- Canada

- /

- Paper and Forestry Products

- /

- TSX:ADN

3 TSX Dividend Stocks To Consider With Up To 6.8% Yield

Reviewed by Simply Wall St

With Canada's election now behind it, the focus has shifted to addressing key economic issues such as trade and fiscal policy, amid a backdrop of potentially softening economic growth and interest rate cuts. As investors navigate this evolving landscape, dividend stocks on the TSX offer an attractive option for those seeking steady income streams in uncertain times.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.41% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.54% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.03% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.12% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.74% | ★★★★★☆ |

| Whitecap Resources (TSX:WCP) | 9.33% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.38% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.13% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 6.00% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.66% | ★★★★★☆ |

Click here to see the full list of 25 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

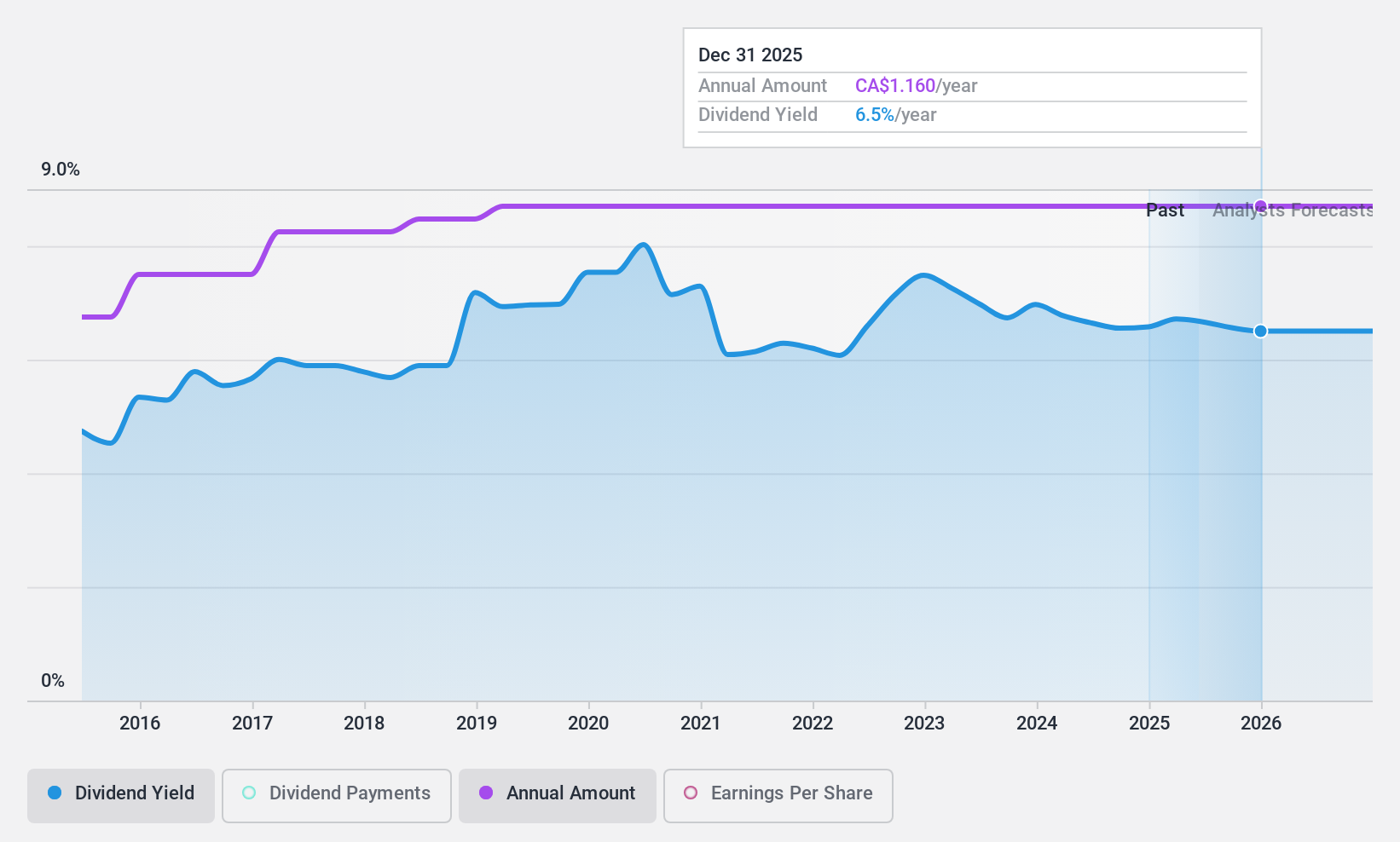

Acadian Timber (TSX:ADN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acadian Timber Corp., along with its subsidiaries, operates in the forest products industry across Eastern Canada and the Northeastern United States, with a market cap of CA$310.65 million.

