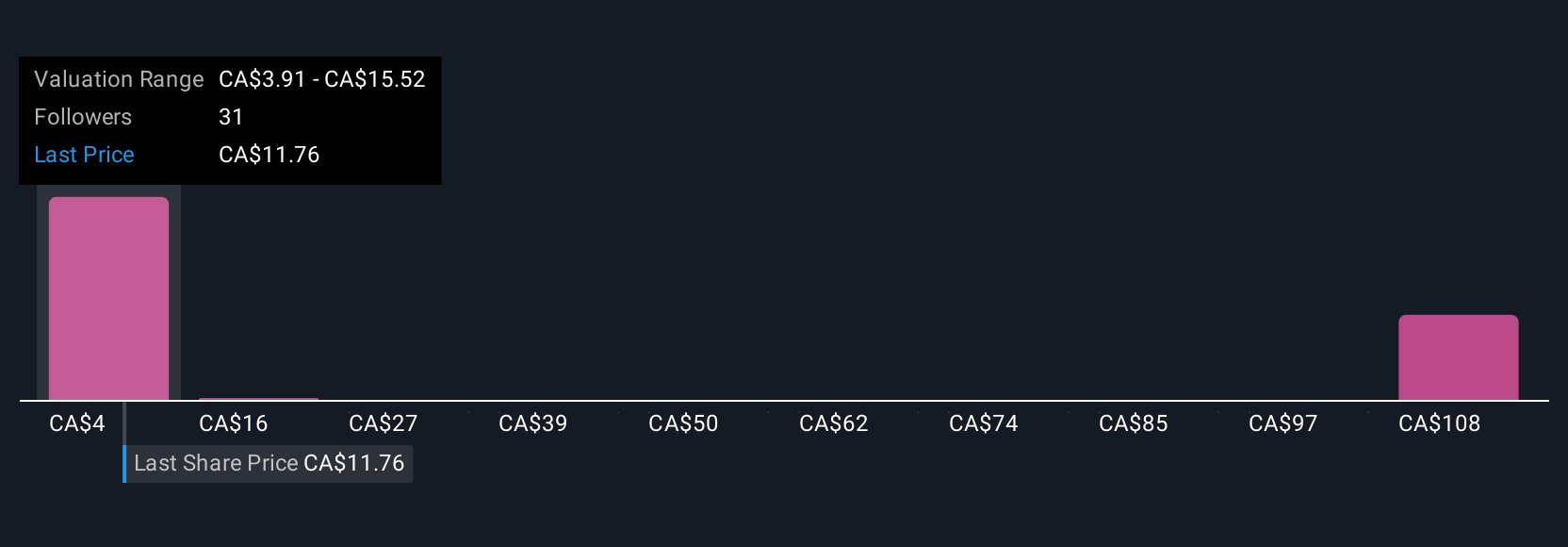

Ten recent fair value estimates from the Simply Wall St Community put the company’s potential worth anywhere from CA$3.91 to CA$161.70. While production growth and strong resource expansion have lifted sentiment, individual outlooks remain split, so consider several perspectives on where First Majestic Silver might head next.

Explore 10 other fair value estimates on First Majestic Silver - why the stock might be worth less than half the current price!

Build Your Own First Majestic Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First Majestic Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Majestic Silver's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives