- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

Allied Gold (TSX:AAUC): Assessing Valuation Following Recent Share Price Surge

Reviewed by Kshitija Bhandaru

See our latest analysis for Allied Gold.

Allied Gold’s momentum has been undeniable lately, with a 1-day share price return of nearly 7% and a rapid 23.9% gain over the past month. Year to date, shares have soared 132.98%, and the 1-year total shareholder return stands at an impressive 169.92%. This reflects optimism around operational progress and shifting risk perceptions following recent updates.

If you’re watching gold stocks surge and want to expand your search, now is a great moment to explore discovery opportunities within other resource-rich sectors through our fast growing stocks with high insider ownership

But with shares up sharply and trading nearly 33% below analyst price targets, the real question emerges: Is Allied Gold still undervalued, or has the market already priced in the company’s future growth?

Most Popular Narrative: 20.9% Undervalued

With Allied Gold’s fair value pegged at $33.58 and well above its last close, the dominant narrative suggests room for significant upside if key assumptions become reality.

Execution of significant operational upgrades, including increased waste stripping, new mining equipment, cost reduction initiatives, and optimization of block models, are expected to unlock higher grades and production efficiency in the second half of the year and into 2026. This positions the company for lower unit costs and improved net margins.

Curious what underpins this optimism? The consensus hinges on bold projections for growth and margins, a formula rarely seen in resource companies today. Discover the surprising calculation that drives this value call.

Result: Fair Value of $33.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated production costs and geopolitical uncertainties in West Africa could quickly undermine Allied Gold's bullish outlook if challenges escalate or persist.

Find out about the key risks to this Allied Gold narrative.

Another View: Discounted Cash Flow Model Tells a Different Story

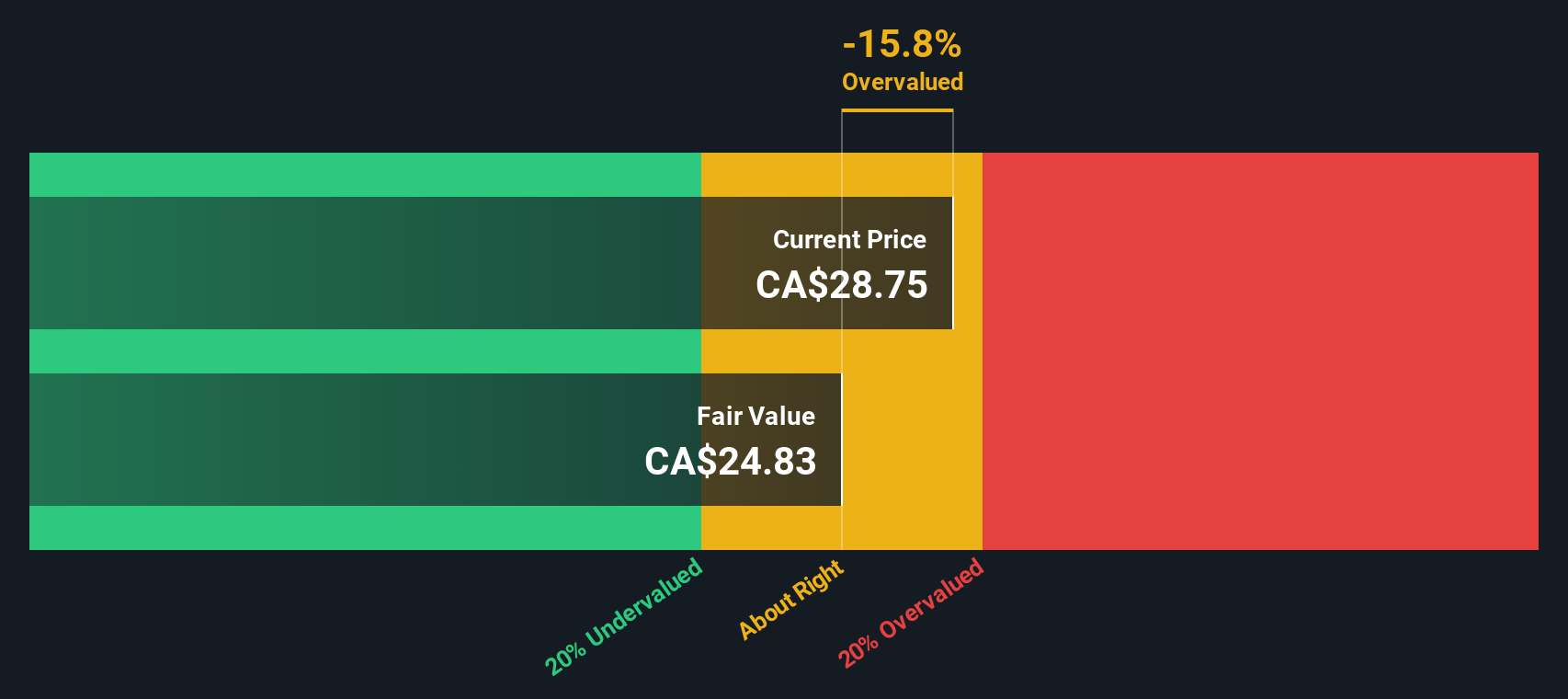

Looking at Allied Gold through our DCF model, the numbers present a more cautious viewpoint. The SWS DCF model estimates the fair value at CA$24.84, which is actually below today’s market price. In practical terms, this signals that, based on projected cash flows, the shares might be overvalued at current levels. This raises the question of whether the market is banking on more ambitious growth than the fundamentals suggest.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Allied Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Allied Gold Narrative

If you see the story playing out differently, or want to dig deeper into the numbers on your own terms, you can shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Allied Gold.

Looking for more investment ideas?

Don't let fresh opportunities pass you by. The right screener can spotlight the game-changers before everyone else piles in. Use the tools smart investors rely on:

- Tap into untapped potential by checking out these 3559 penny stocks with strong financials making waves with their strong fundamentals and growth momentum.

- Secure steady portfolio income by tracking these 18 dividend stocks with yields > 3% yielding above 3% and rewarding shareholders with consistent returns.

- Ride the innovation surge with these 33 healthcare AI stocks combining medical advancements and AI breakthroughs to fuel tomorrow’s health sector leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

High growth potential and good value.

Market Insights

Community Narratives