Operations: Acadian Timber Corp. generates revenue through its segments including CA$17.28 million from Maine Timberlands, CA$24.59 million from Environmental Solutions, and CA$74.31 million from New Brunswick Timberlands.

Dividend Yield: 6.7%

Acadian Timber's dividend yield ranks in the top 25% of Canadian dividend payers, but sustainability is a concern due to a high payout ratio of 93.7%, not fully covered by earnings or cash flows. Despite stable and reliable dividends over the past decade, recent financials show declining net income and profit margins. The company announced a quarterly dividend of C$0.29 per share for April 2025, maintaining its commitment to shareholders despite these challenges.

- Dive into the specifics of Acadian Timber here with our thorough dividend report.

- The valuation report we've compiled suggests that Acadian Timber's current price could be inflated.

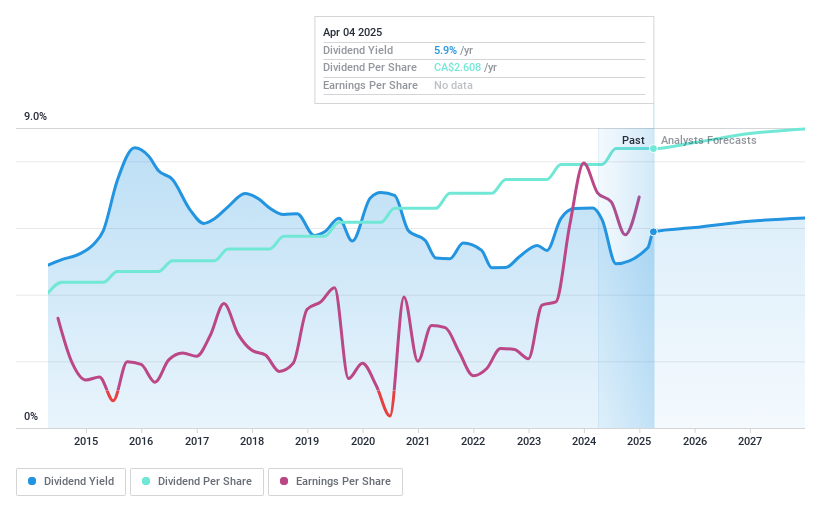

Capital Power (TSX:CPX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Capital Power Corporation develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States with a market cap of CA$8.26 billion.

Operations: Capital Power Corporation's revenue segments include CA$1.45 billion from renewable power generation and CA$2.30 billion from thermal power generation facilities in Canada and the United States.

Dividend Yield: 4.9%

Capital Power's recent dividend declaration of CAD 0.6519 per share highlights its commitment to shareholders, though the payout is not fully covered by free cash flows or earnings, raising sustainability concerns. Despite stable dividends over the past decade and a reasonable payout ratio of 55.6%, the company's high debt level and declining earnings underscore potential risks. Recent acquisitions funded by equity offerings aim to bolster growth but add complexity to its financial landscape.

- Click to explore a detailed breakdown of our findings in Capital Power's dividend report.

- Our valuation report here indicates Capital Power may be undervalued.

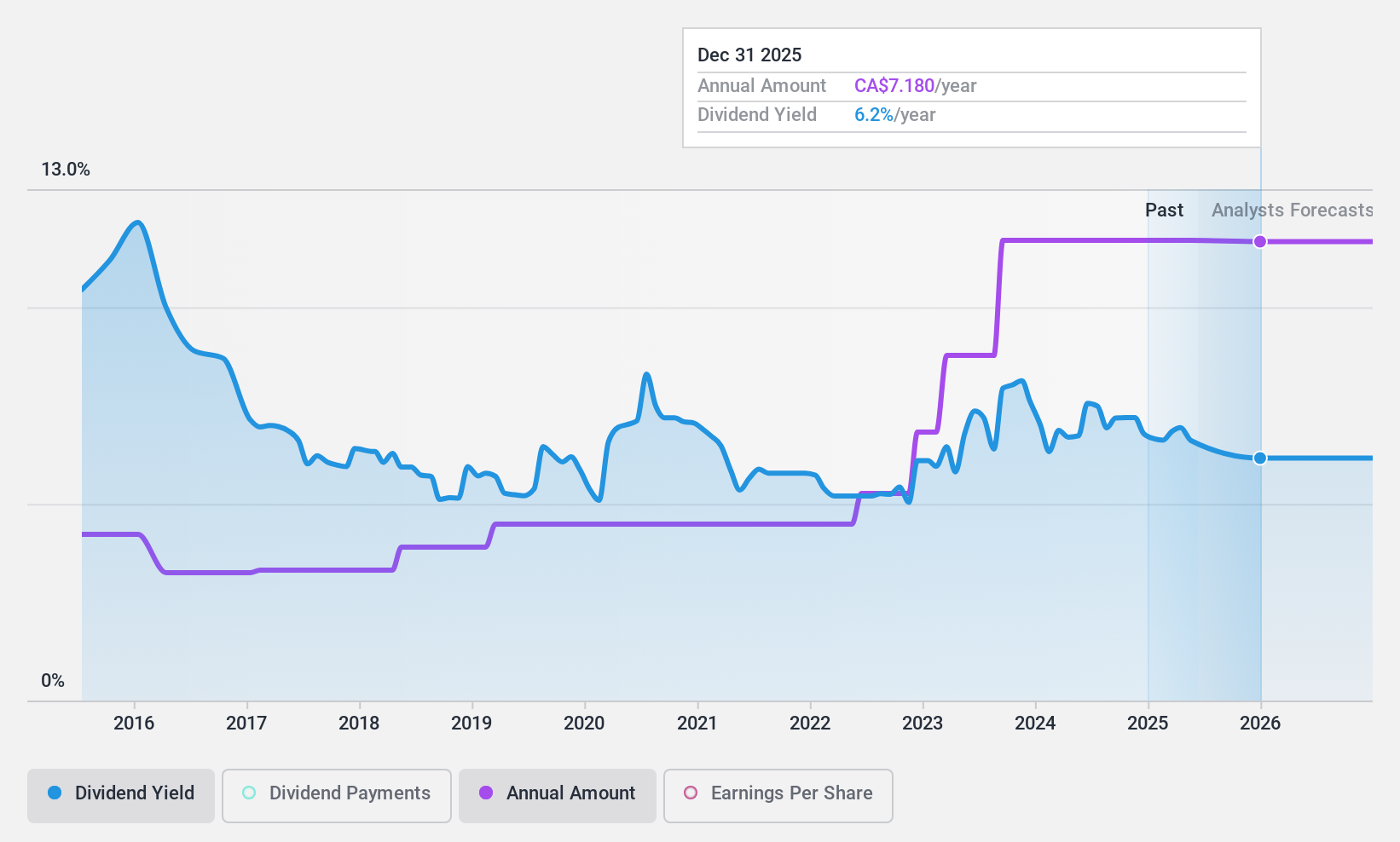

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., with a market cap of CA$254.35 million, operates in Canada as a non-deposit taking trust company through its subsidiary, Olympia Trust Company.

Operations: Olympia Financial Group Inc. generates revenue through several segments, including Investment Account Services (CA$79.18 million), Health (CA$10.30 million), Currency and Global Payments (CA$7.20 million), Corporate and Shareholder Services (CA$4.68 million), Exempt Edge (CA$1.48 million), and Corporate services (CA$0.08 million).

Dividend Yield: 6.8%

Olympia Financial Group's dividend yield of 6.81% places it among the top Canadian dividend payers, with dividends covered by earnings (72.4% payout ratio) and cash flows (84.2% cash payout ratio). However, its dividend history is marked by volatility and unreliability over the past decade, despite recent affirmations of a CAD 0.60 monthly dividend per share. Earnings are stable but not growing significantly, raising questions about future sustainability amid insider selling activity.

- Unlock comprehensive insights into our analysis of Olympia Financial Group stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Olympia Financial Group is priced lower than what may be justified by its financials.

Key Takeaways

- Explore the 25 names from our Top TSX Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ADN

Acadian Timber

Provides forest products in Eastern Canada and the Northeastern United States.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives