- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Barrick Mining (TSX:ABX) Advances Tanzanian Partnership With US$30M Education Investment

Reviewed by Simply Wall St

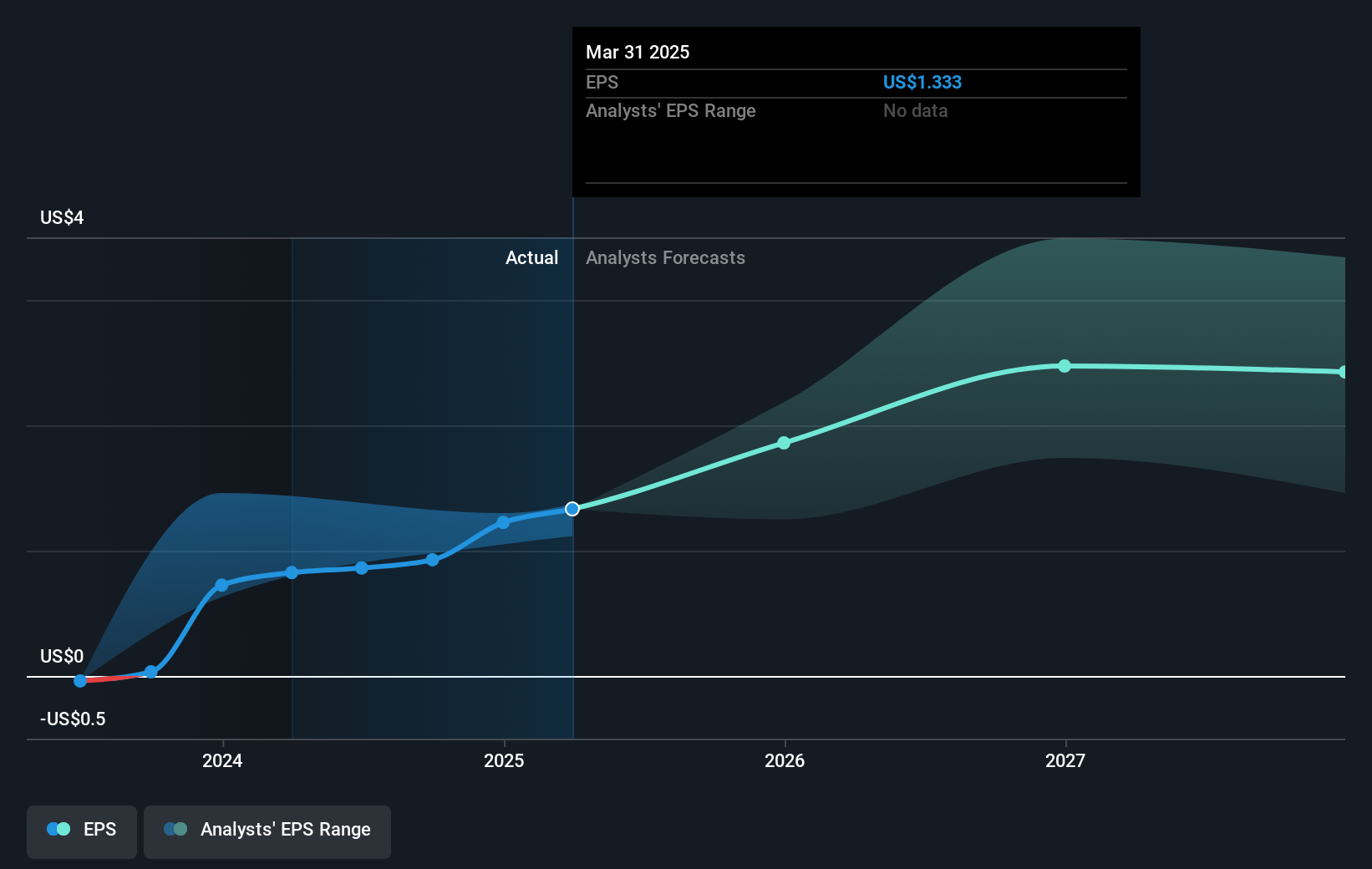

Barrick Mining (TSX:ABX) has formed a new partnership with the Tanzanian government, emphasizing long-term investment and community development, which may have influenced investor sentiment. Over the last quarter, Barrick’s share price rose 18%, outpacing the market's 13% increase over the past year, despite broader uncertainties such as new tariff rates and fluctuating commodity prices. Additionally, the company's improved financial performance, with significant earnings and net income growth, alongside operational enhancements and community initiatives in Tanzania, likely reinforced investor confidence. The market's flat performance in recent days did not overshadow the company's strong quarterly performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The new partnership between Barrick Mining and the Tanzanian government has potential long-term implications for the company’s revenue and earnings forecasts. By focusing on community development and investment, Barrick may enhance its production capabilities and financial stability, leading to improved investor sentiment. Over the long term, Barrick's total return, including share price and dividends, was 44.37% over the past three years, providing context to its short-term share price movements.

While Barrick's performance exceeded the Canadian market's 19.3% return over the last year, it underperformed compared to the larger industry's 33.7% gain. The investments in Lumwana and Reko Diq aim to expand gold and copper reserves, potentially driving future revenue growth and improving earnings forecasts. The share price, currently at CA$26.14, remains below the consensus price target of CA$35.15. Achieving this target would require continued positive performance and overcoming existing geopolitical and operational challenges, which could alter the company's financial trajectories.

Review our historical performance report to gain insights into Barrick Mining's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion