- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Mali Dispute Settlement And Board Shift Could Be A Game Changer For Barrick (TSX:ABX)

Reviewed by Sasha Jovanovic

- Barrick Mining Corporation recently resolved all disputes with the Government of Mali over the Loulo-Gounkoto complex, leading to the release of detained employees, restoration of its operational control at the mines, and withdrawal of its arbitration claims, while also announcing that Ben van Beurden has stepped down as Director and Lead Independent Director, with Loreto Silva assuming the lead independent role.

- This settlement removes a major legal and operational overhang in Mali, potentially allowing Barrick to refocus on consistent production, risk management, and board-level oversight under new independent leadership.

- We’ll now examine how regaining full control of the Loulo-Gounkoto complex may influence Barrick Mining’s broader investment narrative and risk profile.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Barrick Mining Investment Narrative Recap

To own Barrick, you need to believe in its ability to convert a portfolio of large gold and copper assets into resilient cash flow despite geopolitical and ESG pressures. The Mali settlement meaningfully reduces the immediate risk of disruption at Loulo Gounkoto, which had been a key operational overhang, but it does not remove broader jurisdictional and regulatory risks across its African portfolio.

The board change, with Loreto Silva becoming Lead Independent Director, ties directly into this, because strong independent oversight is central to how investors judge Barrick’s risk management in higher risk regions. Combined with reaffirmed 2025 production guidance and recent dividend and buyback actions, the governance refresh frames how investors may weigh the Mali resolution against ongoing jurisdictional, environmental, and permitting challenges.

But while the legal clouds over Mali are clearing, investors should still be watching the broader political and regulatory risk profile across Barrick’s key regions...

Read the full narrative on Barrick Mining (it's free!)

Barrick Mining’s narrative projects $19.4 billion revenue and $5.0 billion earnings by 2028. This requires 11.9% yearly revenue growth and about a $2.2 billion earnings increase from $2.8 billion today.

Uncover how Barrick Mining's forecasts yield a CA$59.49 fair value, a 4% upside to its current price.

Exploring Other Perspectives

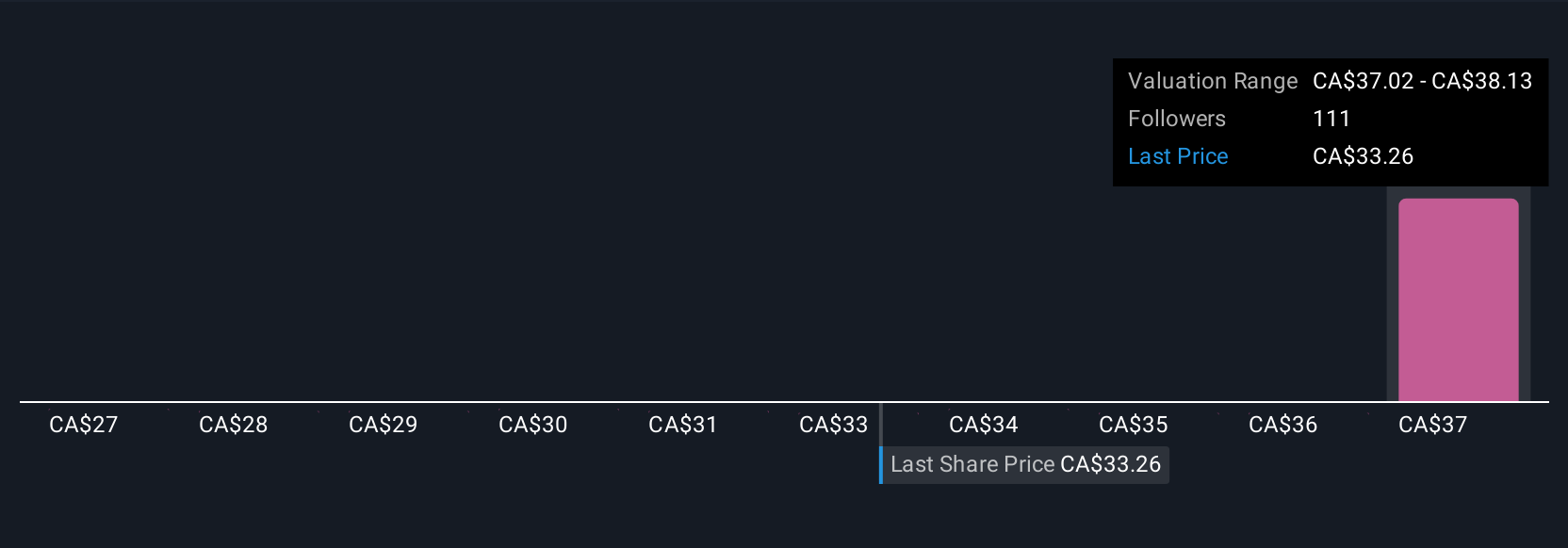

Twelve members of the Simply Wall St Community see Barrick’s fair value spread widely, from CA$30.55 to CA$200.31, reflecting very different expectations. When you set those views against the unresolved ESG and permitting risks highlighted earlier, it underlines why many investors choose to compare multiple risk and reward scenarios before forming a view.

Explore 12 other fair value estimates on Barrick Mining - why the stock might be worth over 3x more than the current price!

Build Your Own Barrick Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Barrick Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Barrick Mining's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026